- Dow Jones recovered about 520 points on Friday.

- Despite the withdrawal at the last moment, Dow is 1,400 points per week.

- The actions have moved from one of the worst consumer moods for years.

The industrial average Dow Jones (DJIA) fought on Friday on the edge, withdrawing about 520 points after a series of bad losses, in which Dow Jones broke 3373 points or -7.66% peak, in a two -week period. However, broad recovery in actions may be poorly transient: the indicators of the consumer perspectives of the University of Michigan (UOM) have contributed to their deepest immersion in the years on Friday, and pain from consumer moods can go further.

The UOM consumer mood indicator for March has fallen into the lowest printing for over two years, falling to 57.9, when the aspirations of the Trump administration in the global trade war with everyone at the same time begin to exclude holes in the perspective of US consumers. The median market forecasts expected a slight deterioration of the economic situation in the key consumer index, expecting a decrease to 63.1 out of 64.7.

UOM consumer sentiments index (March)

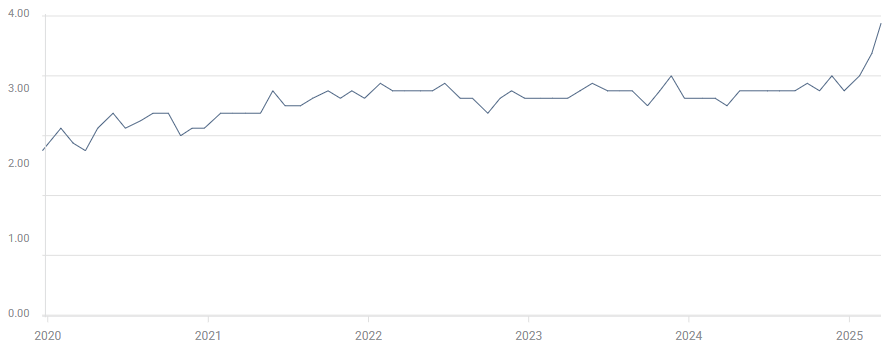

The perspectives of inflation of consumers of the Marc Mountains also increased higher, and 5-year respect reached 3.9%, and the highest monthly rate boost in the indicator for over four decades. The expectation of UOM inflation also increased to a two -year maximum 4.9%, which anchored concerns about consumer inflation far above 2% of the annual goal of the Federal Reserve (FED).

5 years of waiting for consumer inflation (March)

The disintegrating consumer trust is badly lifeless at the USA, as the chief economist Comerica Bank Bill Adams noted:

“Withdrawal of certainty becomes a real threat to consumer expenditure, which, as is often the case, is two -thirds of the US economic activity.”

They must be passed, the rate markets remain stubbornly attached to the idea of reducing the Q2 rate from the Fed. According to the CME Fedwatch tool, salespayers of the rates still value almost 80% of the chances for the next finish of the quarter point from the FED in June. It is expected that Fed Jerome Powell chairman and other members of the Federal Open Market (FOMC) Committee will be rates after convening the rate next week and again in May.

Dow Jones News

Most of the securities listed on the industrial average Dow Jones find a place on the high side on Friday, when investors extend their shopping buttons. However, profits are focused in the favorites of technological rallies and American banking giants. NVIDIA (NVDA) increased by 4.5%, rising above 120 USD per action, when the beloved technology rally tries to make the last lost run that pulled a silicon puncher from record maxims above USD 150.

Read more: JPMorgan, Goldman Sachs, American Express profit from the perspective of budget accounts in the USA

Dow Jones price forecast

Piątkowa Splurge threw a four-day lost Dow Jones series, but the main capital indicator remains after the 200-day-interpretation of the average movable (EMA) near 42,000 main price handles. Dow Jones was at a distance of centimeters from hitting the territory of the correction after the chalk failed in the up-to-date peaks from the peak of November north of 45,000, and traders will want to extend the fresh stubborn leg after briefly testing the territory of the chart below 41,000.

Dow Jones Daily Table

Economic indicator

Index of consumer sentiments Michigan

Michigan consumer sentiments index, issued every month by University of MichiganIt is a survey assessing moods among consumers in the United States. The questions include three wide areas: personal finances, business conditions and purchase conditions. The data shows the image of whether consumers are ready to spend money, a key factor, because consumer expenditure is the main driving force of the US economy. The study of the University of Michigan turned out to be an correct indicator of the future US economy. The study publishes preliminary reading in mid -month and the last print at the end of the month. In general, high reading is stubborn for an American dollar (USD), while low reading is bears.

Read more.

Last edition: Fri March 14, 2025 14:00 (PREL)

Frequency: Monthly

Actual: 57.9

Agreement: 63.1

Previous: 64.7

Source: University of Michigan