XRP has spent most of the last few months trading with lower highs from July 2025, frustrating traders and narrowing price action to an increasingly narrow range.

However, a technical analysis shared by cryptocurrency analyst ChartNerd argued that what looks like stagnation may actually be final preparation the phase before a historic move. The price structure suggests something much bigger, sending XRP on its most aggressive rally in eight years, but the implications only become clear when the full setup is examined.

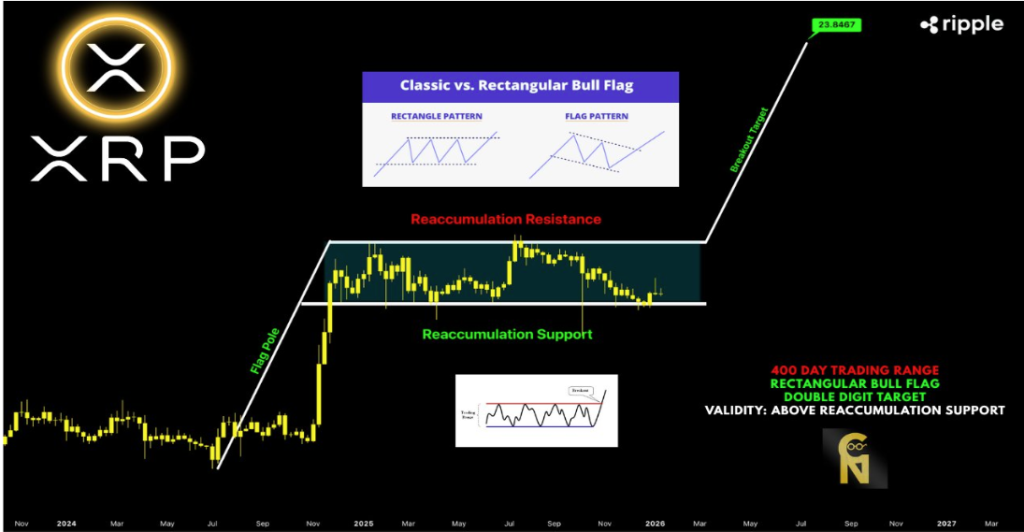

400-day rectangular reaccumulation structure still holding

According to for the technical analysis performed according to ChartNerd, XRP’s price action has been locked in a rectangular re-accumulation zone for approximately 400 days, leading to the formation of what looks like a rectangular bull flag on a macro-term basis. The technical chart shows a forceful impulsive move from July 2024 to December 2024, which acted as a flagpole right when XRP then peaked in the $3.4 price zone.

That impulsive flagpole occurred a long period of sideways trading during which the XRP price repeatedly held with clear support around $1.8 and the limits of resistance about $3.60. This type of structure is associated with reaccumulation at support and resistance zones, especially when it occurs after a rapid expansion move and holding for such a long time.

Any decline in reaccumulation support has been absorbed, preventing indefinite failures and keeping the broader pattern intact. ChartNerd noted that the rectangular flag will be valid as long as this support level is defended, which activates the expansion trip.

XRP price chart. Source: @ChartNerdTA on X

The macro breakout projection puts the XRP price target at $23

According to ChartNerd, there is increasing pressure on bear market participants due to the fact that this fractal continues to persist despite repeated attempts to invalidate it. The longer the XRP price action is trapped inside the rectangle without breaking down, the greater the likelihood that the final resolution will favor the prevailing pre-consolidation trend. In this case, the trend was up, which strengthens the case for a breakout after breaking resistance.

If the rectangular bull flag is resolved up as expectedthe chart shows the breakout trajectory that could occur move XRP into double-digit territory, with a long-term target region near $23. This target price projection is derived from the height of the flagpole extended from the top of the reaccumulation range.

ChartNerd described this possible move as one of the most aggressive gains that XRP could see in seven to eight years. At the time of writing, XRP is trading around $1.92, which means a move towards the $23 region would represent an augment of over 1,000% from its current level, which is the type of percentage expansion that XRP has performed well in the past.

Featured image from Unsplash, chart from TradingView