This article is also available in Spanish.

In technical analysis shared with his followers on X, cryptocurrency analyst Bobby A (@Bobby_1111888) offers a bullish outlook for XRP despite the US Securities and Exchange Commission’s decision to appeal the ruling in its case against Ripple Labs. Amid regulatory turmoil, Bobby’s interpretation of the macro charts suggests a bullish outlook for XRP, belying the potential bearish sentiment created by the SEC’s latest legal maneuver.

Bobby compares the immediate market reactions typically triggered by high-profile legal news with the actual long-term trends observed in asset prices. “Many forget that even with news of the SEC lawsuit in 2020, the asset value increased from $0.11 to $1.95,” he notes.

XRP monthly charts continue to look bullish

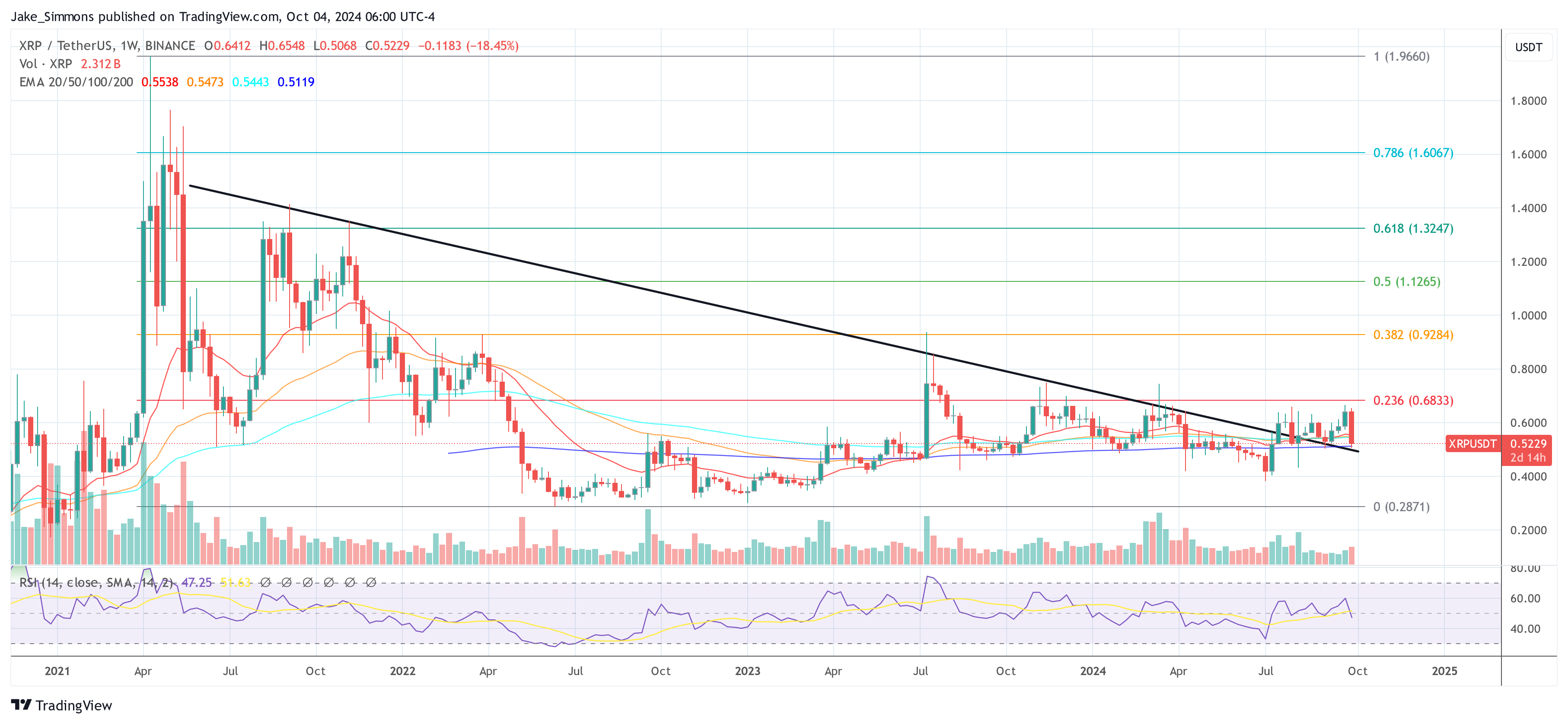

The analyst highlights that XRP has traded over the last nearly seven years in a consistent sideways consolidation pattern, which he describes as a “macro base.” According to Bobby, this extended period of consolidation is crucial to understanding the potential for an upside move.

“The monthly time frame shows that after the Bitcoin halving, during each cyclical rotation of the momentum oscillators, the asset [XRP] is experiencing a sharp price appreciation that could begin at any time. This happened in 2017 and 2020.” Bobby explains further.

The argument from Bobby’s analysis focuses on the monthly Bollinger Bands on the XRP/USD chart, an indicator used to measure market volatility and identify potential price targets based on past market behavior. “As in 2016, the price is closely tied around all important moving averages from higher time frames, including the middle line of the monthly Bollinger Bands,” writes the analyst.

He adds: “While we are on the subject of Bollinger Bands, they are the narrowest in the history of the coin,” he notes. This tightness suggests that XRP is at a key moment where any raise in volatility could lead to significant price movement.

It is worth noting that Bobby’s profit zone lies between the Fibonacci extension level of 1.618 at $5.31 and the Fibonacci extension level of 4.236 at $13.72. So Bobby’s expected return in this bull run ranges from a whopping 950% to 2,600%.

Bobby theorizes that initial moves after volatility returns can be dishonest and potentially intended to mislead market participants as to the true direction of price. He alludes to Bitcoin’s unexpected rally in March 2020, suggesting that XRP may experience a similar dishonest but ultimately bullish breakout.

“The XRPETH and XRPBTC charts do not look like the start of a long, drawn-out bear market, but rather a possible capitulation in deep value areas. Remember, the worst news appears at the bottom and the best at the top,” Bobby added.

The upcoming U.S. presidential election could also play a key role in shaping the regulatory landscape affecting cryptocurrencies like XRP. Bobby speculates on the possible outcomes: “If Donald Trump were re-elected president, I don’t see Gary Gensler remaining chairman of the SEC.” He argues that a change in SEC leadership could ease regulatory control over Ripple and, by extension, XRP, creating a more favorable market environment.

In his closing remarks, Bobby reiterates his powerful belief in the bullish thesis for XRP. “No one ever said it would be easy, and investing never is,” he muses, encouraging his audience to take a strategic, long-term view of investing in XRP.

At press time, the price of XRP was $0.52.

Featured image created with DALL.E, chart from TradingView.com