Image source: Getty Images

The BT (LSE:BT.A), the company’s share price has increased by an impressive 23% since the beginning of the year. City analysts don’t think so FTSE100 supplies are ready.

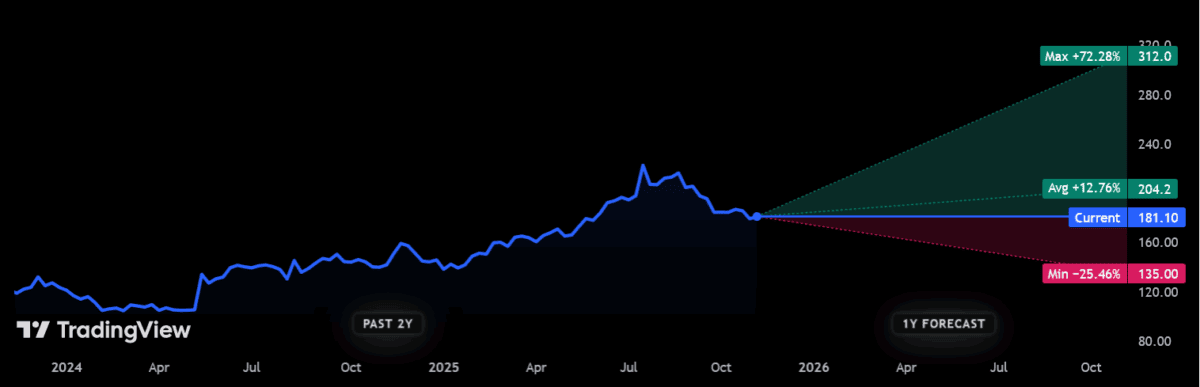

BT shares last changed hands at 181p per share. If forecasts are correct, they will rise above the 200p mark to 204.2p per share next year. This would represent an augment of 12% over the current level.

If projected dividends are also taken into account, BT investors could achieve a total return of 16-17% over the next 12 months. But how realistic are these predictions?

Progress

First, it should be said that brokers are not unanimously hopeful in their estimates. A target above 200p is the average of 15 forecasts currently offered by the analyst community.

One analyst believes BT’s share price could fall by more than a quarter between now and next Remembrance Day. Another believes that it could print a price augment of more than 70% during this period.

What do City analysts think can take the company even higher? Bulls believe BT’s restructuring program will do more than support it continue its impressive cost-cutting strategy. They see it as a way to streamline their product mix and support them recover from shrinking revenues.

BT’s restructuring plan achieved significant savings worth £1.2 billion in the 18 months to September, surprising forecasts.

The company’s high-margin Openreach infrastructure department is also hopeful due to the continuous development of novel fiber optic connections. By the end of next year, 25 million premises are to be connected, and by the end of the decade, 30 million.

Problems

Although BT is making progress on these fronts, I fear stocks may run out as problems persist elsewhere.

There is still no sign of overcoming persistent sales issues – adjusted revenues fell again by 3% in the six months to September, with reversals recorded across consumer, business and international divisions. Against a backdrop of increasing competition and a weakening UK economy, I don’t see income problems easing any time soon.

At the same time, investment spending continues to grow, reaching 8% over the six months. This means net debt has also continued to rise, up another 3% year-on-year to stand at £20.9 billion at the end of September.

This situation becomes even grimmer when you consider the costs of BT’s huge pension deficit. This costs the company around £800 million a year.

Dear

There is also a valuation issue which I think could limit further gains in the BT share price. Thanks to this year’s rapid growth, the company is trading at a forward price-to-earnings (P/E) ratio of 10.3 times.

This is higher than the 10-year average of 8.8 times. Given the persistent problems facing the business, this emerging premium is particularly arduous to understand.

What’s more, BT shares also currently trade at a price-to-book (P/B) ratio of 1.4. This value is up from just 14 months ago and indicates that the company is trading at a premium to the value of its assets.

I wouldn’t be surprised if BT’s share price continues to rise. However, I believe that the chances of this happening are high, so I prefer to buy British shares, which offer much lower risk.