Image source: Getty Images

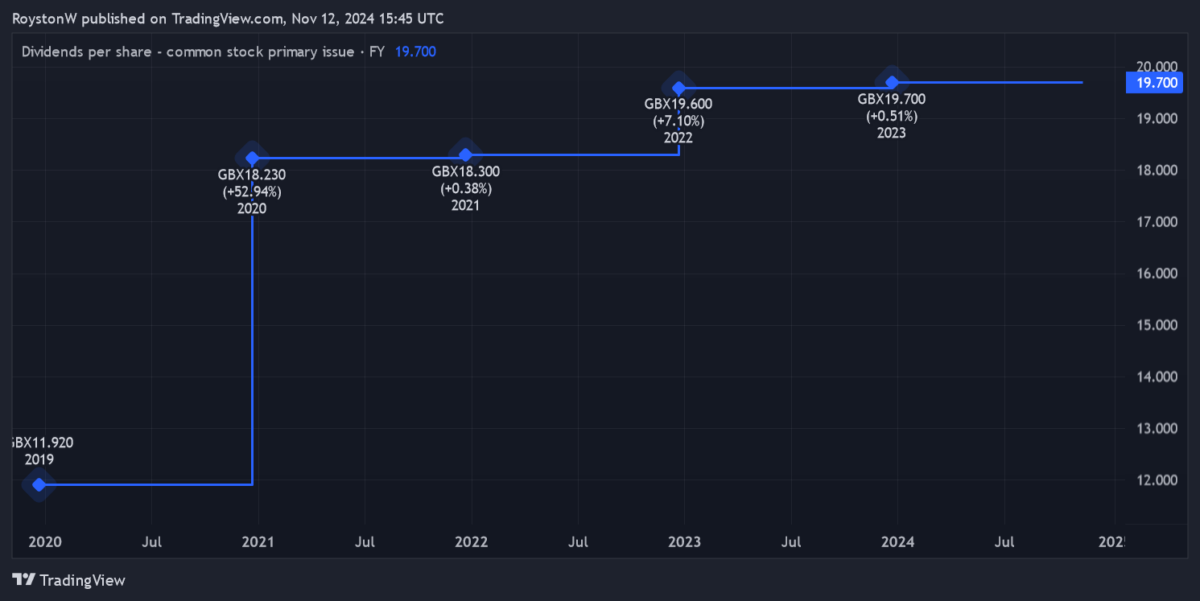

M&G‘s (LSE:MNG) was one of FTSE100highest dividend stocks to buy recently. Not only has the dividend yield exceeded the market average since 2019. Shareholder payouts have steadily increased since the company’s spin-off Prudential five years ago.

What makes M&G such an attractive stock to me today is its double-digit dividend yield. Only for 2024 Feniks Group brings a bigger harvest on Footsie today.

As the chart below shows, City analysts expect prize money to continue rising until at least 2026, pushing yields even further above 10%.

| Year | Dividend per share | Dividend raise | Dividend rate |

|---|---|---|---|

| 2024 | 20/07p | 2% | 10.2% |

| 2025 | 20.63 p | 3% | 10.5% |

| 2026 | 21.26 p | 3% | 10.8% |

However, before I buy any dividend stock, I need to consider how realistic the current forecasts are. I also need to consider whether the M&G share price will continue to fall, which could offset any enormous dividends.

Here’s my verdict.

Financial basics

At first glance, M&G’s stock dividend projections seem a bit uncertain. This rating is based on an easy-to-calculate dividend coverage ratio. As an investor, I am looking for a wide margin of safety, i.e. a reading of 2 times upwards.

Unfortunately, the expected dividend for this year’s profits is actually higher than estimated. And while earnings are expected to raise in 2025 and 2026, dividend coverage is still needy at 1.2 and 1.3 times, respectively.

Theoretically, this puts dividend forecasts at risk if earnings disappoint. However, M&G has a cash-rich balance sheet to fall back on if earnings are unsatisfactory.

The Solvency II capital ratio – a key liquidity signal – was 210% in June, which was double the regulatory requirements and a 7% year-on-year raise.

Encouragingly for future dividends, M&G’s recently increased its three-year cash generation target to £2.7 billion from the previous £2.5 billion.

Solid prospects

All in all, I think there’s a good chance M&G will meet brokers’ dividend forecasts. Poor dividend coverage has been a common occurrence in recent years. However, this did not stop the distribution of enormous and growing cash payouts.

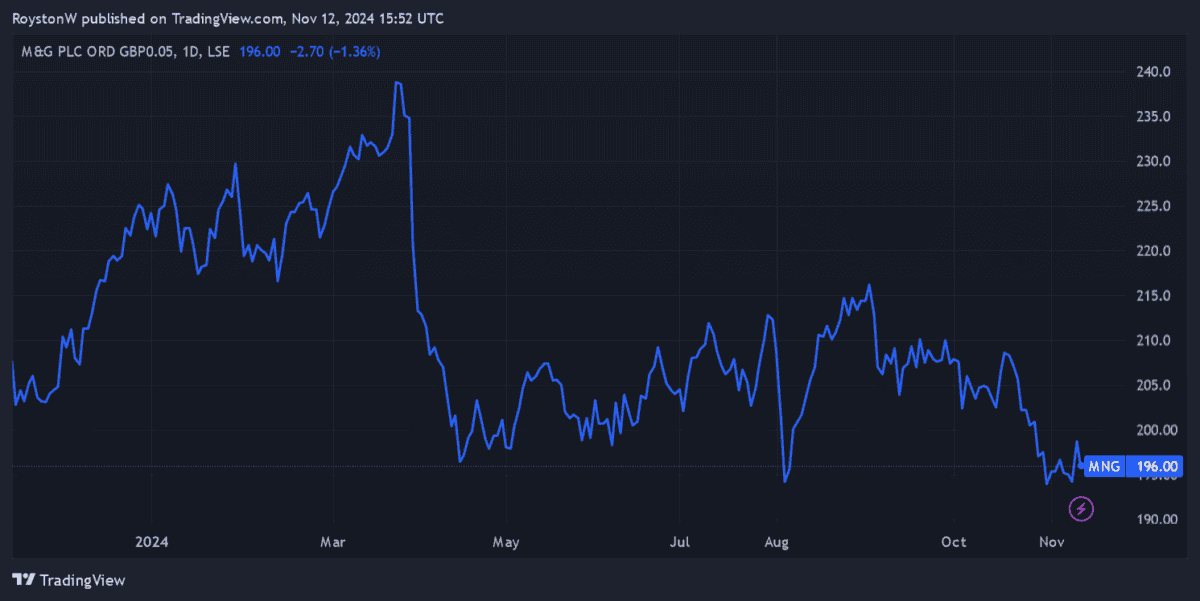

But does that make this company a potential buy? As I said, the company’s share price has declined since overdue March, when the company went ex-dividend. It has continued to struggle since then as concerns about the UK economy persist.

However, I expect M&G shares to rebound strongly over time. As a leading provider of pensions and other investment products, I expect profits to continue to grow as an aging population drives demand for retirement services.

Despite stiff competition, I believe the FTSE-owned company has the expertise and brand recognition to capitalize on this opportunity.

Verdict

At 196p per share, M&G shares offer a huge dividend yield of over 10%. But that’s not all value seekers can get excited about. The price-to-earnings growth ratio (PEG) this year was just 0.4. Any reading below 1 suggests the stock is undervalued based on expected earnings.

This is not without risk. Overall, though, I think M&G is the most dividend-worthy stock and should be considered. Especially at today’s price.