Image source: Getty Images

The rapid raise in earnings over the past decade has contributed to the value Greggs“(LSE: GRG) shares will explode over the past decade.

Someone who has invested 10,000 pounds in FTSE 250 Baker in mid -April 2015. The value of their shares increased to $ 15,999. During this period, its price was jumped from £ 11.33 to £ 18.15 today.

When taking into account dividends, the investor would achieve a cumulative profit of 10 157 pounds. This is a total refund of the shareholder of 101.6%.

But Stormclouds have recently gathered over the Greggami, and its price has rapidly dropped from the closing level of 31.84 pounds in 2024, achieved in September.

Should investors today consider catching a piece of sausage manufacturer? Or maybe the company is through the best date?

The expansion continues

Greggs’s story for most of the last decade was an aggressive expansion and a subsequent raise in profits. Since having 1650 stores just over 10 years ago, the company currently has 2618 (including 2,057 stores managed by the company and 561 franchise units).

After finding the appropriate recipe for an raise in earnings, the company, perhaps, which is not a surprise, there is no plans to withdraw. The fresh opening of the store reached the annual record in 2024, and Greggs plans to have “”Significantly over 3,000 stores“In your portfolio in the long run.

He invests huge sums in production and distribution to become a reality. In fact, the company believes that two fresh sites in Derby and Kettering – to be opened in 2026 and 2027, respectively – will provide sufficient capacity for about 3500 stores.

Encouraging that Greggs plans to put more fresh stores in places with high traffic, reflecting its agility from High Street. More precisely, he plans to focus on the future towards travel places, such as airports and railway stations.

The company is preparing for further extension of opening hours throughout the store to capture the lucrative evening “food to”. Greggs also plans to invest in its delivery channel after the last impressive trade. Delivery revenues increased by an impressive 30.9% in 2024, despite the challenging commercial environment.

27.6% of the reflection?

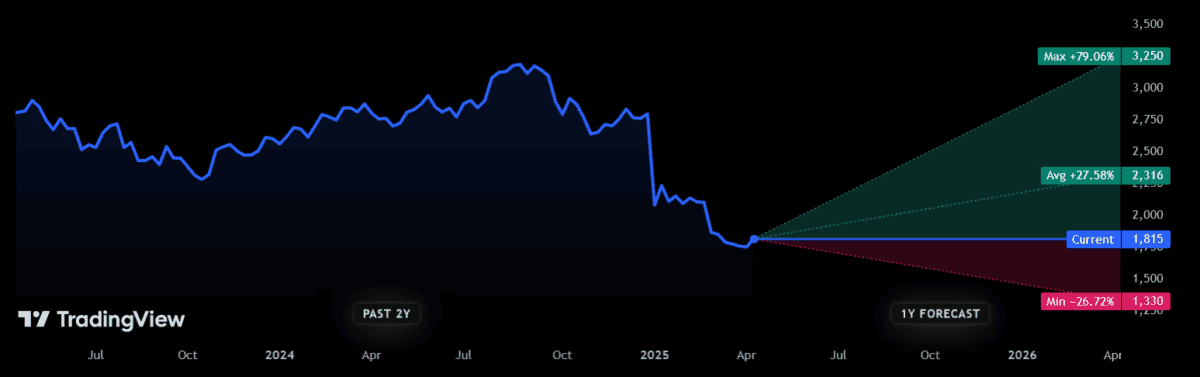

I hope that these factors will facilitate Greggs bounce back after the last bulky dips. Encouraging that a dozen analysts about the action ranking expect prices to rise over the next 12 months, although the forecasts are not uniformly stubborn.

One particularly enthusiastic broker, which Greggs shares will raise from 18.15 £ today to 32.50 £ in the next 12 months. At the other end of the scale, other analysts believe that the baker will fall back to £ 13.30.

The average target price, however, is $ 23.16. This is an raise of 27.6% compared to current levels.

Is Greggs a purchase?

To sum up, I think that Greggs shares are worth consideration after a recent weakening of share prices. Currently, it trades in a reasonable price -profit ratio (P/E) of 13.3 times.

It is true that trade conditions may remain challenging in the near future, because consumer expenditure remain restricted. It also becomes in the face of significant competition on High Street and elsewhere.

The reflection of these pressure, like the raise in sales in Greggs, cooled down to 5.5% in 2024 from 13.7% a year earlier. However, my long -term view on the bakery chain is unrepired. I believe that the price of Greggs shares will raise rapidly when wider economic conditions improve.