Arthur Hayes created a raw market warning: Sees the growing divide between his preferred risk measure, Bitcoin, and the tech-heavy Nasdaq 100 index as a sign that credit tensions may be building beneath the surface.

Hayes, co-founder and former CEO of cryptocurrency exchange BitMEX, calls Bitcoin a “fiat liquidity fire alarm” — an asset that responds quickly to changes in credit conditions.

Warning against market signals

When two assets that have often moved together begin to separate, investors take notice. Hayes believes such a gap deserves investigation because it could indicate problems in banks’ balance sheets or in the flow of credit.

He says this move is not about one stock or one transaction; it’s about how the credit works and how quickly liquidity can run out when the situation changes.

How AI job cuts may affect credit

Reports show that companies have cited artificial intelligence as the reason for thousands of layoffs in recent years, with the outplacement company recording around 55,000 layoffs in 2025 related to artificial intelligence. Much of this hit was about technology.

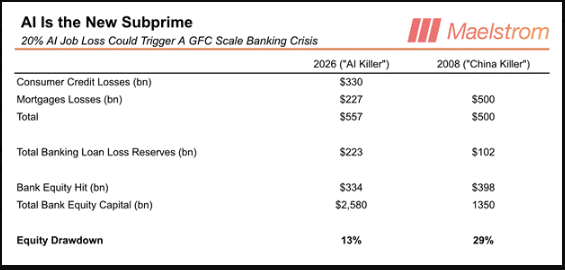

Hayes sketches a scratchy scenario: a significant decline in white-collar employment would weaken mortgage and consumer loan repayments, which could then cut banks’ equity and tighten lending.

The numbers he gives are approximate and based on many assumptions, but are intended to show how a shock to white-collar wages could fall on the credit system.

Expectations regarding the actions of the central bank

Hayes expects a political response if banks begin to fail and loans are frozen. He claims that the Federal Reserve will step in with fresh liquidity and that there will be more money creation – which he believes will be good for Bitcoin price perspectives.

This scenario was a recurring theme in his comments; previous essays and posts have linked the Fed’s projected liquidity to soaring cryptocurrency markets.

Altcoin betting and fund positioning

His fund, Vortexis to plan to implement staking or stablecoins in privacy-focused and exchange-native games as soon as there are changes in liquidity policy, citing Zcash and Hyperliquid as examples. The goal of this type of tactical posture is to benefit from a short-term boost in risky assets following a policy change.

Measured view

It’s a dramatic chain of events: AI job losses lead to credit losses, which causes banking stress, which forces the central bank to boost the money supply, which raises Bitcoin.

Every link is trustworthy, but none is guaranteed. Some of Hayes’ data are scratchy estimates intended to illustrate risk rather than serve as an right forecast.

Market history shows that central banks sometimes step in and that policy moves can fuel asset growth, but outcomes depend on timing, scale and public confidence – factors that are arduous to predict in advance.

Featured image from Unsplash, chart from TradingView