Some Ethereum Whale has caused panic among community members after a recent transaction suggested they might want to get rid of their holdings. This comes amid a recent prediction Matrixport Research Company that the price of Ethereum could augment significantly from its current level.

Ethereum Whales Transfers 11,215 ETH

On the chain data shows Ethereum whale transferred 11,215 ETH ($34.3 million) Coinbase cryptocurrency exchange. A trader usually makes such a move by selling these tokens, and given the amount of tokens involved, such a sale could significantly impact the price of ETH. However, data With IntoTheBlock Market Intelligence Platform shows that there may be demand for these tokens if this whale actually wants to get rid of them.

There has been a 132% augment in the ratio of vast holder net flows to exchange net flows over the past seven days, suggesting that Ethereum whales are actively accumulating more ETH. The flow metrics also paint an accumulation trend among Ethereum Holderswith the volume of funds flowing into exchanges falling by over 11% over the last seven days.

During this period, the outflow volume from these exchanges increased by 3%, which further confirms that Ethereum investors want to maintain their positions and accumulate more ETH at this point. This is undoubtedly a positive development for the Ethereum price, which could experience a significant rebound thanks to this accumulation wave.

The research company Matrixport also Planned that the price of ETH will bounce back from the current price level thanks to Spot ETFs Ethereumwhich, they say, could start as early as this week.

While this remains uncertain, market experts such as Bloomberg analyst James Seyffart suggested that it shouldn’t be long before these Spot Ethereum ETFs start trading. This is because fund issuers have implemented most of the comments that Securities and Exchange Commission (SEC) filed S-1 documents.

ETH is ready for a rally

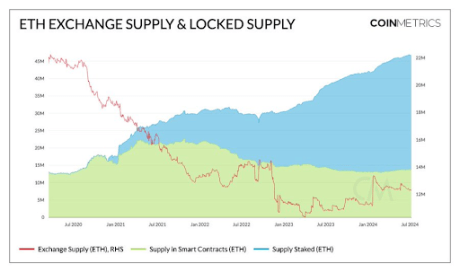

Cryptocurrency analyst Leon Waidmann mentioned in X (formerly Twitter) fasting that Ethereum is ready to rally. He claimed this based on the decreasing supply of Ethereum. He noted that 40% of Ethereum’s supply is frozen, 28% is pledged, and the remaining 12% is in shrewd contracts and bridges.

Moreover, Waidmann expects that this supply will continue to decline after Spot ETFs Ethereum start trading with institutional investors taking a huge chunk of supply from exchanges. Based on this, Ethereum could benefit from the supply and demand dynamics, as demand will certainly outstrip supply at some point.

Follis Cryptocurrency Analyst mentioned that Ethereum’s chart looks exactly like Bitcoin’s just before it surged more than 200% last year. He suggested that Spot Ethereum ETFs could be the catalyst that starts a similar rise in ETH.

Featured image created with Dall.E, chart from Tradingview.com