Dogecoin is trading along a technical fault line around the $0.10 low, with traders pointing to a tight band of support that could determine whether DOGE stabilizes or falls into a structurally weaker regime.

The immediate set-up is portrayed as a high-conviction “line in the sand” in chart-focused reports, even though chain whale activity appears to be fading rapidly. Ali Charts he said transactions worth more than $1 million on the Dogecoin network “fell 94.6%, from 109 to just 6 over the past four weeks,” indicating a keen decline in big-ticket activity over the same period that DOGE was investigating the support.

This must be the bottom of Dogecoin

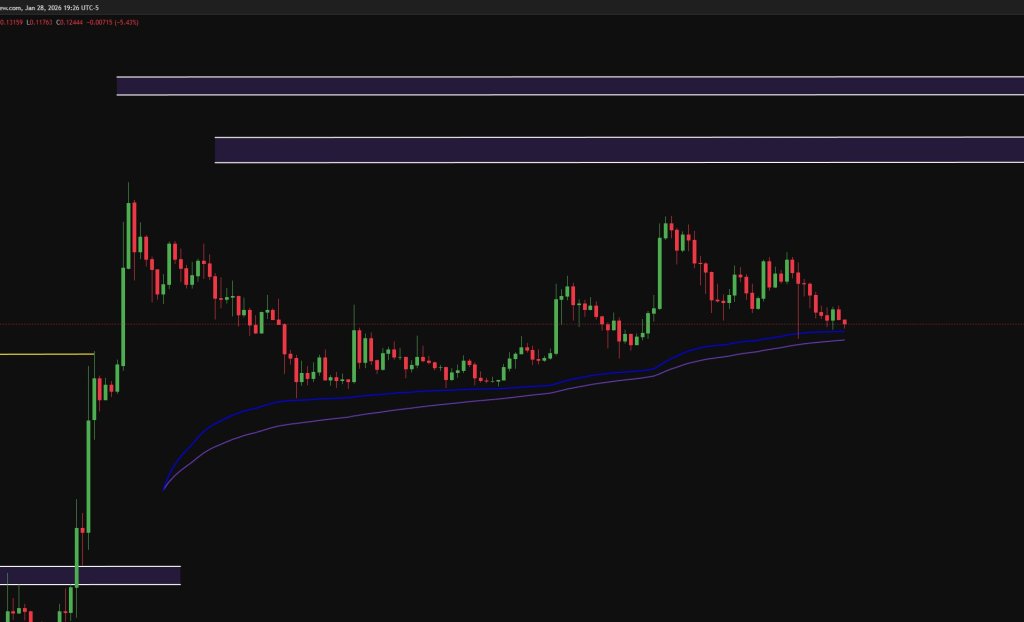

Kevin. he argued that DOGE is currently at the top of a long-term trend support that tends to attract attention. “Want to see a very important chart? Dogecoin is currently at the top of its 2W 200 ema/sma as well as the main organized support zone. The 0.12-0.10 zone is everything,” he wrote.

“If there was ever a place where you wanted to see the bottom, it’s in this zone, otherwise the situation will become structurally very dangerous. The results will be, as always, completely dependent on BTC.”

This approach matters because it ties the trade to two distinct conditions: DOGE maintaining a specific price range, and Bitcoin avoiding a broader de-risking move that could force correlation trades to end. In other words, even a “pure” level of DOGE may not stay isolated if BTC drops.

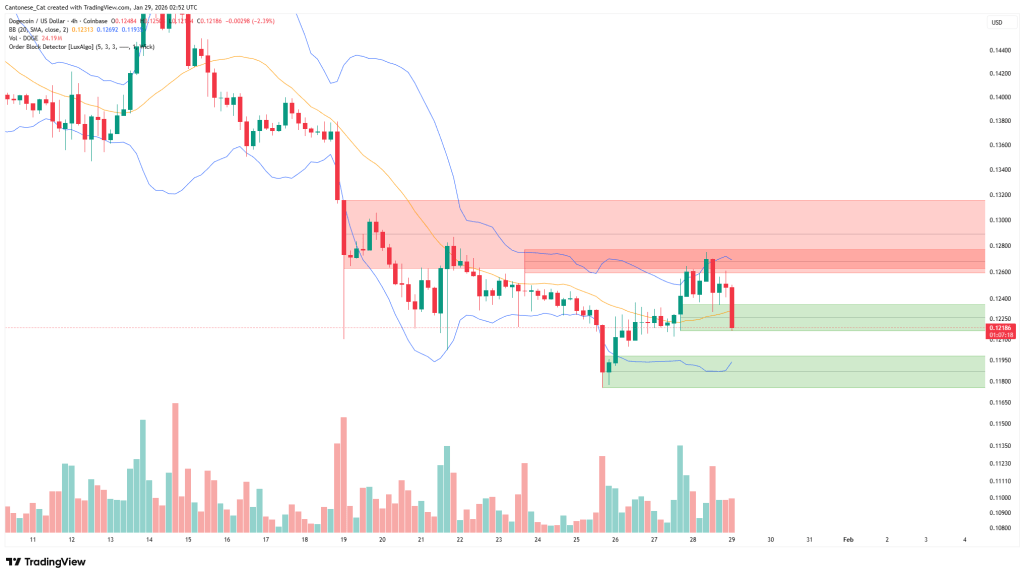

Short term charts provided by Cantonese Cat (@canton meow) we are focusing on the same battlefield. Posting a 4-hour Bollinger Bands view, the account highlighted a breakout through local levels into what it described as a buy side zone: “Breaking out to a buy order block below on low volume,” Cantonese Cat wrote today, adding, “I think I’ll buy some DOGE tonight.”

The chart shows DOGE falling below the 4-hour Bollinger Band midline. Therefore, the price may return to the lower band near $0.12, an area coinciding with the support zone marked by Kevin. A clear break below this group would shift the configuration from “support defense” to “lower continuation risk”, which would again result in deeper declines.

On January 28, Cantonese Cat also released a macro comparison of DOGE vs. DXY, suggesting that the broader backdrop could still support a reflexive move higher if conditions converge. “The macroenvironment favors the growth of DOGE,” the account wrote. “So either DOGE will never appear again because it is of no use, or history will repeat itself.”

It’s a clear binary, but it captures the tension DOGE traders are operating in: meme coins can trade as pure beta liquidity when macroeconomic conditions loosen, but the market can also penalize assets that struggle to sustain up-to-date demand when speculative momentum fades.

The next move will likely be dictated by whether DOGE can defend the $0.10-$0.12 range until participation returns, either through renewed gigantic investor inflows or broader risk appetite led by BTC. If this floor holds, investors are positioning themselves for a bottoming process and a return to overhead supply.

At the time of publication, DOGE was trading at $0.121.

Featured image created with DALL.E, chart from TradingView.com