Image source: Getty Images

When the stock market becomes uncertain, growth actions are often the most complex. And this is not an accident – their future cash flows are often less certain than the actions of values or dividend actions.

In general, these things are quite cyclical. I don’t know exactly when everything is reversed, but I think it’s a good time to look at growth supplies when they do it.

Increase versus value

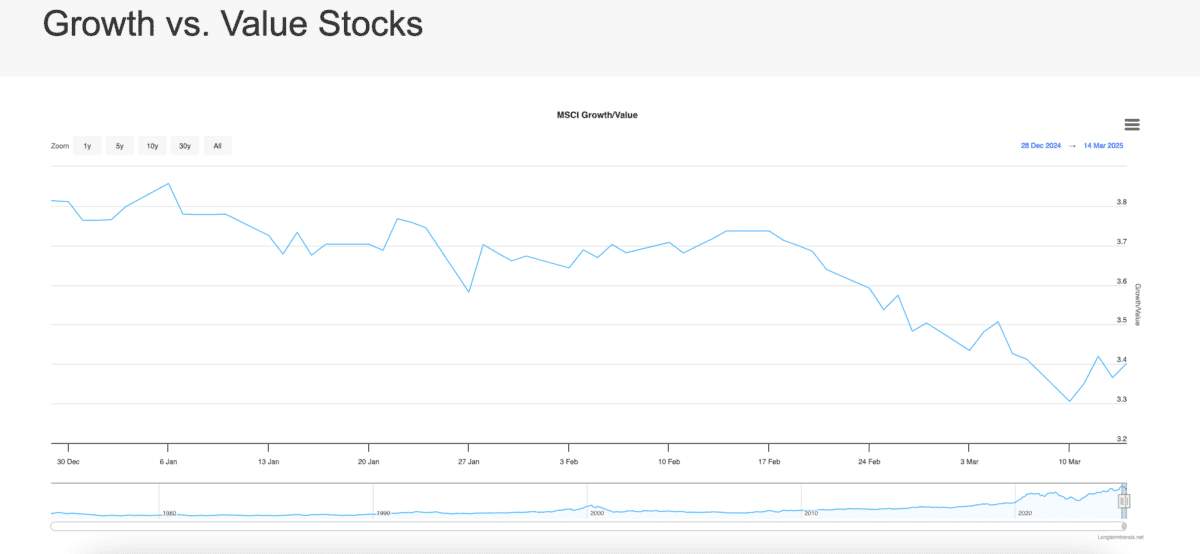

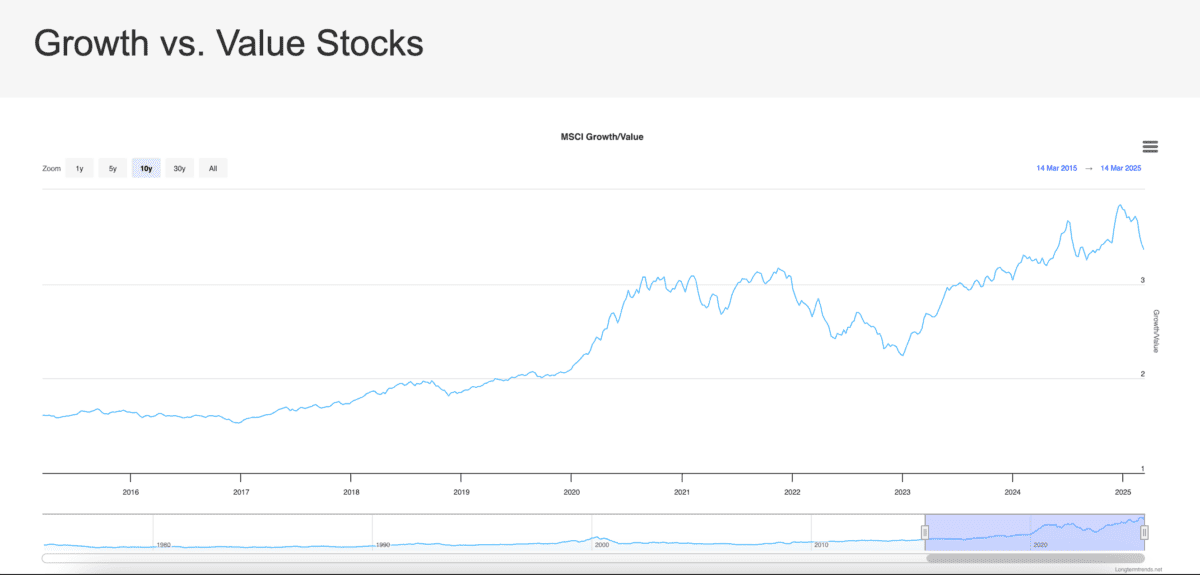

So far, this year, the ratio of the US MSCI Growth index to the MSCI US MSCI value indicator has fallen from 3.8 to 3.4. In other words, US growth actions have worse value actions.

The same general trend was real somewhere else. . FTSE 100 surpassed S&P 500 In 2025, but the main reason for this is the concentration of growth in the US index.

However, investors should be careful. The difference between growth actions and valuable actions closes, but it is still towards the higher end of the place where it has been over the past decade.

As a result, I do not see the latest slowdown on the stock exchange as time to buy growth shares as opposed to fists. But I think it’s a chance to look for specific opportunities.

FTSE 100 breeder

Compass group (LSE: CPG) are actions that recently catches me. Actions at the FTSE 100 catering company fell by 13.5% in the last month.

Despite this, I think that there is a lot to like at the company. The company’s scale gives it a clear competitive advantage when it comes to negotiating mass prices from suppliers.

In addition, the latest commercial update recorded a certain boost in revenues. Ecological sales increased by over 9%, and the company expects that it will remain above 7.5% for the rest of 2025.

Looking to the future, I think that there is also good potential under the upper line. The level of debt and the number of shares are still high after the pandemic, and their reduction should boost profits.

What is the problem?

Despite this, the supplies fell sharply. And the latest reason was a double reduction from better results to worse results by BNP Paribas Exane.

The reason is that the reduction of work in the USA – especially in the healthcare sector – can be determined on demand. And this is a reasonable reason for concern in the company.

However, I think that investors must remain perspective. Healthcare & Senior Living in the USA constitutes just over 18% of the company’s total revenues. Considering this, a decrease by over 13% seems to be a huge decrease, and the current price of shares 24.25 £ is lower than the changed price of BNP in the amount of $ 25 GBP. As a result, I added it to my observation list.

Finding shares for purchase

Growth actions could have achieved worse than actions from the beginning of the year. But as a group, I don’t think they are of course on the territory of the occasion.

Individually, however, I think that there are supplies that have fallen to attractive levels. The Compass Group is not my best supply to the purchase, but carefully.