Reports show that Polygon closed the last quarter of 2025 with higher network usage driven by payments, stablecoin transfers and tokenized assets.

While investors watched MATIC drift in a narrow range, on-chain activity told a different story, focusing on payments, stablecoins and tranquil institutional adoption rather than price dynamics.

The operate of polygonal payments is growing faster than prices

According to Messari Network review in the fourth quarter released on January 4, Polygon processed high payment traffic as fees remained low and settlement times were miniature. More than 50 payment apps processed approximately $3.50 billion in transfers this quarter.

This result was 96% higher than in the previous quarter and almost four times higher than a year earlier. Stablecoin-linked cards added another level of activity.

The ten card programs moved a total of almost $363 million using Mastercard and Visa rails, with Visa accounting for the larger share. Reports say this enhance was due to day-to-day spending rather than one-off events, meaning Polygon is used for routine transfers rather than short-term experimentation.

In addition to card payments, several companies have expanded the way they transfer money online. DeKard allowed users to pay USDC and USDT among a wide range of traders.

Flutterwave chose Polygon for cross-border business payments in 30 African countries. Revolut integrated low-cost stablecoin transfers into its app, while Stripe continued to build USDC-based subscription tools.

None of these moves made headlines, but together they provided steady volume on the network.

Tokenized assets are slowly gaining popularity

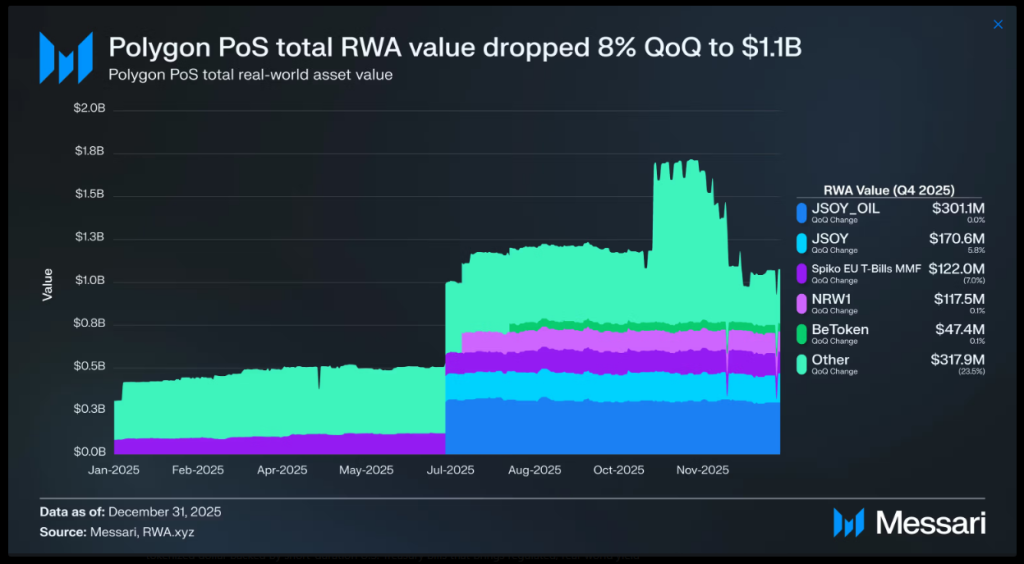

Beyond payments, tokenized real-world assets continued to accumulate. Reports show that Polygon ended the fourth quarter with nearly $1.10 billion RWAranking ninth in the world. Growth was driven less by retail hype and more by regulated structures.

The supply of stablecoins has increased to almost 3 billion, led by USDC at the level of USD 1.34 billion and DAI of nearly USD 630 million. Latin America stood out as a key region with non-USD stablecoin volume reaching $1.18 billion. Average daily DEX volume increased 44% to just over $200 million.

MATICUSD trading at $0.19 on the 24-hour chart: TradingView

MATIC is seeing declines as activity increases

MATIC price action she remained reserved despite her rise in the chain. The token broke out of short-term resistance during the broader market weakness and then stabilized as buyers defended key support zones.

Deeper losses were avoided, but there were no robust upward movements. The volume has not yet confirmed a trend change. For now, Polygon is showing growing usage across payments and tokenized assets while its token waits for a clearer signal from traders.

Featured image from Unsplash, chart from TradingView