Looking at the pattern on the daily chart, there is no relief for Bitcoin at spot rates. After the June 6 crash, prices plummeted from $72,000, further underscoring the importance of the liquidation level.

Bitcoin prices have fallen from this level in the past, and analysts expected a compact breakout after crossing this line.

Hedge Funds Sell Bitcoin Futures Short: Will This Strategy Backfire?

Amid this mistake, one of X’s analysts notes that hedge funds and Wall Street firms are increasingly taking compact positions on Bitcoin futures in anticipation of a decline in BTC prices.

While they could go net long in the spot market by taking advantage of the fee differential, the trader notes that such a strategy is risky. Otherwise, huge losses may occur in the event of an unexpected price boost.

Stock data and trader notes show that between current price levels and just above historical highs of $74,000 Short positions in BTC futures worth $12 billion.

This move means that hedge funds are bearish, and since everyone knows that Wall Street’s biggest players are shorting, this move could backfire spectacularly.

Still, hedge funds selling BTC futures are nothing fresh. Often, hedge funds tend to compact futures contracts on a given product and at the same time buy the spot markets, taking advantage of the carry trade to make a profit.

The problem is that this hedging tactic is popular in established finance and has been profitable before. Bitcoin, on the other hand, is a fresh asset class that sits outside the established financial system.

Therefore, the strategy may not work exactly as expected, leading to huge losses.

BTC brittle, but noticeable ETF issuers in a buying frenzy

Time will tell if Bitcoin recovers at spot rates. As it stands, BTC is under huge selling pressure, falling from $72,000.

While the uptrend continues, buyers have not yet recovered from June 6’s losses, meaning the path of least resistance in the compact term is to the south. A break below $66,000 would completely erase the May 20 gains, signaling a trend change.

Still, buyers are confident about what lies ahead. Last week, despite the decline, all ETF (spot Bitcoin Exchange) issuers in the United States went on a buying spree.

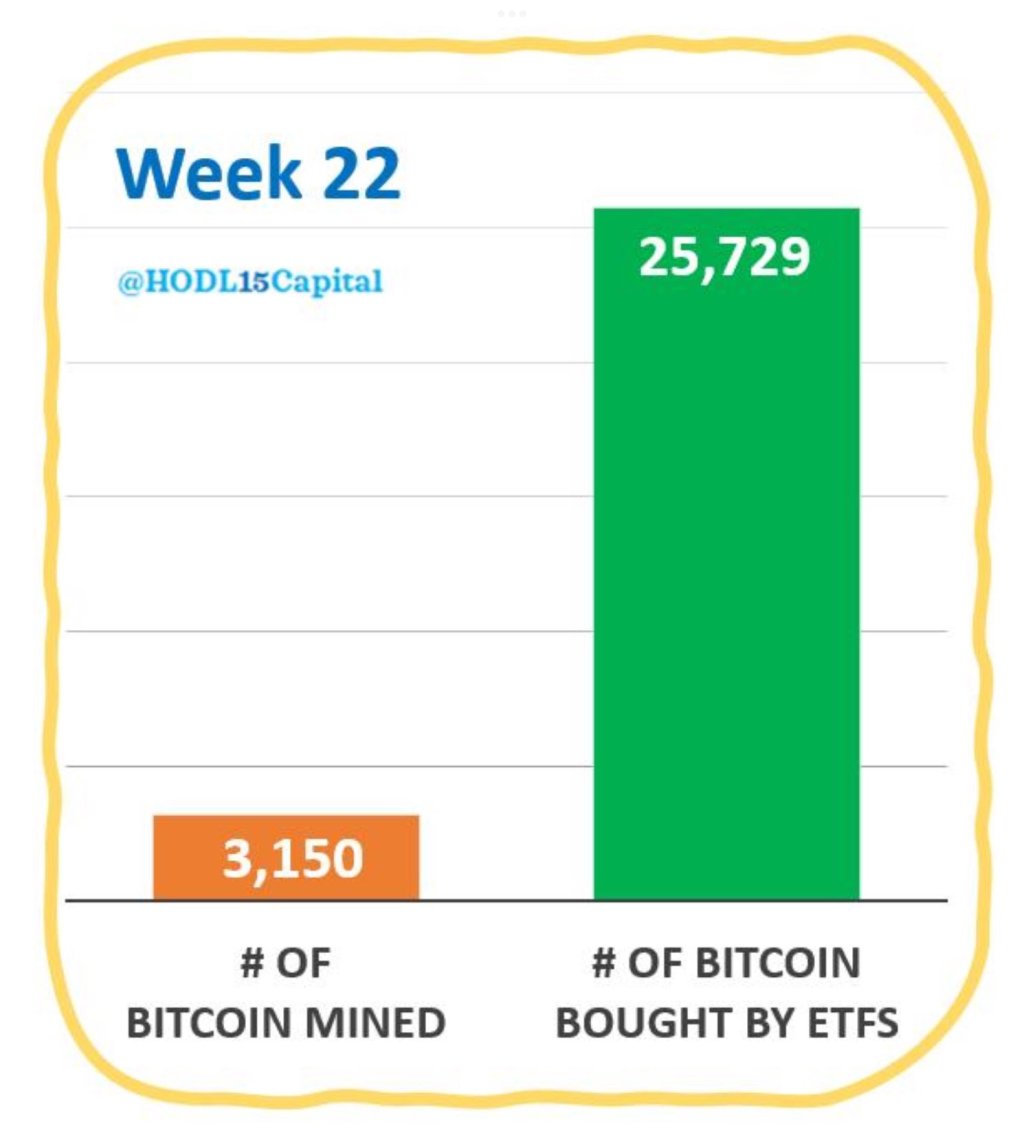

According to HODL15 Capital, in the first week of June this year added 25,729 Bitcoins. This cache represents approximately two months’ worth of mined coins and represents the highest weekly purchasing activity since mid-March. BTC then hit an all-time high of around $73,800.

Feature image from DALLE, chart from TradingView