If there’s something financial markets don’t like, it’s uncertainty. Of course, who will become the next President of the United States of America is often subject to great uncertainty, especially in the 2024 elections, which feature two opposing candidates. Since the President of the United States wields great economic power at home and abroad, and the stock market is an economic barometer, the question of whether the election result could cause a crash in the U.S. stock market is an extremely crucial question.

To answer this question, we should first go back to our previous update from three weeks ago where we stated that the index

“… the index could still end up with a counter-trend rally: red Wb/ii, potentially reaching $20,600, assuming the standard (gray) Wc = Wa relationship. A break below gray Wb, the October 1 low of $19,622, could largely support this thesis, with full confirmation below the September 6 low of $18,400“

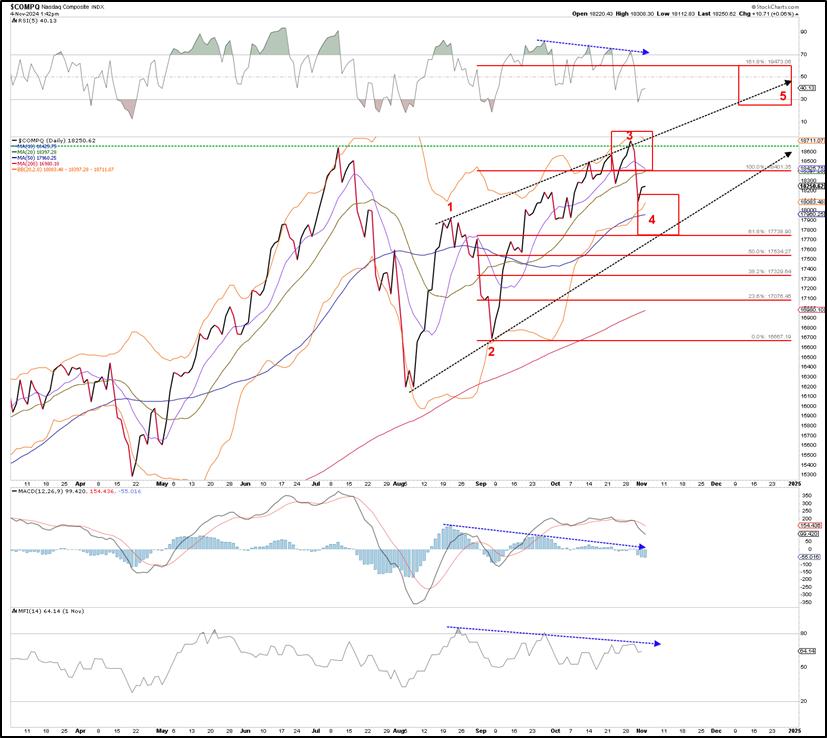

Fast forward to today: Last Tuesday, October 29, the index peaked at $20,600.01 and has been withering since then. So the counter-trend red Wb/ii, see chart 1 below, is still alive and well, but the Bears have not yet pushed the index price even below the October 1 low. So, while we keep our bear warning levels unchanged, we still cannot rule out a potential bullish setup on the charts. Let us explain below.

Figure 1. NDX daily chart with detailed Elliott wave number and technical indicators

Before the bears get too excited, remember this

AND) NASDAQ (NAS) hit a fresh all-time high (ATH) last week, ruling out the red Wb/ii setup for the index. Because the NDX and NAS are often attached to the hip, it is infrequent for both to have significantly different EWP values. Namely, as we explained in our previous update, if Bears are unable to keep the index price below July ATH, we must focus on the alternative EWP calculation in Figure 2 below, which is the “dreaded” trailing diagonal (ED).

Figure 2. NASDAQ daily chart with detailed Elliott wave number and technical indicators

As we explained in our previous update,

“In ED, 3rd wave… typically targets the 1.236x Fibonacci extension [1st wave]measured from [2nd wave] Short, … . Correction from this point on [the 4th wave]may typically, but not necessarily, target a 61.8-76.4% Fib extension… before [5th wave] starts, ideally to 161.8-176.4% Fib extension… .“

This also applies to NASDAQ. Figure 2 shows that it follows this ED pattern quite well. This path is contingent on staying above the September 6 low, although with a potential of 4vol the wave as shown can become more chronic, i.e. a bounce followed by another downward move before the final fivevol the wave begins.

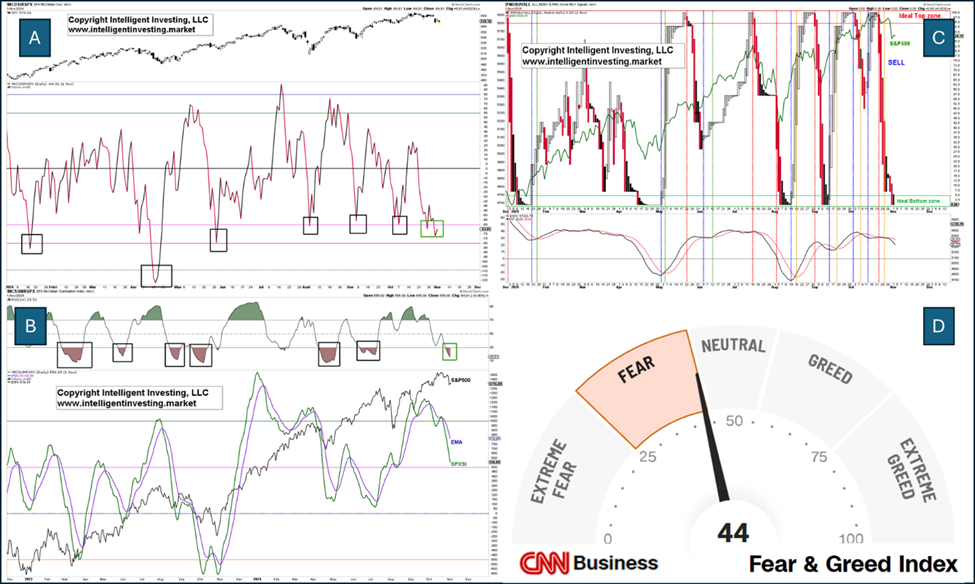

B) Market breadth readings and sentiment are quite blurry. See Figure 3 below. Although these are conditions, i.e. these readings can always go lower and the final arbiter is always the price of the indices, the McClellan Oscillator (3A), the summation index (3B) and the PMO (3C) are all at levels from previous good buy signals have emerged. Meanwhile, the mood is terrifying. Therefore, it appears that the path of least resistance for these indicators is heading upwards, which could push the indices higher.

Figure 3. Several market breadth indicators and the CNN Fear and Greed Index

The bottom line is that the Bears stopped their advance right where they needed to be (20,600 NDX) and still have a chance to break the multi-year high. To confirm this thesis, however, a breakout is required at least below the low of October 1, and especially the low of September 6. Otherwise, the Bulls may struggle with this. Meanwhile, market breadth and sentiment are quite blurry, favoring the Bulls, if only because of the “dead cat bounce.”