Image Source: Getty Images

UK shares have enjoyed impressive gains since early 2024. FTSE100‘s rose 6%. But the powerful upside is fueling fears of a potential stock market crash.

These dire warnings don’t just come from fringe commentators. None other than the Bank of England warned of a potential storm in financial markets.

On Thursday (June 27), the central bank warned that the prices of many assets, such as stocks and bonds, remain high relative to historical norms, with some continuing to rise. This suggests that investors in financial markets continue to expect economic recovery and a decline in inflation.

They attach less importance to risks such as geopolitical developments or persistently high inflation, which could result in weaker economic growth or interest rates remaining higher than expected.

This risk increases the likelihood of a edged correction in asset prices.

What I should do now?

Investors can take steps to protect themselves. They can do this by scanning the market for economical stocks.

Companies that trade at a low price – whether that price is related to their earnings, assets, dividends or future cash flows (known as intrinsic value) – have a built-in cushion against losses.

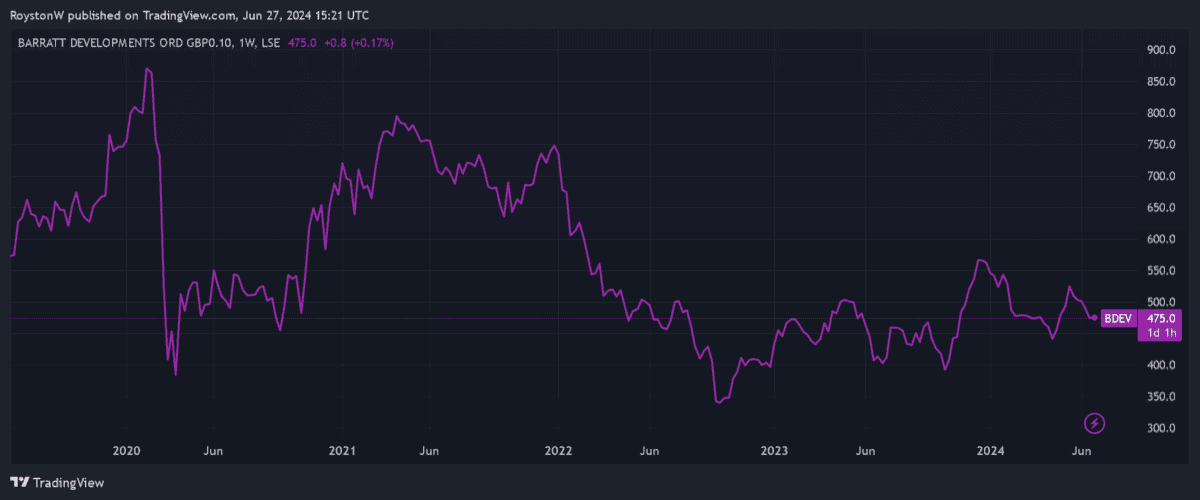

Barratt’s Development (LSE:BDEV) is one stock I would consider buying today. It currently trades at a price-to-earnings growth (PEG) ratio of 0.7, below the water mark of 1.

Meanwhile, the dividend yield this year is 4.1%, which is above market value. This is higher than the FTSE 100 average forecast of 3.5%. Actions.

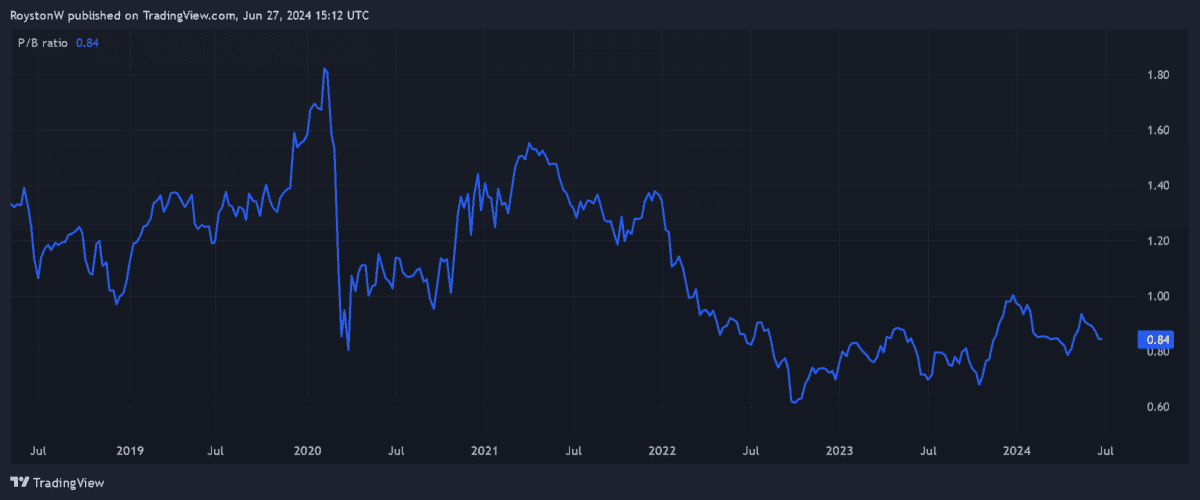

Finally, Barratt looks economical when compared to its price-to-book (P/B) ratio (see below). As with the PEG multiple, a P/B ratio below 1 indicates that the stock is undervalued.

Bright future

Barratt could still experience some short-term headwinds if the stock market corrects. But over the longer term, I believe the company has the potential to deliver exceptional returns.

But there is some risk here. Lloyds Bank said Chief Charlie Nunn News from heaven this week that mortgage rates will be between 3.5% and 4.5%fresh normal” in the future. This is over 1.5-2.5% in the last decade.

In turn, a higher mortgage rate environment would hurt fresh build sales and house prices. Overall, however, I still think there is huge investment potential in housebuilders like Barratt.

Demand for fresh homes is expected to continue to grow as the population grows. This is illustrated by Labour’s promise to build 1.5 million fresh homes over five years.

Moreover, homebuilders’ profit margins are expected to augment dramatically as cost inflation continues to decline.

Keeping the faith alive

Sudden stock market corrections are a constant risk. However, speaking as an investor, the threat of fresh volatility is not enough to put me off buying UK shares.

Past performance is no guarantee of the future. However, history shows that stock prices always recover strongly after periods of extreme weakness.

Since its founding in 1984, Footsie has experienced several economic crises. It reached fresh closing highs of 8,445.80 points last month.

As a long-term investor, I am willing to accept some short-term difficulties in order to ultimately achieve significant profits. That’s why I will continue to buy UK shares despite the Bank of England’s warnings.