Despite a enormous outflow just a day earlier, Spot XRP ETFs defied bearish sentiment, setting record trading volumes and attracting fresh inflows. This resilience and surge in investor demand is particularly surprising considering the recent XRP price crash and the general deterioration of the broader cryptocurrency market.

XRP ETFs are bucking trends and reaching record volume

XRP is making headlines after… The ETF recorded a novel inflow of funds after a significant low tide. According to SoSoValue data, XRP ETFs saw a record decline of $92.9 million on January 29, 2026. This marked the largest reduction since their launch on November 13, 2025.

Since becoming available for trading, the XRP ETFs have only seen three outflows, with the third being a recent decline of $92.9 million. The reason for this recall was primarily GXRP in grayscaleas a result of which as much as USD 98.39 million left the fund, partially offset by inflows into Franklin Templeton’s XRPZ funds, Bitwise’s XRP ETF fund and XRPC by Canary.

At the time of the outflow, total net assets of XRP ETFs fell to $1.21 billion from $1.39 billion a day earlier. The decline coincided with a decline in the price of XRP, which fell from $1.92 to $1.80 within 24 hours. Surprisingly, XRP ETFs surged just a day after $92.9 million was withdrawn. They recorded total daily net inflows of $16.79 million, although total net assets still declined slightly to $1.19 billion.

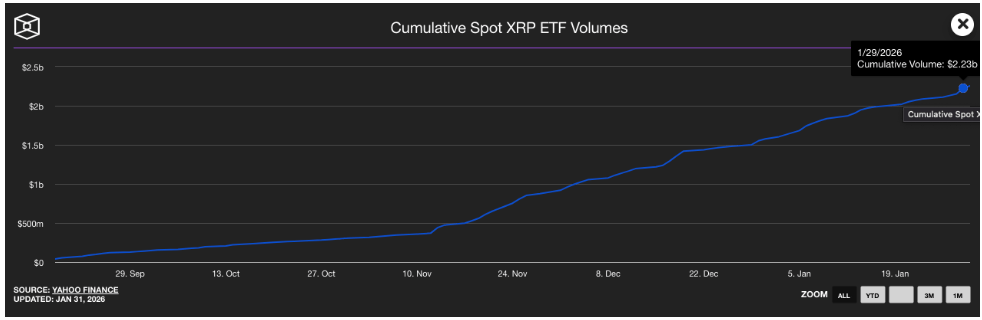

More impressively, XRP spot ETFs achieved record trading volumes despite the overall downward trend. Data from the block can be seen that cumulative XRP ETF volume rose to $2.23 billion from $2.15 billion just one day after the daily outflow of $92.9 million. Reports show that Bitwise’s XRP ETF had the highest trading volume at the time, followed in that order by Grayscale’s GXRP, Franklin Templeton’s XRPZ, Canary’s XRPC and 21Shares TOXR.

In fact Assets under management (AUM)XRP ETFs fell slightly, from $1.48 billion to $1.32 billion after the Jan. 29 outflow.

The price of XRP continues to fall amid market uncertainty

As XRP ETFs recover from recent outflows, the cryptocurrency price continues to fallincreasing losses from the beginning of this year. According to CoinMarketCap, XRP is down over 11% over the past week and just over 3% over the past 24 hours. Following this decline, its price is now around $1.69, down more than 15% from the $2 level seen just a few weeks ago.

At the time of writing, daily XRP trading volume has also dropped by over 26.6%, indicating a potential decline in investor confidence and growing uncertainty in the market. Supporting this trend, the XRP Fear and Greed Index has emerged fallen to the “Fear” zone. The broader cryptocurrency market is showing similar weakness for the index signaling extreme fear for major digital assets.

Featured image from Unsplash, chart from TradingView