Image source: Getty Images

The UK stock market offers a wealth of dividend stocks that haven’t missed a payout in over two decades. In many cases, these heroes with reliable incomes not only paid consistently, but actually increased each paycheck.

As of December 5, I can find as many as 22 stocks across the country FTSE100 AND FTSE250 that have generated dividends for over 20 years in a row.

Of these, I have selected the top five that I believe offer the best combination of high yields and long-term reliability. These are:

| Warehouse | Give | Payout Ratio |

|---|---|---|

| Tobacco from British America | 5.5% | 170% |

| Bunzl | 3.5% | 50% |

| The international company Croda | 4.2% | 110% |

| Investment fund of the City of London (LSE: CTY) | 4.1% | 30.7% |

| Schroder Oriental Income Fund | 3.7% | 30% |

Despite my belief in high dividend stocks, I will allow myself some reservations. As a tobacco company, BAT’s future depends largely on its ability to successfully bring less harmful products to market. And with its share price down 56% over the past five years, Croda could lose favor if it fails to turn things around.

But apart from these minor exceptions, you’d be hard-pressed to find five companies in the UK with more stable earnings.

Let’s take a closer look at the City of London Investment Trust and discover why it has long been a favorite of income investors.

Stability in diversity

City of London Investment Trust leads the pack with an incredible 59-year track record of growing dividends. Since 1977, the company has increased its dividend from just under 1p per share to the current 21.6p per share, representing annual growth of 6.6% per year.

What’s more, the share price is up 42.6% in five years, which is more than just profitable. The fund managers do an excellent job of balancing the highest growth and dividend stocks on the FTSE 100.

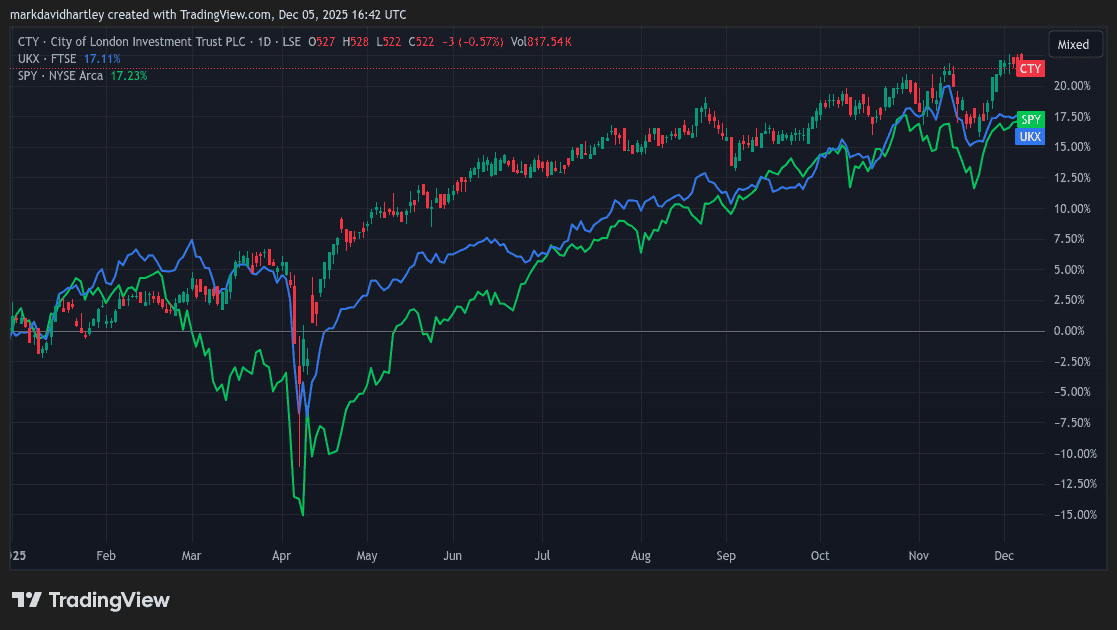

Some of his most crucial holdings include HSBC, Shell, Unilever, NatWest, BAE systems, Tesco AND Imperial Brands. Achieving a total return of 21.7% so far this year, it has outperformed both the FTSE 100 and S&P500.

But while the focus on earnings has helped spur growth this year, at other times it increases risk. Regulatory changes affecting dividend-heavy financial and consumer goods sectors could lead to cuts, limiting stock returns. Moreover, its operations are entirely concentrated in the UK, so any problems in the country could harm the fund’s overall performance.

The most crucial thing

It’s not basic to raise dividends consistently over decades. To make this possible, the company must have robust foundations, supported by excellent management and built around a sustainable business model. That’s why I think City of London Investment Trust is a company worth considering, along with the other four on this list.

However, regardless of the basis, circumstances are constantly changing, leaving no commodity without risk. In addition to those already mentioned, Schroder Oriental Income Fund is exposed to concentration risk in Asia, and Bunzl’s growth strategy relies heavily on successful acquisitions.

While these amazing achievements don’t leave much to say, it’s always wise to do a full assessment before taking action. Most importantly, identify any emerging risks that may not have been present in previous years.

Keeping up to date with modern events is the key to choosing the right stocks at the right time. So while these are my go-to dividend stocks today, who knows what tomorrow will bring?