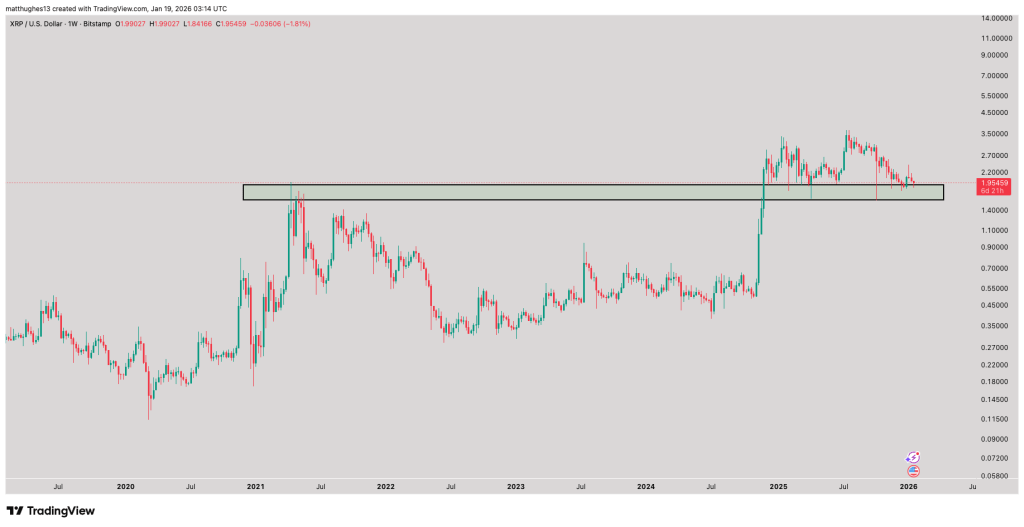

According to crypto analyst Matt Hughes (“The Great Mattsby”), XRP is generating a sporadic signal of relative strength against ETH that points to the two-week Ichimoku Cloud reversal, which he believes is not support from 2021. With XRP also trading within a specific USD range on the lower time frame, Hughes characterizes the next phase as a conditional “prove it” moment: reclaim one level and the market has room to work; will not succeed and the narrative of a breakthrough will remain premature.

XRP Ready to Surpass ETH?

Hughes Elementary School law is anchored in the XRP/ETH pair on the 2-week chart. From his reading, it appears that a massive regime shift is taking place: “Looking at the 2-week Ichimoku Cloud, you can see that XRP is doing something it hasn’t done since 2021: turning the 2-week cloud into support. The cloud has been a huge resistance throughout most of the chart’s history up to the present (with a noticeable break in 2021, but only for a few weeks).”

On the Hughes chart, XRP/ETH is pushing into the upper part of the 2-week Ichimoku cloud, with the last candle marked around 0.00062. His bullish reading is that a spotless flip, keeping the price above the cloud and treating it as a bottom for pullbacks, would represent a regime change for the pair.

XRP Roadmap to $9

Hughes’ work on shorter time frames shifts from relative performance to mechanics in terms of box office dollars. On the daily XRP/USD chart, the price continues to behave like a market that has not completed its major consolidation, oscillating between superimposed horizontal levels while maintaining sloping fan lines, visually confirming why upside attempts have repeatedly stalled.

Hughes boils this structure down to a single threshold that can be applied: “The price moves gradually, and this Gann fan perfectly illustrates why the price is stuck in its current range. Once XRP manages to close the candles above $2.30, the upward move can continue.” Above, the next targets on the daily time frame are $2.59 and $2.95.

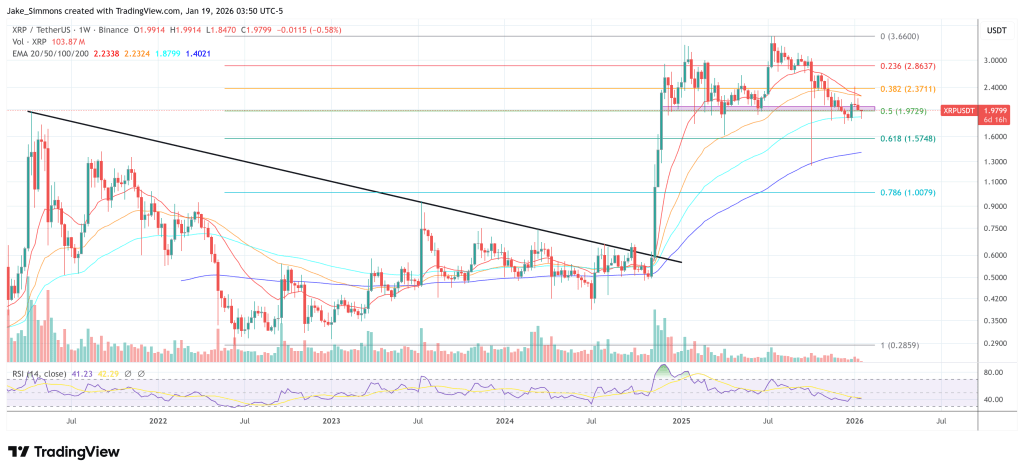

XRP/USD weekly chart adds another level if acceptance arrives. Two extension levels are clearly marked (plotted from the 2014 low to the 2017 high): 2.272 at $3.09882 and 2.618 at $9.00194, with the path drawn by Hughes first heading towards the $3 low area and then extending higher if the momentum continues.

So, the Hughes bullish scenario has two parts: first, remove the USD range trigger (a constant close above $2.30), and then turn the last major zone before the 2025 high into support. He states this in a more blunt way on the

The failure scenario is simpler and more direct. If XRP is unable to secure a close above $2.30, the fan and range structure will remain intact: the rally will continue to be merely a rally to the same ceiling, and the market risks a return to the $1.78 level.

However, a drop towards this price would not change anything on the long-term bullish chart of XRP. Pointing out the gap between chart structure and crowd sentiment, Hughes wrote:

“A real baby in diapers and a 120-year-old grandpa who forgot his own name can look at this chart and say, ‘Yep, a classic break above the 2021 high, now turning it into solid support.’ Meanwhile, every bear on X, their mailman, their mailman’s dog walker, and that one guy who still thinks it’s 2022 are screaming “BEAR!” DOOM! SELL YOUR CHILDREN!’ as if this was still an exceptional bear market. Brother, even my grandmother’s bingo partner is confident at this point. Wake up and smell the bull fuel.

At press time, XRP was trading at $1.9799.

Featured image created with DALL.E, chart from TradingView.com