Warning signs are flashing on the charts, and market analysts are predicting that Bitcoin’s price may soon to fall again. According to technical analysis, if BTC does not continue its uptrend, it may repeat bear market crash from previous cycles, potentially reducing its price by a double-digit percentage.

Will Bitcoin Price Repeat the Bear Market Crash in 2022?

Cryptocurrency analyst Tyrex believes that Bitcoin could be approaching a critical turning point if the current upward trend does not continue. In his latest BTC price prediction for X, he compares current market structure until the April 2022 cycle when Bitcoin hit ATH and then crashed challenging for weeks.

Tyrex revealed that Bitcoin fell approximately 45% from its all-time high in 2022 before entering an extended consolidation phase that lasted almost four months. The accompanying chart shows that during this period prices remained within clear horizontal boundaries, creating a false sense of strength and stability, while at the same time underlying weakness continued construction.

This consolidation ultimately led to successful fraudwith Bitcoin price briefly breaking resistance before reversing sharply. Unfortunately, the rejection resulted in a continuation of the broader downtrend this year, leading to another aggressive price collapse that wiped out any remaining bullish confidence.

According to Tyrex, the current BTC chart structure is very similar 2022 historical configuration. Bitcoin has once again retreated sharply after reaching an all-time high of over $126,000. Additionally, the cryptocurrency has spent about two months consolidating within a range, repeatedly stopping at resistance levels.

Tyrex warns Bitcoin is barely holding above $95,000which coincides with the resistance zone shown on the chart. If the price fails to recover and continues to stay near this level, the upward move could prove false and potentially lead to another pointed breakdown – as it did in 2022. The red-shaded area on the chart shows how far BTC could fall in the event of a breakout of the uptrend, with the analyst predicting an 11.04% drop to the $86,000-$84,000 range.

Bitcoin Set for March ATH and May Flash Crash

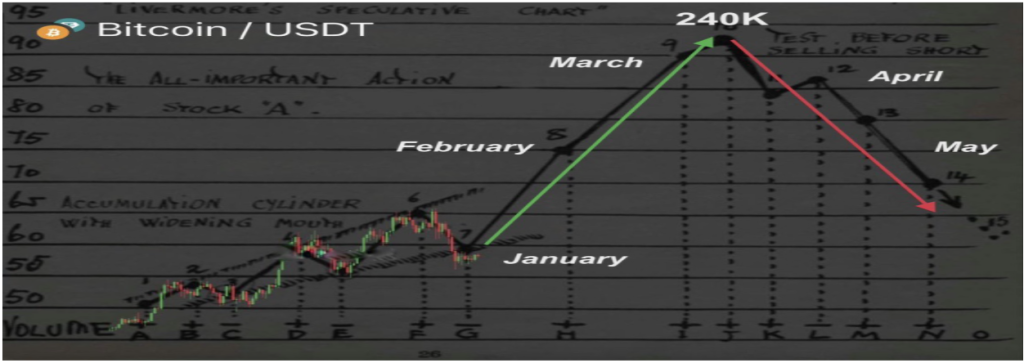

Another forecast from the CryptoXLarge market expert guidelines where Bitcoin may be heading in the next four months. The analyst bases his forecast on historical market behavior, suggesting that the current cycle may mirror past cycle peaks.

CryptoXLarge points to January 2026 as a silent accumulation phase with controlled price action and subdued volatility. February is expected to see a massive rally as momentum builds rapidly and buyers drive up the price of BTC. This growth could set the stage for Bitcoin achieve a novel all-time record in March, about $240,000.

After this projected peak, April will likely be a bull trap, where price appears mighty but fails to maintain upward momentum. The forecast ends with a warning regarding flash failure in May 2026, during which prices may return to novel lows.

Featured image from Unsplash, chart from TradingView