In an analysis shared via X, renowned cryptocurrency analyst Ted (@tedtalkssmacro) provided compelling evidence to support his claim that the current Bitcoin bull market is far from over. Ted’s insights are based on four critical metrics related to conventional finance and cryptocurrency liquidity, each of which points to sustained growth in the near future. Here is an excerpt from his analysis:

#1 65-month liquidity cycle

Ted highlights the 65-month liquidity cycle, a historical pattern that determines the ebbs and flows of liquidity in financial markets. According to his analysis, this cycle bottomed out in October 2023, signaling the beginning of a modern phase of expansion.

“We are currently in an expansion phase that is expected to peak in 2026.” – Ted said. This projection is in line with central banks expected to ease monetary policy in response to slowing economic data over the next 18-24 months. Historically, increased liquidity has been a precursor to bull markets across asset classes, including Bitcoin and the broader crypto ecosystem.

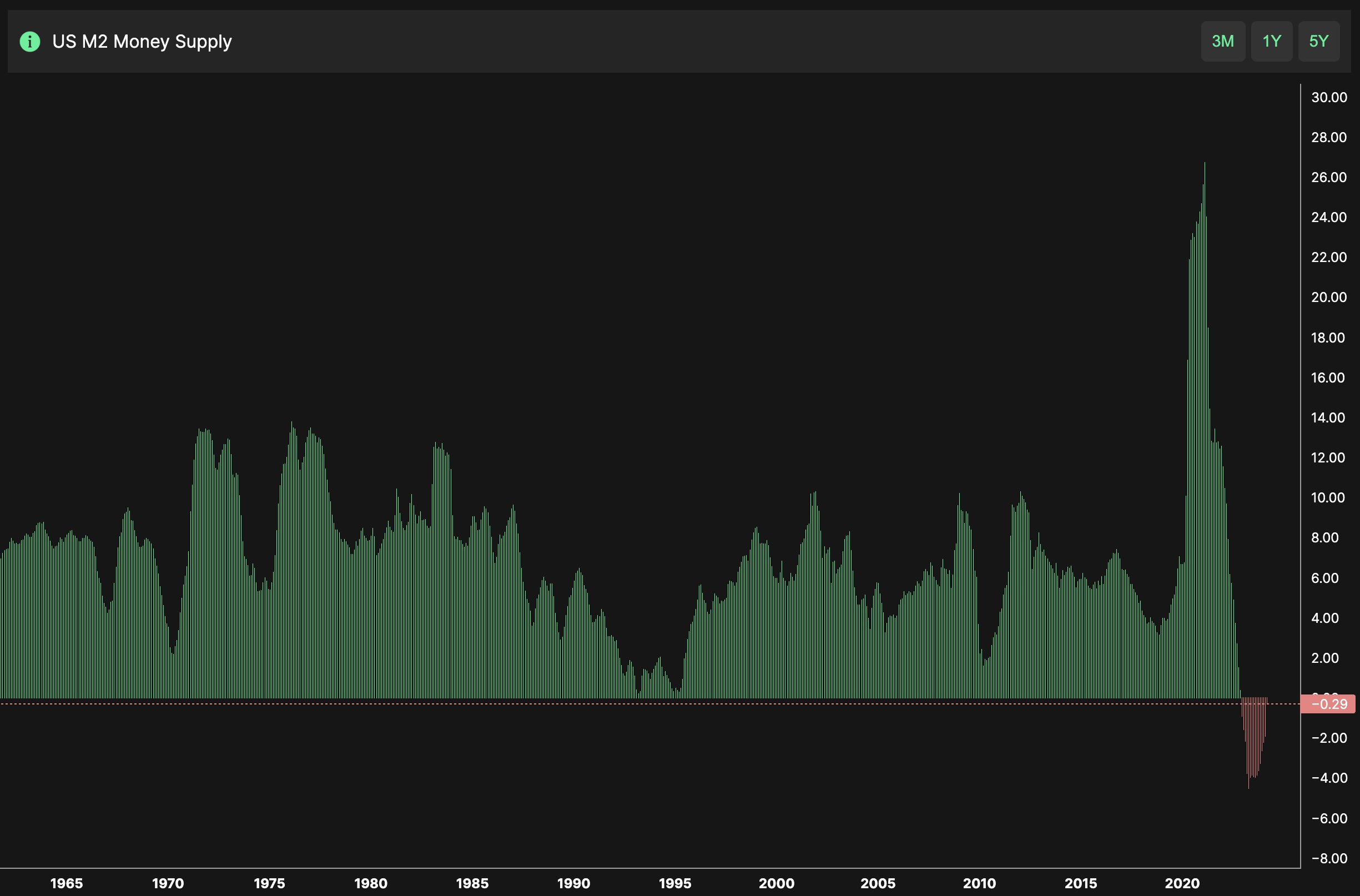

#2 M2 money supply

The M2 money supply, which includes cash, checkable deposits, and easily convertible near money, is another significant indicator, if not the most significant, of global liquidity. Ted notes that the growth rate of the M2 money supply is the lowest since the 1990s.

“There is a lot of upside in terms of easing liquidity conditions,” he explained. As central banks potentially ease monetary policy to stimulate economies, increased M2 growth could lead to more capital flowing into risky assets like Bitcoin.

