This article is also available in Spanish.

Today, the Ethereum-Bitcoin (ETH/BTC) rate fell below 0.04, a level last seen in April 2021. The falling ETH/BTC ratio could have a number of implications for the broader altcoin market.

Altcoins may suffer from frail Ethereum

One of the key metrics for assessing the resilience of the altcoin market is the ETH/BTC ratio. This ratio essentially tracks the relative price strength of Ethereum versus Bitcoin and is widely considered an indicator that can indicate potential future price movements for altcoins.

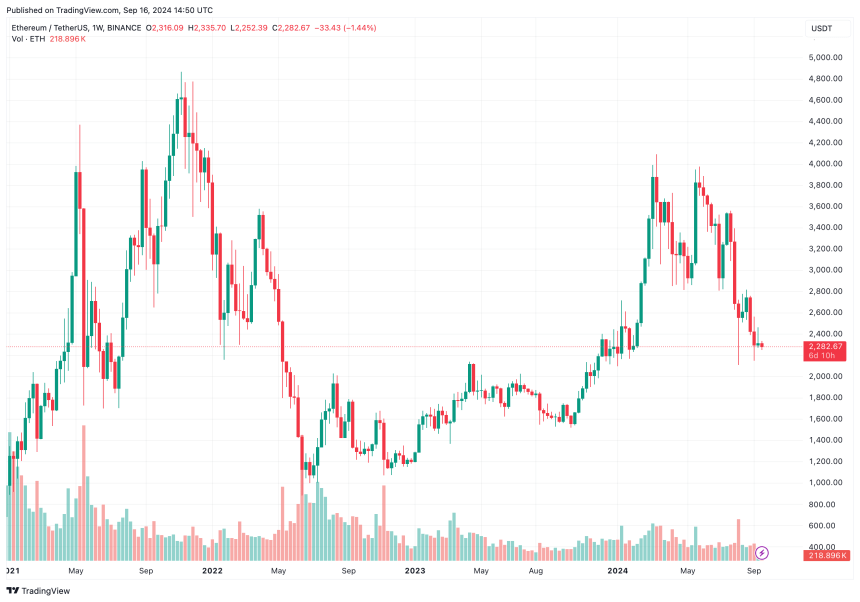

As of September 16, 2024, the ETH/BTC ratio stood at 0.039, a level it last reached 3 years ago in April 2021. In fact, after peaking at 0.088 in December 2021, the ETH/BTC ratio had been on a long-term decline, barring occasional upticks, before experiencing further erosive loss of value.

In terms of altcoin price action, the rising ETH/BTC ratio indicates that Ethereum is doing well compared to Bitcoin. On the other hand, the falling ratio suggests that Bitcoin is doing better than Ethereum and other altcoins, which could trigger a change in confidence from Ethereum to Bitcoin.

As a result, the broader cryptocurrency market could see a sell-off in altcoins as capital seeks out more stable and better performing assets.

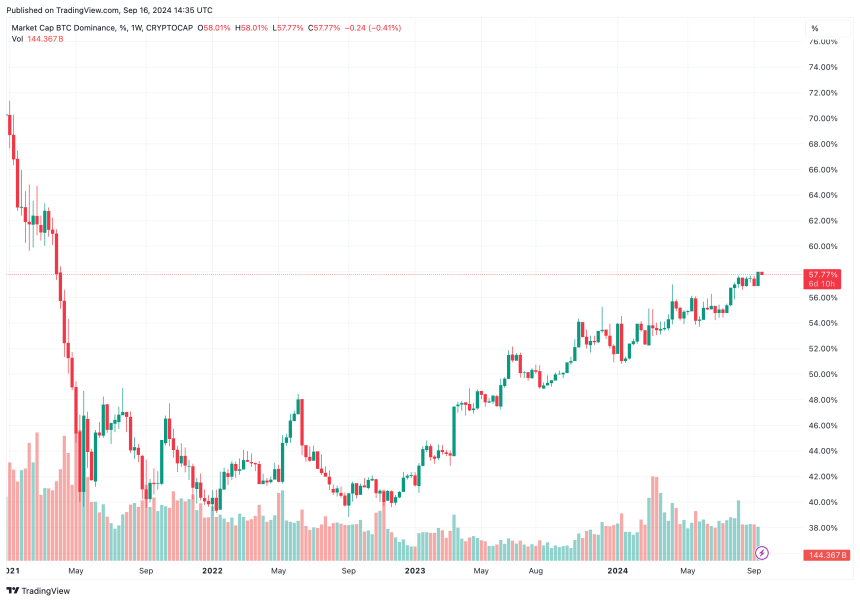

Currently, Bitcoin (BTC.D) has a dominance of 57.78% and it can be seen that this indicator has been on a steady upward trend since November 2022. The rise in BTC.D further strengthens the weakening altcoin market, suggesting that liquidity is withdrawing from small-cap tokens, which could lead to volatile price action and quick price reductions.

It is worth noting that the US Securities and Exchange Commission (SEC) has approved Ethereum-based ETF funds NO turned out to be as vital an event for the ETH price as for the BTC price.

Data Data from cryptocurrency ETF tracker SoSoValue shows that the cumulative net outflow from U.S. Ethereum ETFs is $581 million, while the net inflow from U.S. Bitcoin ETFs is $17.3 billion.

Can the price of Ethereum change its dynamics?

Ethereum is trading at $2,282, a price level it last reached in January 2024. Interestingly, the second-largest cryptocurrency by market capitalization briefly hit $3,900 before losing all its gains.

It was recently reported that 112,000 ETH was transferred to cryptocurrency exchanges in a single day, suggesting that investors may not be too keen on holding ETH until its price drops against Bitcoin.

Some experts opine that now might be a good time to swap your BTC holdings for ETH, as a potential 180% raise is predicted in the strained ETH/BTC ratio.

The continued selling pressure on Ethereum has also pushed ETH into oversold territory, which has resulted in hope ETH holders understand that the digital asset has most likely already bottomed out and could soon see a robust price rebound.

Featured image from Unsplash, charts from Tradingview.com