Cryptocurrency markets are heading towards the calmest mood in years, and some analysts say it could be a sign that sellers have run out of steam. According to MatrixportThe deterioration in investor sentiment has led to indicators reaching levels that have historically corresponded to market turning points.

Cryptocurrency market sentiment at its lowest level in many years

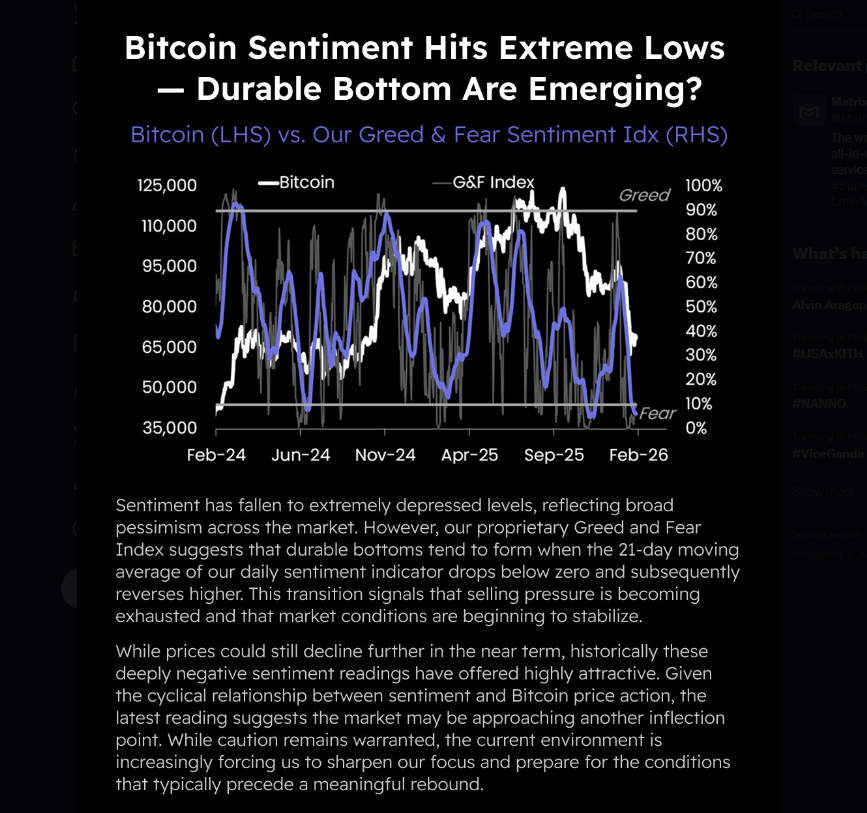

According to Matrixport, it is Bitcoin fear and greed the indicator has a 21-day moving average below zero and is starting to rise, the kind of shift that in previous episodes marked the end of broad selling.

Reports show that the Alternative.me Fear and Greed Index is close to 10 out of 100, which coincides with what traders call “extreme fear.” These are boring, ugly numbers. They also cause several investors to start looking for opportunities.

Similar readings from the past

Previous moments with similar readings followed acute declines. June 2024 and November 2025 were identified by Matrixport as earlier periods in which market sentiment reached comparable depths, each followed by at least a transient change in price action.

This pattern doesn’t promise a rebound every time, but it shows how deeply negative feedback can ultimately be absorbed by buyers who offer lower prices again.

📊 Today #Matrixport Daily chart – February 17, 2026 ⬇️

Bitcoin Sentiment Reaches Extremely Low Levels ⁰ – Permanent Bottom Emerging?

#Matrixport #Bitcoin #BTC #CryptoMarkets #MarketMood #FearandGreed #RiskManagement #Variability #CryptoResearch pic.twitter.com/WxJg3xrHSf

— Matrixport Official (@Matrixport_EN) February 17, 2026

Technical indicators are flashing oversold signals

Hive’s Frank Holmes says Bitcoin is trading about two standard deviations below its 20-day trading norm – a scarce reading seen only a handful of times in five years. Reports It is significant to note that in the past, these extremes have resulted in short-term bounces over the next 20 trading days.

Bitcoin itself has been fluctuating wildly: it briefly rose above $70,000 over the weekend before falling by about 2.5%, reaching near $68,750 at the time of writing.

Other trackers say it has fallen to near $60,000, marking one of the deepest declines in several years. Traders are closely monitoring U.S. GDP and earnings data, which could influence risk appetite and next moves in cryptocurrency markets.

The selling pressure may be close to exhaustion

Reports say Matrixport continues to warn that prices may fall before any significant bottom is established. The company points to a cyclical relationship between sentiment and price – deep pessimism often precedes change, but cycles can be cluttered and protracted.

Selling pressure can parched up, and yet modern headlines or data can push prices even lower before buyers feel confident enough to stick around.

What investors can do next

Some investors see the current readings as an attractive starting point, while others prefer to wait for clearer price and volume confirmation.

Long-term bondholders often point to network fundamentals and institutional interests as reasons for optimism, and their positions are closely watched.

Short-term traders, on the other hand, take a cautious stance by using stops, scaling entries, or waiting until signals stabilize.

Featured image from Unsplash, chart from TradingView