Cardano (ADA), a intelligent contract platform known for its precise development process, is on… critical moment. Analysts are divided on the cryptocurrency’s immediate future, with some predicting a bullish breakout and others preparing for a bearish correction.

The analyst is preparing for a turnaround

One analyst, known as Trend Rider, took an confident stance. They identified a technical pattern suggesting a potential trend reversal for ADA. This pattern involves an initial price surge followed by a pullback, a scenario recently mirrored in several other cryptocurrencies.

$ADA it had a compact pump and then corrected like all other coins.

Based on the facts, I see that he lacks dynamics. I have marked the key levels on the chart:

🟢Long Zone: USD 0.36-0.40

📈Key price to start the trend reversal: USD 0.50Note: Daily time frame pic.twitter.com/3fH7xI08Ke

— Trend Rider (@TrendRidersTR) June 10, 2024

Trend Rider believes that the key breakout point is at the $0.50 level. Exceeding this level could signal a significant change in dynamics, potentially starting a modern upward trend for ADA. Moreover, they identified a buy zone between $0.36 and $0.40, suggesting it could be a favorable entry point for traders looking to go long.

Analyst averages offer a tentative midpoint

An additional layer of complexity is the average price forecasts made by various cryptocurrency analysts. Collectively, these predictions suggest average price $0.422 for ADA in June 2024, ranging from $0.405 to $0.439. This midpoint forecast puts ADA precariously close to its current price, offering little guidance for investors looking for firm direction.

ADA Price Forecast

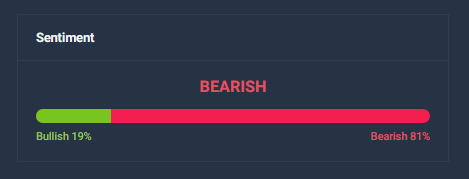

Current analysis for Cardano (ADA) indicates a potential price escalate of 5.00%, potentially reaching $0.446851 by July 12, 2024. Despite this confident price projection, technical indicators suggest bearish market sentiment.

This is further confirmed by the fear and greed index, which currently stands at 72, which indicates a state of greed in the market. Over the last 30 days, Cardano has experienced a moderate volatility level of 3.52%, and only 40% of those days were positive, indicating circumscribed bullish momentum.

Given the prevailing market conditions and sentiment indicators, it doesn’t seem like a good time to invest in Cardano. Bearish sentiment and high levels of acquisitiveness suggest a potential market correction or increased risk of downside volatility. Investors may consider waiting for a more favorable market environment or clearer bullish signals before opening a position in Cardano.

Ultimately, the fate of the ADA price depends on a combination of factors that go beyond the realm of pure technical analysis. Regulatory changes, institutional adoption, and broader market sentiment will all play a role in shaping the trajectory of the ADA.

Featured image from Goodwood, chart from TradingView