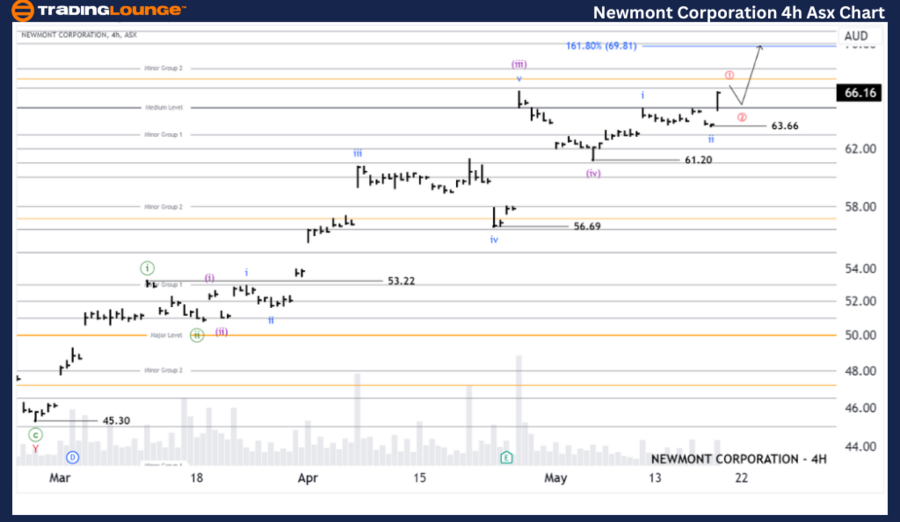

ASX: NEWMONT CORPORATION – NEM Elliott Elliott Wave Technical Analysis TradingLounge (1D Chart)

Hello, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with NEWMONT CORPORATION – NEM. We found that the NEM will likely continue to rise even higher in the (v)-violet wavelength.

ASX: Newmont Corporation – NEM Elliott Wave Technical Analysis

Function: Main trend (minute degree, green).

Mode: Theme.

Structure: Pulse.

Position: Wave III – blue or Wave (v) – purple.

Details: Short-term forecasts indicate that the (iv)-violet wave has ended earlier than expected and the (v)-violet wave is developing and will continue to climb. Now waves ii ii-blue have just ended and wave iii-blue is developing and climbing higher, reaching the level of 69.81. To maintain this outlook, the price needs to stay above 63.66.

Point of invalidation: 63.66.

ASX: Newmont Corporation – NEM Four Hour Chart Analysis

Function: Main trend (minute degree, green).

Mode: Theme.

Structure: Pulse.

Position: Wave ((1))-red Wave III-blue Wave (v)-violet Wave ((iii))-green.

Details: An even shorter perspective shows that the (v)-violet wave is developing and climbing upwards. It is divided into ii ii-blue waves which have just ended. Now wave III-blue is starting to develop and push higher. This iii-blue wave splits into a ((1))-red wave, and the ((2))-red wave may develop next, setting the stage for the ((3))-red wave to continue pushing higher, aiming for 69.81 – 70.00.

Point of invalidation: 63.66.

Application

Our analysis, contextual trend forecast and near-term outlook for ASX: NEWMONT CORPORATION – NEM are designed to provide readers with insight into current market trends and how to effectively leverage them. We offer specific price thresholds that act as signals to validate or invalidate our wave count, increasing confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional view of market trends.