Image source: Getty Images

. FTSE 250 The MID-Cap index increased by 5% of the value in 2025. This is not bad, but it is below the performance of other main global indexes. . FTSE 100 For example, it increased by 12% during this period.

This worse results reflect gloomy prospects for the British economy, as well as growing pessimism in relation to the cuts of interest rates as inflation increases. About 40% -45% of the FTSE 250 earnings comes from Great Britain, much higher than Footies with a flavor on the international arena.

Some of the highest quality index components actually dropped rapidly from January 1, which in my opinion is a potential opportunity to buy immersion. Here are two such actions, I think, require sedate consideration today.

Bloomsbury publishing

Bloomsbury publishingActions (LSE: BMY) recorded 29% per year. While this Harry Potter The franchise remains as popular as always, the weakness of other parts of the business has rapidly lowered the book manufacturer.

More precisely, indigent sales in the Academic Publishing Department separated the gloss from other operations of the company. Organic sales here fell by 10% in the last budget year, it announced in May, partly due to budget pressure in Great Britain and the USA. Since then, the company has not regained the land.

Although these problems can persist, I think that there is a lot to like in Bloomsbury, which makes it worth looking. Long -term perspectives of academic publishing units Solid remaris, the acquisition of the Rowan & Littlefield high margin operator helped its range.

But in fact I am attracted by the quality of his consumer division, and more precisely its pedigree on rapidly developing fantasy markets and science fiction. Harry Potter Is not the only series of stars in his portfolio – Sarah J Maas’s Court of thorns and roses This is another of the best -selling series, with 75 million sales and subsequent books that were included in order to reduce the pipeline.

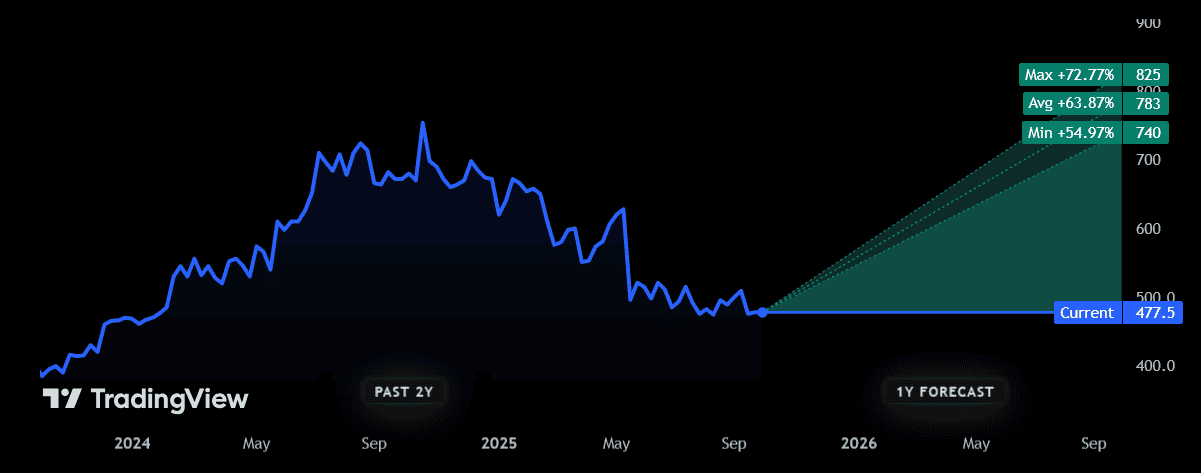

Municipal analysts are united in their opinion that Bloomsbury shares will be reflected in the next 12 months. The consensus view concerns 64% growth from current levels to 783 pens per share.

Ibstock

IbstockThe price of shares (LSE: IBST) has fallen by 21% from January 1. It was feared that the recent recovery of the housing market could be marked when the British economy is fighting and inflation is growing.

However, for long -term investors I believe that the investment case of the brick manufacturer remains solid. That is why I keep the company in my own shares and ISA shares.

Despite the high competition, the requirements of the growing population could discharge the sale of products over the next decade. The government plans to build modern 3M houses until 2029. Wisely, Ibstock has invested strongly in the ability to satisfy future demand.

But that’s not all that attracted me, because I think that the company can also expect a solid departure from the repair sector, maintenance and improvements (RMI). British housing are one of the oldest in the world, so for many years there should be a constant demand.

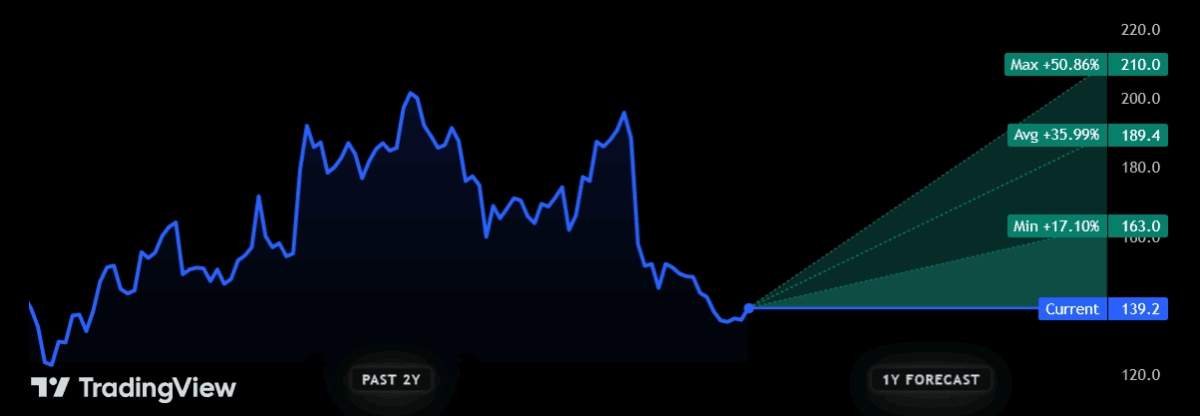

As in the case of Bloomsbury, city brokers are united in their belief that Ibstock will share over the following year. The average price of shares among them is 189.4p, which is 36% of the bonus from today’s levels.