Image source: Olaf Kraak via Shell PLC

Crude oil reserves have been one of the largest victims of sales induced with a tariff over the past few weeks. But with a recent turn from renewable energy sources, Shell (LSE: Shel) The price of shares can be set to push higher in the coming years.

Fall in oil prices

This month, the fall at the price of Brent oil at a four -year minima screwed Shell. This clearly emphasizes how the company’s fortunes are related to the price of assets over which there is no control. This may be such, but is this really an crucial reason against making the investment?

If I took this argument to his logical conclusion, I would end up in nothing. The point is that no company or industry has full control of various macro external forces. The bank cannot prevent recession than an insurance company can prevent destructive floods or fires.

I really like the long -term trajectory of demand for oil and gas. Here I am on a much more solid ground.

Scenarios planning

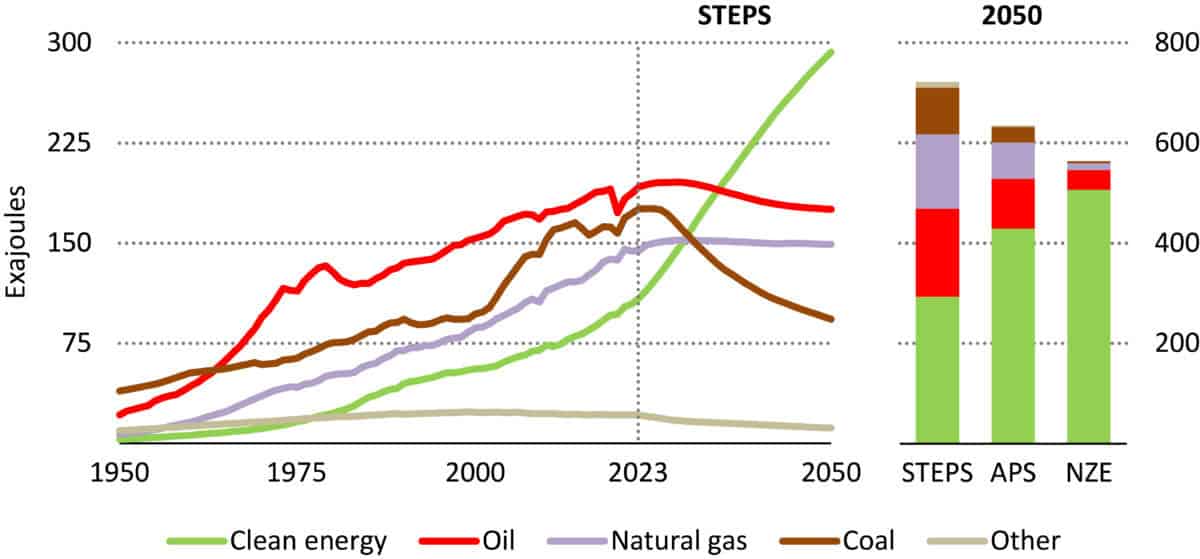

In its global Energy Outlook 2024 program, the International Energy Agency updated its energy mixtures by 2050 due to the default scenario of specific rules (stages), both the demand for oil and gas in 2030, but unlike oil, which later will slowly decrease, the demand for natural gas remains flat.

Source: International Energy Agency

His Net Zero (NZE) scenario sees huge decreases in the demand for fossil fuel. However, its assumptions regarding energy trajectory seem completely unreal to me, especially based on the current state of technology and adoption indicators.

On the day of capital markets in March, Shell published his own updated scenarios. Some say that the scenarios are simply guessed, but they basically lack their usability. They are not used as expressing a strategy or business plan. But they facilitate stretch your minds, broaden the horizons and discover the assumptions.

Energy demand

I think that we can learn a lot about the future energy demand after the instructions. We saw the political and social tensions of this size from the end of the Cold War. Plus, countries are struggling with a modern era of economic growth with AI, energy security and climate change.

Slowly unwinding globalization and developing commercial wars can potentially again pull the world production base away from China. Development in China will probably accelerate a lifestyle of higher income there, thus increasing the demand for energy. At the same time, because the US is building more production capabilities, it can also be strengthening demand.

Ultimately, I see that hydrocarbons remain an crucial part of the energy mixture for decades. But the rate of adoption to zero net is a great unknown and remains the greatest risk of Shell.

We already see the growing regulatory pressure in Great Britain, which prevents further search licenses. Whether investors turned against the industry Very The consequences for him can be catastrophic.

Like his peer BishopShell recently reduced his expenses for low carbon technologies. I am convinced that this is the right approach to taking up. Because the priority is the returns of shareholders in the coming years, I think that its price at the level of sales of check -in means that investors should consider adding it to their wallets.