Based on the pattern on the daily chart, Bitcoin is at a critical point in terms of price. As the battle between bulls and bears continues, it is clear that sellers have the upper hand despite recent price stability.

BTC prices reach key level: will bulls take control?

As BTC bulls try to recoup losses incurred last week, one analyst, citing a technical candlestick formation and reaction at the 200-day moving average, believes that the current price reaction will have a significant impact in the coming days.

In the post on X analyst recorded that the coin fell and closed below the 200-day moving average after last week’s losses. This formation was key.

For months, this active line provided key support, anchoring buyers during the last up cycle from October to mid-March.

The rally continued and although this level was not tested again until delayed June when prices were generally delicate, last week’s break proved decisive.

Although bearish, the analyst admitted that last week’s breakout was clear. However, as it is, bears are hopeful because there was no confirming bear bar.

For this to happen, prices need to break below $56,500 and fall below $53,500, which would be last week’s low. Once that happens, it will be official that the bears are back, and sellers will likely continue to push lower in a bearish continuation pattern.

If Bitcoin is to turn around, it is imperative that prices reject last week’s losses and break higher, closing above the 200-day moving average. This bounce will be a bullish signal that could signal the beginning of an uptrend, resuming the uptrend from Q1 2024.

For now, traders are watching the psychological line at $60,000 and, ideally, a close above $66,000. In that case, Bitcoin could find momentum to retest $72,000 – an significant liquidation level.

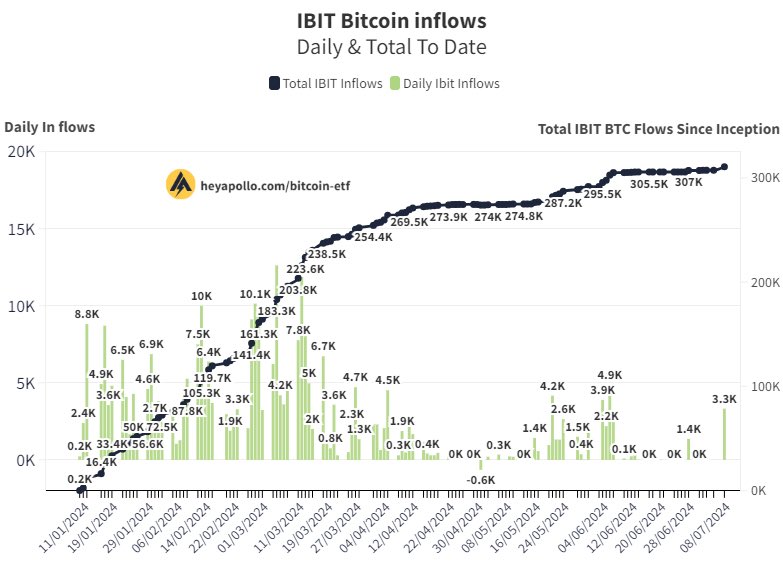

Eyes On Spot Bitcoin ETF Inflows

Despite the optimism, investors are close watching inflows into Bitcoin-based ETFs (Exchange-Trading Funds), especially in lightweight of the German government’s continued withdrawal of funds. The sell-off put more pressure on BTC, limiting gains and dampening its growth momentum.

If sellers are persistent and heed recent trends, there could be more bloodshed and Bitcoin ETF issuers could see outflows.

Over the past few weeks, especially in June, as prices fell, BlackRock, Fidelity, Grayscale and other leading issuers saw outflows, accelerating the downtrend.

Featured image from DALLE, chart from TradingView