The price of gold (XAU/USD) turns around on Friday and pares some of Thursday’s losses, rising almost 2% after the release of a softer-than-expected US inflation report, which increased speculation that the Federal Reserve (Fed) may cut interest rates. At the time of writing, the XAU/USD rate is above the USD 5,000 milestone.

XAU/USD rises almost 2% after cooler US inflation data fueled expectations for a June interest rate cut

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) fell below estimates of 2.5% in January, reaching 2.4% y/y, down from December’s 2.7%. Initially, the printout is good news for the economy, but the so-called core CPI remains firm at 2.5% y/y, also in line with forecasts and below the previous print of 2.6%.

Bullion initially traded near $5,000 before reversing, but buyers came in and bought the dip at around $4,950 before the yellow metal surged toward an intraday high.

However, this week’s broad U.S. economic data release was solid. An excellent Nonfarm Payrolls report revealing the creation of over 130,000 in January. jobs and a drop in the unemployment rate to 4.3% reduced the pressure on the US central bank in terms of the labor market.

The question is: Will the Fed lower interest rates? They usually seek further data to confirm that the disinflation process has resumed. After peaking last year at 3% in September, the latest three readings are 2.7% in November and December last year and 2.4% in January. So the stage is set, but the current position of most Federal Reserve officials, led by Jerome Powell, suggests it will remain on hold until Kevin Warsh replaces Powell in May.

Money markets have increased the odds of an interest rate cut in June, with a 55% chance the Fed will cut rates by 25 basis points, according to Main Square Terminal data.

Lower yields in the US enhance gold prices

Meanwhile, U.S. Treasury yields continued to decline during the week, underpinning Bullion’s rise in value. U.S. 10-year Treasuries are down nearly three and a half basis points on the day, 14 basis points on the week, to 4.06%.

According to the US Dollar Index (DXY), the US dollar will end the week with a loss of 0.85%. DXY, which measures the value of the dollar against a basket of six currencies, fell 0.07% on the day to 96.84.

The focus is on FOMC minutes, Fed speeches and PCE data

Next week, the US economy will be busy with the release of tough goods orders, housing data, speeches by Fed officials and the release of the Federal Open Market Committee (FOMC) minutes. Later this week, investors will pay attention to jobless claims, the second GDP estimate for the final quarter of 2025, and the release of the Fed’s favorite inflation measure, the Personal Consumption Expenditures (PCE) Price Index.

