Image source: Getty Images

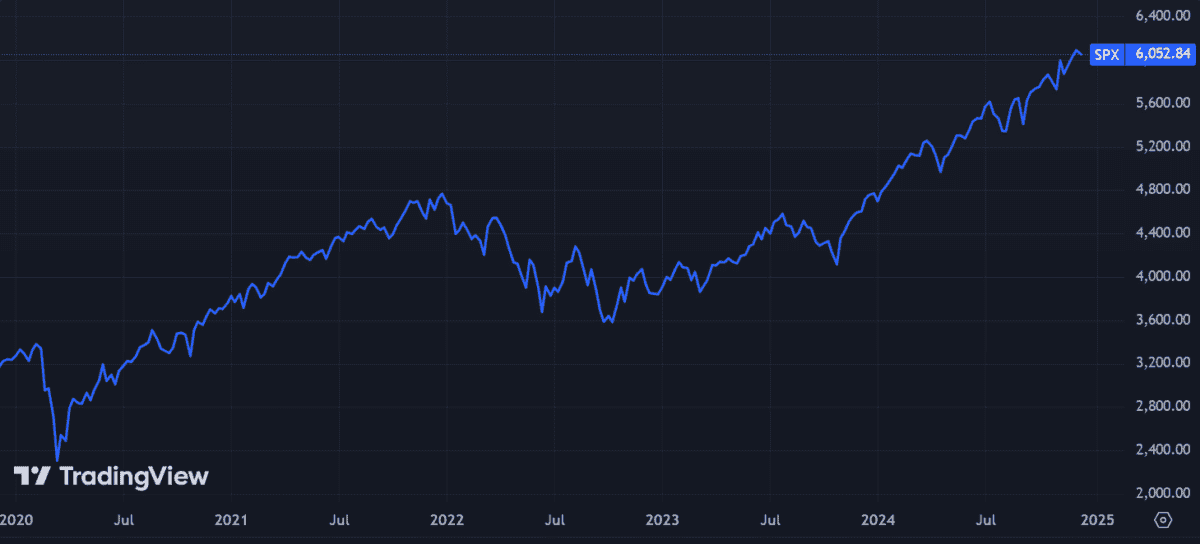

Since its establishment in 1957 S&P 500 — which includes the 500 largest U.S. companies by market capitalization — has delivered powerful returns while helping shareholders effectively diversify their portfolios.

If someone invested PLN 30,000 pounds 10 years ago, how much would he have now?

Strong comebacks

Since December 9, 2014, the S&P 500 has increased an impressive 196%. This corresponds to an average annual rate of return of 11.4%.

However, this does not apply to dividends paid during this time. When shareholder distributions are taken into account, the index’s average annual return increases to an impressive 13.7%.

To put this into context, the average annual earnings (including dividends) of a company FTSE100 AND FTSE250 they lag far behind and are just above and below 6%, respectively.

So how much would powerful S&P 500 results bring in cash terms? If someone had invested £30,000 in an S&P 500 index fund at the end of 2014, they could now – after reinvesting dividends – get as much as £117,148.

Focus on technology

The largest companies in the US index are technology companies, and this sector is not well represented in the UK. I think these tech giants will continue to push the S&P 500 higher.

The value of these companies has surged amid investor buzz around the evolving digital landscape. Recently, there has been excitement in the market about artificial intelligence (AI) – helped by powerful trading updates from Nvidia, AlphabetAND Microsoft — increased demand for their shares.

But artificial intelligence isn’t the only game in town. There are many other segments of tech growth that could lift the S&P over the long term, including:

• Cloud computing

• Green technologies (including renewable energy and electric cars)

• Robotics

• Cybersecurity

• Quantum computing

• Internet of Things (IoT)

• Autonomous vehicles

Top product I’m considering

To take advantage of these themes myself, I added a few US ETFs to my portfolio.

One is wider HSBC S&P500 ETFwhich gives me access to the entire index. The second one is iShares S&P 500 Information Technology ETF, which gives me more targeted access to tech stocks.

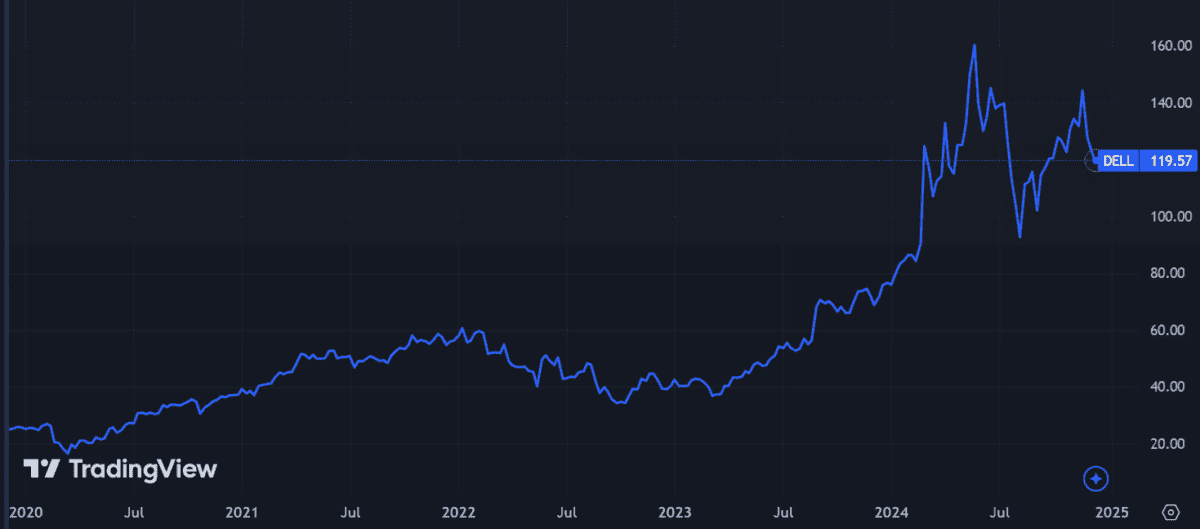

Once I achieve my diversification goal, I also intend to augment my profits by purchasing individual stocks. Dell Technologies (NYSE:DELL) is one of the US stocks I’m considering today.

Like Nvidia, the company is also betting on the artificial intelligence revolution. However, so far it has not achieved such spectacular results, which is why it does not have as high a valuation as its technological rival.

Dell’s forward price-to-earnings (P/E) ratio is 15.8 times. That’s quite low compared to the broader tech sector and well below Nvidia’s endurance factor of 47.1 times.

It may not yet be achieving results as spectacular as Nvidia, but it is making stern progress in AI.

Between September 2023 and June, it sold an impressive $3 billion worth of AI servers. In November, it achieved a significant milestone by selling Blackwell server racks, the first to employ liquid cooling technology. This could be a game changer for energy efficiency and server performance.

Although Dell faces significant competition in the AI space, I find it an attractive proposition given the encouraging recent progress – especially at current prices.