Hedera (HBAR) emerged as a standout in the second quarter (Q2) of the year, reversing the downward trend that many projects had been struggling with. The latest report from research firm Messari presents Hedera’s progress on key financial metrics.

Ivy’s momentum in Q2

One of the most vital events of Hedera’s second quarter was progress in key areas financial indicatorsDespite a 29% quarter-on-quarter (QoQ) decline in market capitalization to $2.7 billion, HBAR managed to move up six spots from 36th to 30th among all tokens, surpassing similarly priced cryptocurrencies.

According to the report, revenues also became a beacon of success for Hedera in Q2, with the chain recording a 26% augment in USD revenues, reaching $1.4 million. Additionally, HBAR revenues increased by 19% quarter-on-quarter to $14.6 million.

The pace of HBAR issuance and circulation continued to be in focus, with 72% of the 50 billion HBAR in circulation at the end of Q2. Quarterly distribution HBAR announced an additional $1.5 billion in HBAR funding in the coming quarter, with a significant portion, 94%, going to ecosystem and open source initiatives.

While the number of daily account creations increased by 31% to 11,100, the number of daily busy addresses fell by 37% to 10,600, reflecting a mixed picture of growth and engagement across the network. Transaction activity The second quarter saw growth, with the average daily number of transactions increasing by 46% to 132.9 million, mainly due to the Hedera Consensus service.

Staking Growth And DeFi Fluctuations

The report also highlighted on-chain staking, which has emerged as a significant trend in the ecosystem. Staking has taken up 62.2% of the circulating supply, indicating a high level of engagement from entities such as Swirlds and Swirlds Labs.

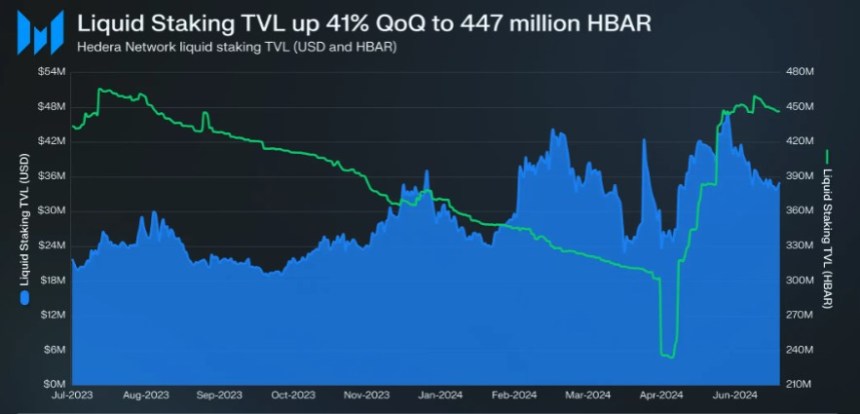

However, the decentralized finance (DeFi) landscape on Hedera saw fluctuations in the second quarter, Total value locked (TVL) sees declines in both USD and HBAR.

Regardless, Messari says initiatives like the HBAR Foundation’s DeFi TVL development program have revitalized the ecosystem, driving liquidity and awareness. On the other hand, liquid staking saw a resurgence in Q2, with Stadera’s TVL increasing by 41% on an HBAR basis.

Finally, decentralized exchange (DEX) Hedera’s volumes also saw a decline in Q2 following bullish According to Messari, in the first quarter, but year-on-year (YoY) it remained robust.

At the time of writing, HBAR has seen a significant price decline of 22% over the past month, currently trading at $0.050 amidst the backdrop of general market uncertainty caused by increased volatility in the largest cryptocurrencies on the market: Bitcoin (BTC) and Ethereum (ETH).

Additionally, CoinGecko data shows that the token has seen a noticeable drop in trading volume over the past 48 hours, dropping by 35%. Most importantly, HBAR is still 91% below its all-time high of $0.056 reached in September 2021.

Featured image from DALL-E, chart from TradingView.com