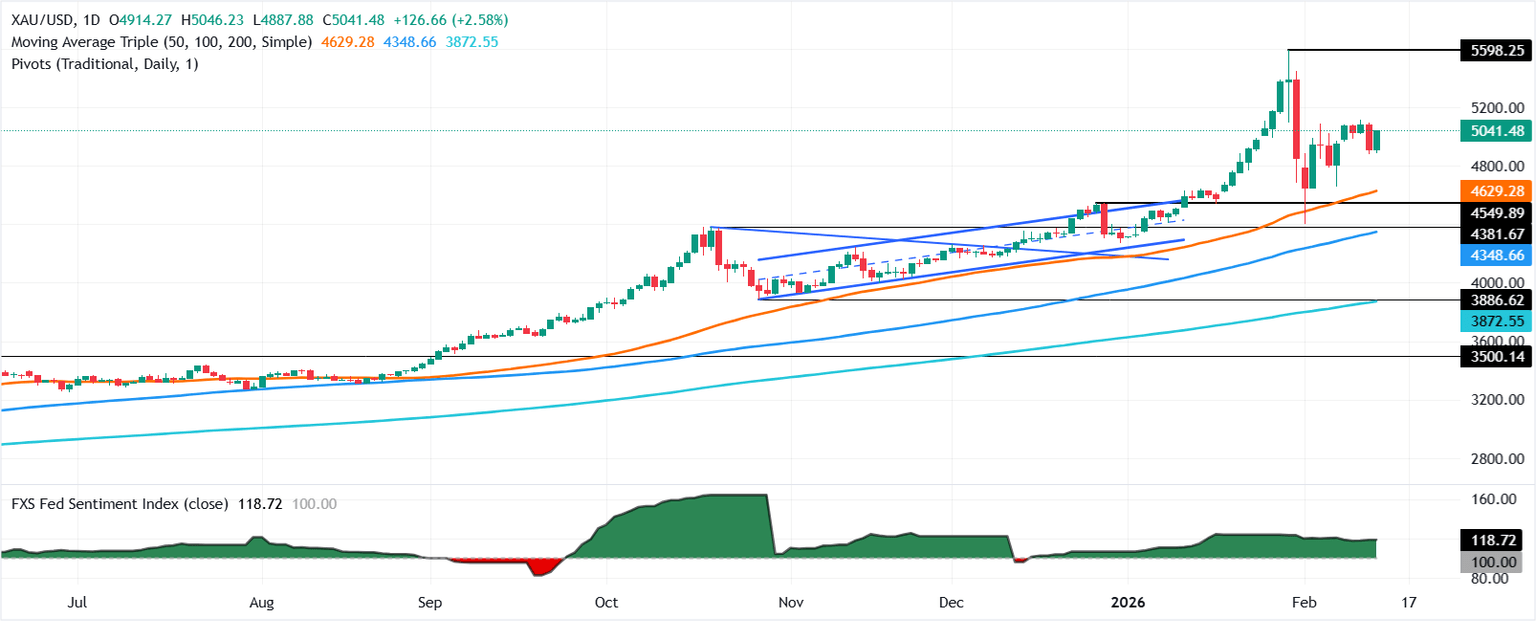

XAU/USD Price Forecast: Gold Climbs Above $5,000 at Key Resistance Level of $5,100

Gold’s bias remains unchanged, with bulls reclaiming the 20-day exponential moving average (EMA) at $4,971, sharpening the rally above the $5,000 mark. The momentum shown by the Relative Strength Index (RSI) shows that buyers are gaining momentum.

However, XAU/USD needs to clear USD 5,100. Once this occurs, the next key resistance will be the $5,200 level, followed by the January 30 high of $5,451, which will break above the all-time high near $5,600. Conversely, if gold struggles to stay above $5,000, it will open the door to lower prices.

The first key support will be the 20-day EMA before $4,900. Once broken, the next level will be $4,800, before the 50-day EMA of $4,618 as the next demand zone.

Gold FAQs

Gold has played a key role in human history as it has been widely used as a store of value and a medium of exchange. Nowadays, beyond its luster and exploit in jewelry, the precious metal is widely viewed as a safe-haven asset, meaning it is considered a good investment in turbulent times. Gold is also widely seen as a hedge against inflation and currency depreciation because it is not tied to any particular issuer or government.

Central banks are the largest holders of gold. To support their currencies in turbulent times, central banks typically diversify their reserves and purchase gold to improve the perceived strength of the economy and currency. High gold reserves may provide a source of confidence in the country’s solvency. According to data from the World Gold Council, central banks added 1,136 tons of gold to their reserves in 2022, worth about $70 billion. This is the highest annual purchase since registration began. Central banks in emerging economies such as China, India and Turkey are rapidly increasing their gold reserves.

Gold has an inverse correlation with the US dollar and US treasury bonds, which are both major reserve assets and secure haven assets. When the dollar depreciates, gold tends to rise, allowing investors and central banks to diversify their holdings in turbulent times. Gold is also inversely correlated with risky assets. A rally in the stock market tends to weaken the price of gold, while sell-offs in riskier markets support the precious metal.

The price may change due to many factors. Geopolitical instability or fear of a deep recession can quickly cause gold prices to rise due to its safe-haven status. Gold, as a non-yielding asset, tends to rise at lower interest rates, while the higher cost of money tends to weigh on the yellow metal. Still, most of the movements depend on the behavior of the US dollar (USD) when the asset is priced in dollars (XAU/USD). A powerful dollar tends to keep the gold price in check, while a weaker dollar will likely cause gold prices to rise.