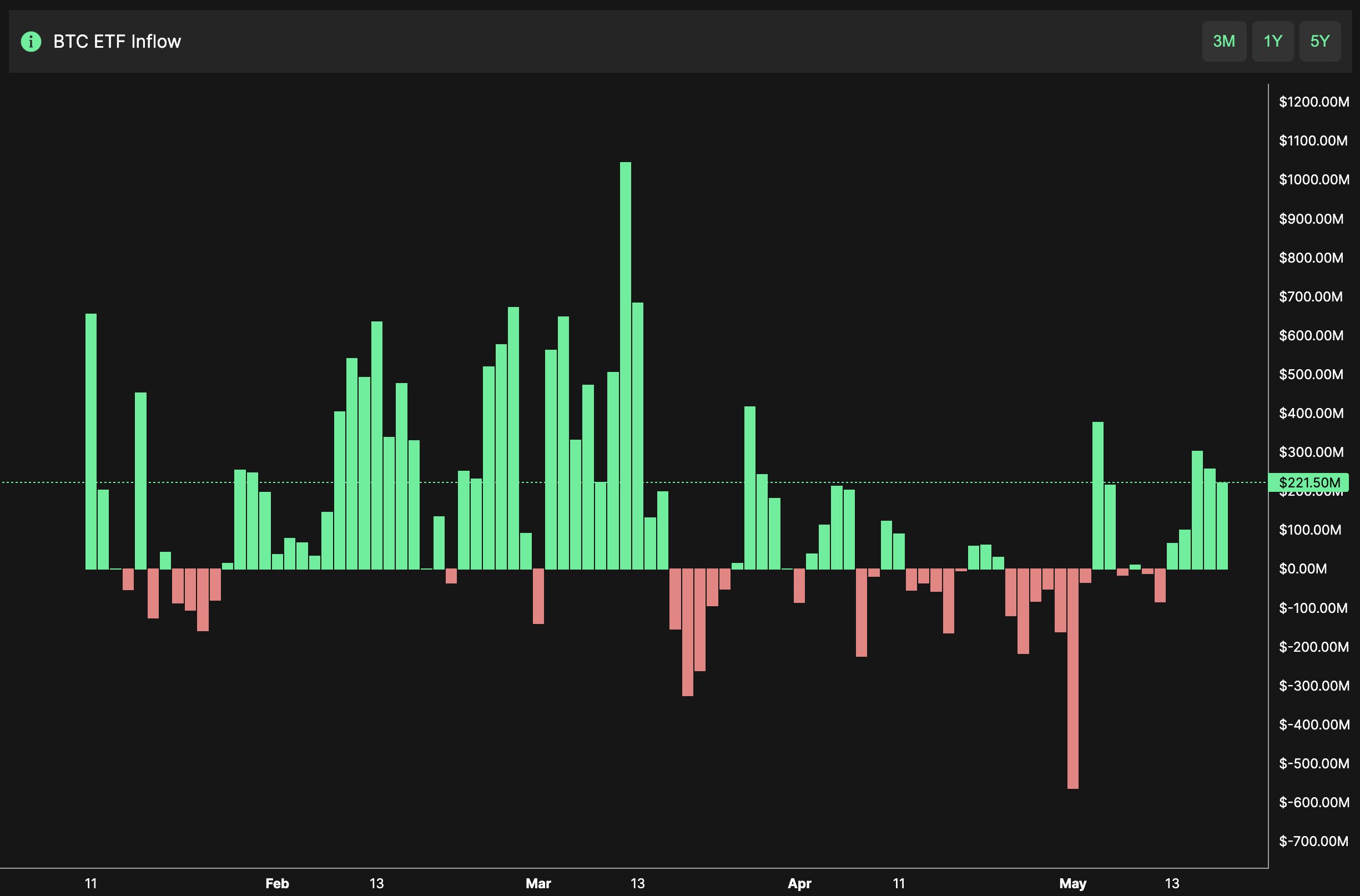

#3 Cryptocurrency liquidity

While liquidity has returned to cryptocurrency markets, particularly with the introduction of cash Bitcoin ETFs, Ted points out that the speed of inflows has not yet reached the levels seen at cycle peaks. “The inflow velocity has not yet reached the manic phase corresponding to the peaks of the cycle,” he noted.

This suggests that while interest and investment in Bitcoin is growing, the market has not yet reached the speculative frenzy that usually precedes a major correction. This phase of measured inflows could provide a more stable basis for further price increases.

#4 Bitcoin ETF Spot Flows

U.S. spot Bitcoin ETFs have seen significant inflows, with $950 million flowing into U.S. spot Bitcoin ETFs last week alone, the largest net inflow since March. Ted expects these inflows to enhance as the price of Bitcoin increases and conventional financial investors regain confidence in the asset.

“Expect these to only increase as prices rise and tradFi renews faith in the asset,” he said. Increasing acceptance and investment by institutional investors via ETFs is a mighty bullish indicator of Bitcoin’s continued growth.

Each of these factors points to a sustained and solid bull market for Bitcoin. Ted’s analysis, powered by conventional financial metrics and cryptocurrency data, provides a comprehensive look at the current and future state of the Bitcoin market. As central banks potentially ease monetary policy and institutional interest continues to grow, the right conditions appear to be in place for Bitcoin’s bull run to continue in the coming years.

At the time of publication, the price of BTC was $66,602.

Featured image created with DALL·E, chart from TradingView.com