Image source: Getty Images

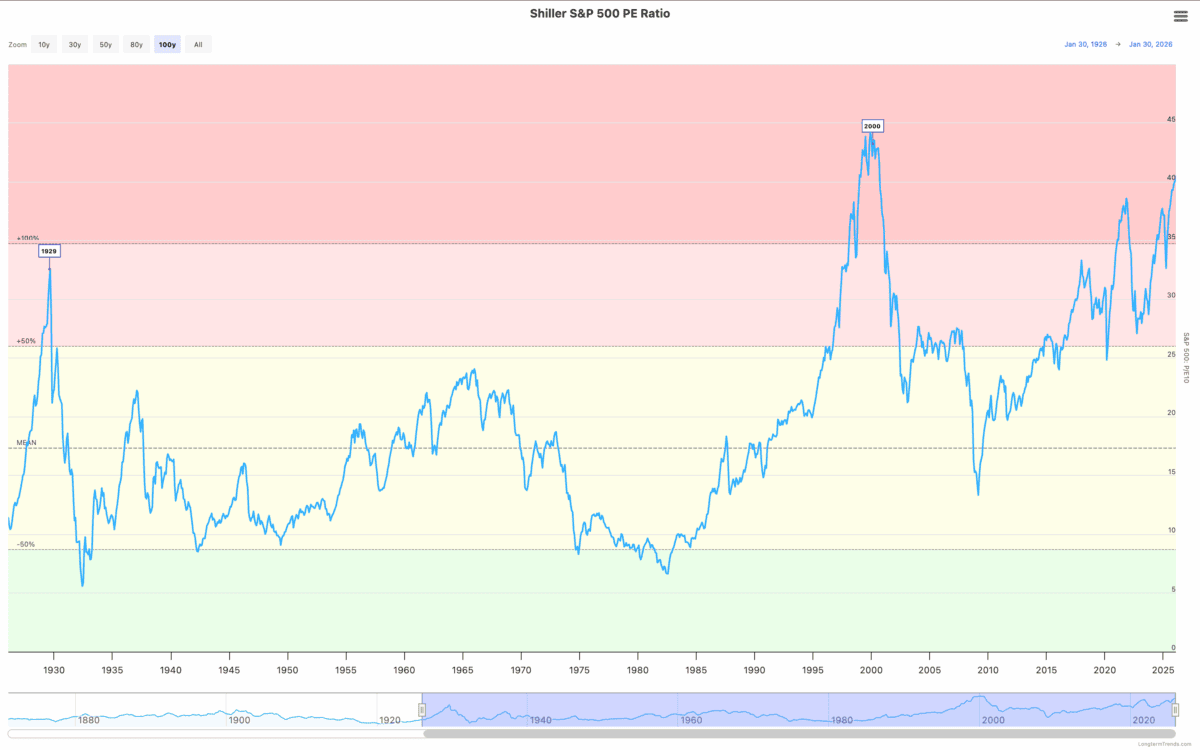

After taking into account cyclicality, only once S&P500 was more high-priced than it is now in 2000. Just before the dotcom crash, technology stocks fell.

Investors can’t ignore this, but the question is what they should do about it. The answer is not necessarily to start selling the stock or even stop buying it.

Stock market crash

It is almost impossible to ignore the similarities between the stock market in 2000 and the market today. The development of artificial intelligence resembles the emergence of the Internet.

The losses from the dotcom crash were enormous. Some stocks have fallen more than 90%, and investors who bought them at the peak are still waiting for them to rebound.

Outside of the technology industry, there were stocks that not only held their value, but actually rose as investors sought safety. These included stocks from sectors such as consumer defense and utilities.

Therefore, one strategy for investors looking for U.S. stocks in the current market is to look beyond artificial intelligence for potential stability. However, I believe this is a risky approach and requires caution.

Defensive

One company that did well during the 2000 crash was the company Procter & Gamble (NYSE:PG). The reasons are obvious – it has a forceful position in the market where demand is constant.

The stock could remain in good stead if the market sells off again. However, it has underperformed the S&P 500 since 2000, and investors must decide whether this is truly a long-term opportunity.

Revenue growth has remained below 2% annually over the past decade. And the stock is trading at a price-to-earnings (P/E) ratio of 22, which isn’t low-cost at all.

This is not a criticism – there has simply been no room for growth in recent years. However, investors need to think of stocks as a long-term investment, not just short-term speculation.

Staying the course

When thinking about the 2000 crash, it’s basic to forget that for many investors, the best move was to stay in the market. Amazon (NASDAQ:AMZN) is a great illustration of this.

After the dotcom bubble burst, the company’s share price fell by over 95%. But even investors who bought at the very top and simply held on since then have gained more than 14,000% of their investment.

There is a good reason for this. Amazon has taken a disciplined approach to creating shareholder value. Its online platform has created a dominant position by focusing on the long term.

This aggressive focus on customers has achieved a scale that makes it virtually impossible for other companies to compete. And the rest went from there over time.

What am I doing?

I own Amazon stock, and the company is in the middle of spending on artificial intelligence. There is a real risk that it won’t pay off if demand doesn’t materialize as expected.

In such a situation, the share price may fall. But at today’s levels, I’m more of a buyer than a seller – even with the S&P 500’s historically high valuation levels.

In my opinion, the lesson of history is quite clear. Investors who can identify companies with long-term competitive advantages don’t have to worry about short-term stock market crashes.