Yesterday, August 5, LINK, the native currency of decentralized oracle provider Chainlink, fell to a six-month low. Changing hands at around $8, LINK fell 64% from its March highs, breaking out of a bull flag, signaling weakness. The correction was all-encompassing, with leading altcoins like Solana and Cardano also seeing huge declines.

LINK holders are accumulating, outflows from exchanges are growing rapidly

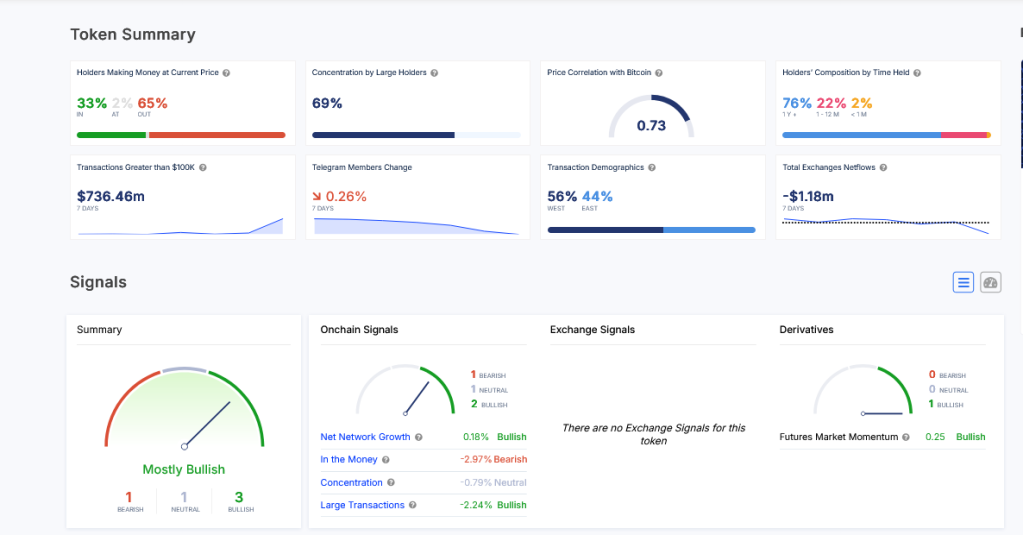

However, as markets bled, breaking below key support levels, shrewd investors saw an opportunity to accumulate. According to IntoTheBlock data Yesterday, August 6, there was a significant escalate in the number of lively LINK addresses, reaching a level not seen for about three months.

The escalate in lively addresses coincided with an escalate in outflows from exchanges. This development suggests that users were more inclined to accumulate LINK rather than sell, despite falling asset prices.

Outflows from centralized exchanges like Binance and Coinbase are typically considered net positive. Since users control the coins through their non-custodial wallets, they cannot easily sell for other liquid coins or stablecoins.

Over the years, prices have tended to steadily recover whenever there is extreme fear, especially among LINK holders. Similar to what happened in March 2020 when cryptocurrency prices plummeted due to the COVID-19-induced crash, aggressive investors may see such declines as buying opportunities.

In March 2020, LINK’s value fell by a whopping 70%. However, a few months later, when the money printers were launched, cryptocurrency prices surged, causing LINK’s value to escalate by almost 35 times at its peak in 2021.

As was the case then, the price decline combined with the outflow of funds from exchanges and accumulation among entities makes it likely that LINK will rebound strongly.

Most of the owners are in red, But Partners are interested in Chainlink solutions

So far, IntoTheBlock data reveals that 65% of LINK holders suffer losses and only 32% are in the green. What is encouraging is that most LINK holders are “diamond hands” and have been holding their stocks for over a year.

The greater the number of long-term holders or addresses holding a given coin or token for more than 155 days, the more resilient prices are to a liquidation wave.

In addition to the price action, optimism is high among LINK holders. Chainlink is a leading decentralized oracle provider offering services for DeFi and NFT protocols.

At the same time, Chainlink Labs, the middleware developer, continues to forge high-quality partnerships. Recently, 21Shares integrated Chainlink’s Proof-of-Reserve on Ethereum to escalate transparency.

Featured image from DALLE, chart from TradingView