Image Source: Getty Images

Over time, the London Stock Exchange has become the ideal place for investors looking for stocks with growing dividends.

With an average dividend yield of around 3.5% FTSE100 AND FTSE 250 Index indices offer higher dividends than most foreign exchanges. This is partly due to the UK’s long-standing culture of paying cash rewards.

It’s also because many UK companies are well-established in mature markets. They receive stable cash flows in industries such as energy, banking, consumer goods and utilities. These can then be distributed as dividends.

Moreover, due to lower growth opportunities, UK stocks in these sectors tend to return a higher proportion of their profits to shareholders.

Taking care of

Of course, dividends are never guaranteed. As we’ve seen during the Covid-19 pandemic, even the most reliable dividend stocks can suddenly reduce or eliminate their payouts.

Buying stocks with forceful balance sheets, solid positions in defensive markets, and a proven commitment to paying dividends can significantly enhance an investor’s chances of receiving high passive income.

Here’s one I’d buy if I had the spare cash to invest. If analysts’ predictions are right, it could provide a £1,000 second income this year.

Power play

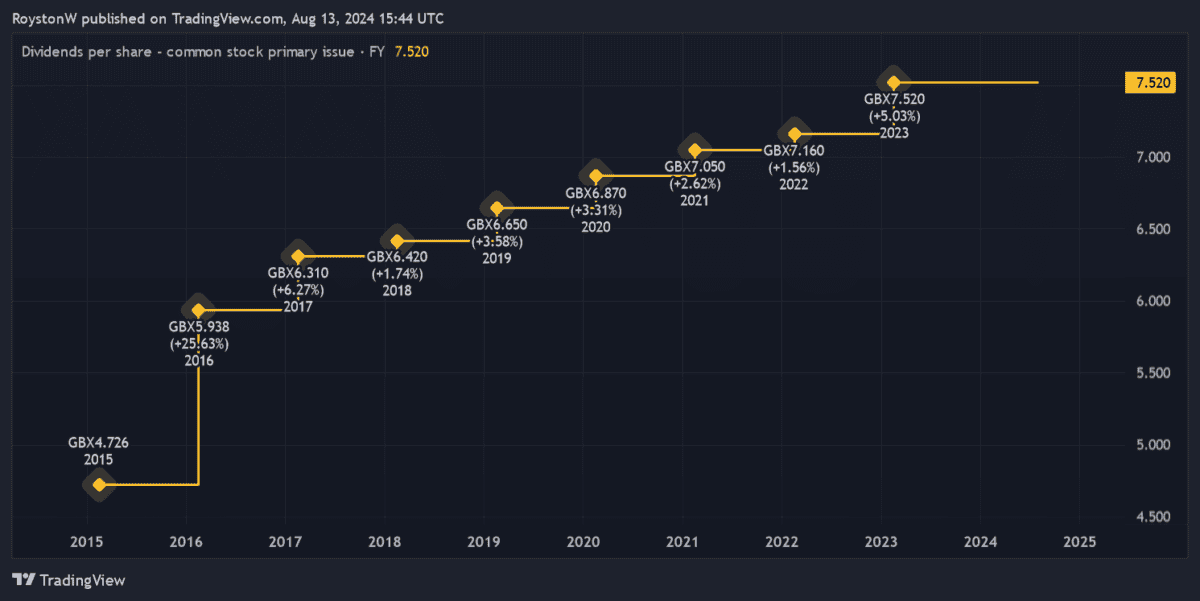

As the graph shows, NextEnergy Solar Fund (LSE:NESF) has a long history of raising its annual dividend. In fact, after deciding to raise its total payout for fiscal 2024 to 8.35 pence per share, it has increased its cash rewards every year since its 2014 IPO.

As a renewable energy company, the company benefits from stable cash flows at all points in the economic cycle. Electricity is one of life’s most basic commodities, so NextEnergy has the financial strength as well as the certainty of paying a growing dividend.

Furthermore, because a significant portion of the company’s regulated earnings are linked to the Retail Price Index (RPI), its ability to raise dividends remains forceful, even in periods of inflation.

There are risks associated with buying NextEnergy Solar Fund. Power production fell almost 7% last year to 852 GWh, which the company attributed to “increased rainfall and humidity (which may affect the operation of some components)”.

But weather-related issues in this regard are scarce. Indeed, solar panels are well-known for providing a steady flow of electricity, thanks to average annual irradiance and a confined number of moving parts. This makes NextEnergy a much more reliable profit generator than many other renewable energy stocks.

10.1% dividend yield!

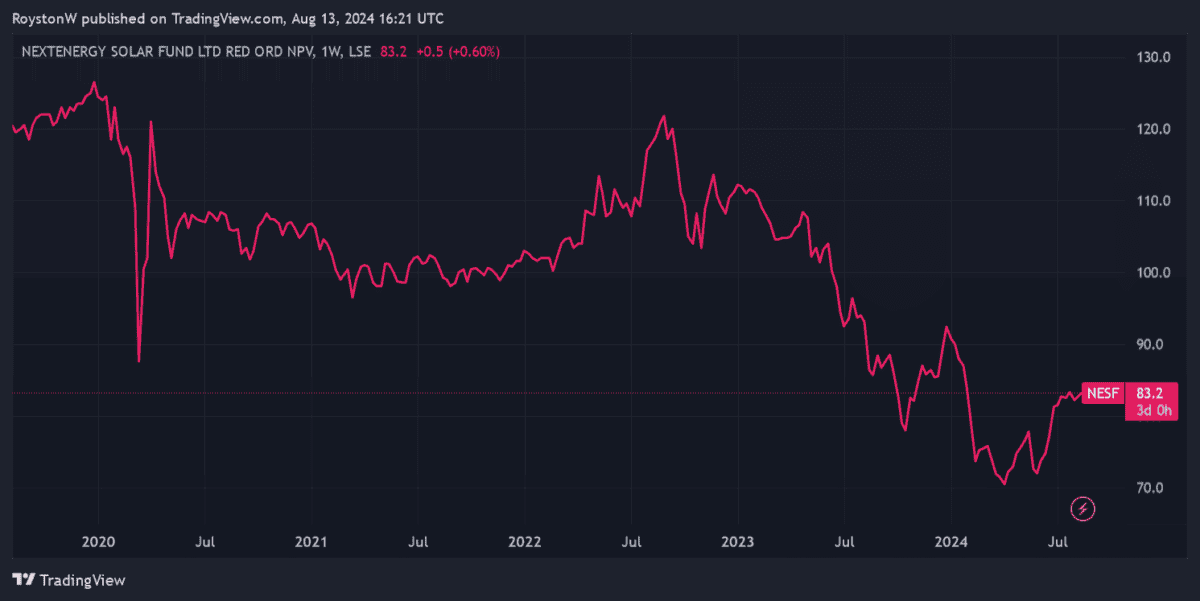

As the chart shows, the company’s share price has struggled recently. Higher interest rates have squeezed net asset value (NAV) and depressed earnings. That, too, could remain a problem if inflationary pressures persist and central banks keep interest rates at current levels.

However, the spectacular cheapness of NextEnergy’s share price makes it worth grave consideration in my opinion. The company is trading at a 22% discount to its estimated net asset value per share of 105.7p.

Given the forward dividend yield of 10.1%, I believe this could be one of the best quality income stocks to consider.

If I invested just over £9,900 in NextEnergy shares, it would give me a juicy £1,000 in passive income this year. Assuming brokers’ predictions are right.