Pendle (PENDLE), a cryptocurrency powering the decentralized finance (DeFi) protocol, has seen a surge in prices in recent days. This rally comes on the back of positive growth in the Pendle ecosystem and a high-profile investment from industry veteran Arthur Hayes. However, concerns about token distribution could cast a shadow over Pendle’s long-term prospects.

Hayes stokes the fire: Crypto Whale inspires investor confidence

The recent price surge can be partially attributed to a strategic move by Hayes, co-founder of BitMEX and a prominent figure in the crypto space.

Pendle saw a 25% surge from its low point this week to an intraday high of $6.21 after Hayes publicly announced his acquisition of Pendle tokens, which is interpreted by many as a sign of confidence in the project.

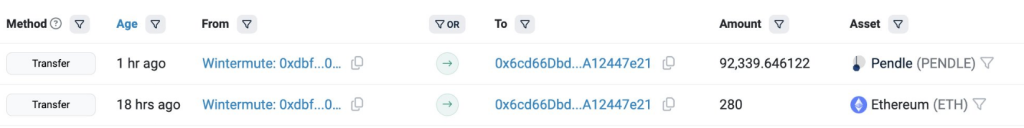

After Arthur Hayes (@CryptoHayes) wrote on Twitter that he was adding $PENDLE AND $DOGE 92,339.6 was purchased for his bags in one of his wallets $PENDLE($554,000). #Winter serene down.

He transferred 2.05 million $USDC Down #Winter serene downand then received 280 $ETH($1 million) and 92,339.6 $PENDLE($554,000)… pic.twitter.com/wo2Sl4245B

— Lookonchain (@lookonchain) June 20, 2024

This endorsement from an experienced investor with a successful track record, such as Hayes’ involvement in the fast-growing USDe stablecoin, has undoubtedly strengthened investor sentiment towards Pendle.

The Pendle ecosystem is gaining momentum: TVL is growing rapidly, the user base is expanding

In addition to Hayes’ influence, Pendle’s internal development lends its current development. The project’s total value locked (TVL), a key metric that reflects the total value of crypto assets deposited on the protocol, has seen significant growth.

The boost in TVLs suggests that more and more people are using DeFi Pendle features. These features allow users to make impressive profits on their cryptocurrency holdings, with some reaching up to 25%.

This is significantly better than what most users get from classic investments such as short-term US Treasuries. Moreover, the number of Pendle token holders continues to grow, demonstrating the protocol’s growing and busy user base.

Total crypto market cap at $2.28 trillion on the 24-hour chart: TradingView.com

Cloud on the horizon: token distribution raises concerns

While the current prospects for Pendle seem promising, a potential obstacle is the tokenomics of the project: a miniature number of addresses control a significant portion of Pendle’s circulating supply.

This concentrated ownership structure may lead to market manipulation in the future. Moreover, the planned introduction of additional tokens into circulation raises concerns about the potential dilution of the existing value of tokens.

Balance growth and sustainability

Pendle’s recent price boost and positive ecosystem development paint a rosy picture, but the token distribution model poses significant challenges. Going forward, a token’s success will depend on its ability to support sustainable growth while solving tokenomics issues.

Expanding the user base and diversifying token ownership will be key steps to ensuring Pendle’s long-term future.

Featured image from The Economist, chart from TradingView