Glassnode says XRP is returning to the cost-based setup last seen in February 2022, with modern buyers flocking to levels that leave the previous “top” cohort increasingly underwater, which could shape selling pressure in key price zones.

In note shared on Monday via X, the analytical company pointed to the rotation of prices realized by age ranges. “The current XRP market structure closely resembles February 2022.” – wrote Glassnode. He added that “the psychological pressure on prime buyers builds over time,” describing the current tape as one in which patience is tested rather than rewarded.

What does this mean for the price of XRP

The firm’s main observation is that portfolios vigorous in the short-term window, roughly the 1-week to 1-month cohort, accumulate below the cost basis of portfolio holders in the 6-month to 12-month window. In practice, this means that modern demand appears at prices lower than those paid by a significant part of medium-term bondholders.

This relationship matters because cohorts tend to behave differently when the price again reflects their cost basis. When spot transactions are below a cohort’s realized price, that cohort is, on average, underwater. If the market returns to this level, some of this supply may want to reduce risk to breakeven, creating overall liquidity that could limit growth until it is absorbed.

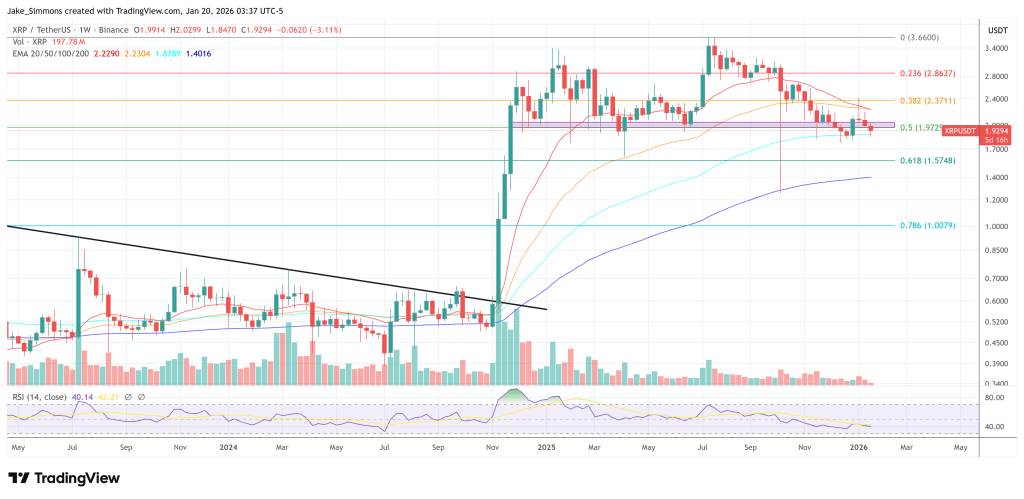

Glassnode’s ‘Realized Price by Age’ chart (7-day moving average) visualizes this energetic by plotting cohort realized prices against spot. A distinguishing feature is the difference between the short-term cost base and the 6-12 month cost base during the latest consolidation, as reflected in the company’s February 2022 comparison.

With the price of XRP once again trading just below the $2 level, Glassnode’s November 24, 2025 post is also gaining attention again. Glassnode cited this aged post by X where he singled out $2 as the level where cohort bias is most noticeable in flows. “The $2.0 level remains a major psychological zone for Ripple holders,” the company said. “Since the beginning of 2025, each retest of the $2 quota has resulted in losses of $0.5 billion to $1.2 billion per week,” a reminder that many bondholders have emerged at a loss as prices have retested.

These realized loss estimates are a key qualifier: they suggest that $2 is not just a level on a chart, but a behavioral level where spending decisions change and where capitulation (or forced risk reduction) can occur.

It is worth noting that in February 2022, XRP saw a piercing reversal in both directions: after falling to around $0.6034 on February 2, it rose to a monthly high near $0.8758 on February 8, and then recovered in the second half of the month as macro risks increased. Then, on February 23-24, the XRP price returned to around USD 0.70 (about 20% from the February 8 high), before rebounding on February 28 to end the month near USD 0.7856.

The month-end decline coincided with the escalation between Russia and Ukraine and the February 24 invasion, which hit broad risk assets and sent major cryptocurrencies tumbling intraday, in line with the risk-off impulse seen across the cryptocurrency market.

At press time, XRP was trading at $1.9294.

Featured image created with DALL.E, chart from TradingView.com