Image source: Getty Images

Last year I was considering adding one Founding capital to my Stocks and Shares ISA. However, I decided I needed more evidence that manager Terry Smith could return to great form after four consecutive years of impoverished results.

Last week, Fundsmith released its 2025 annual results. Based on this information, can I now answer the question whether it is time to invest?

Efficiency

For the uninitiated, Fundsmith invests in high-quality companies with powerful brands or competitive moats, high returns on capital, predictable cash flow, and the ability to grow earnings without the need for weighty debt.

Smith boils it down to a straightforward three-step mantra: “Buy good companies. Don’t overpay. Don’t do anything“

In putting this into practice, Smith beat the fund’s benchmark (MSCI World Index) from 2010 to 2020. Since then, however, Fundsmith has underperformed for five years in a row.

In 2025, the return rate was just 0.8% compared to a 12.8% gain for the MSCI World Index. In a powerful year in which most indexes rose, this is very disappointing.

What went wrong?

Smith said three things aid explain these impoverished results:

- Extreme S&P500 index concentration

- Passive index investing

- Dollar weakness

The latter doesn’t concern me at all. However, Smith points out that the top 10 stocks accounted for 39% of the S&P 500 at the end of 2025, providing 50% of the total return.

The fund manager says that without immense holdings in Magnificent Seven shares, it has been very challenging to outperform in recent years.

While this is true, it is more challenging, but not impossible. For example, Bill Ackman (Pershing Square) and Chris Hohn (TCI Fund Management) have successfully outperformed the S&P 500 over the past five years without having Tesla, Meta, AppleOr Nvidia.

He further argues that passive index funds distort markets by buying stocks without regard to their quality or valuation, essentially creating a momentum-driven bubble.

[E]even if we correctly diagnose this shift to index funds as one of the reasons for our recent impoverished performance and it lays the groundwork for a major investing disaster, I have no idea how or when it will end, all I can say is bad.

Terry Smith

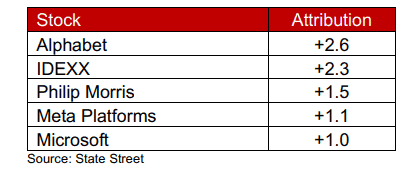

It’s worth noting that Fundsmith owns three shares of Magnificent Seven (MicrosoftMeta i Alphabet) and all of them were among the top five people who had the greatest impact on the results for 2025.

Indeed, this is the fifth time Meta has been named among Fundsmith’s top contributors, and it’s the tenth time Microsoft has appeared there. So while Big Tech helped support the fund’s long-term performance (which continues to be powerful), Smith simply didn’t have enough exposure to it.

Producer by Wegovy

New Nordisk (NYSE:NVO) crashed about 40% last year, which was Fundsmith’s worst performance by far. Manufacturer Wegovy lagged behind its rival Eli Lilly in the GLP-1 drug race, which led to the ouster of its CEO.

I note, however, that the company’s stock is up 17% so far this year, driven by news that Wegova’s treatment has been approved by U.S. regulators as a daily pill.

In addition to improving the company’s competitive position, this could also bring sales growth back in the right direction. The main risk in this business is that Eli Lilly will beat it again with an improved GLP-1 drug.

However, with forward earnings of 16.7 times, I think Novo Nordisk stock is worth considering.

As for Fundsmith, though, I’ll skip it. I remain concerned about continued impoverished performance.