Image source: Getty Images

The FTSE100 AND FTSE250 have seen significant growth so far in 2025, growing 20% and 7% respectively. And they may have much further to go in the coming months and years. However, I believe there are better UK shares to buy outside the two main London share indexes.

Predicting short-term stock market movements is extremely hard. However, City analysts expect the following UK stocks to rise next year. Here’s why I think they require consideration from both compact and long term investors.

We are reaching for gold

At 271.4p per share, Golden pancake (LSE:SRB) has increased by as much as 143% since January 1. It was pushed higher by the soaring price of the precious metal, which reached a fresh high of around $4,381 per ounce in October.

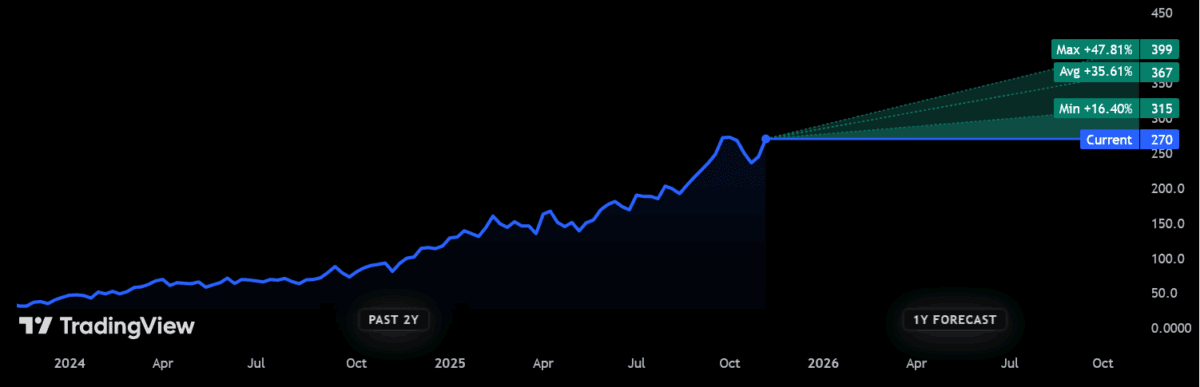

The broker consensus, supported by a solid gold price outlook, suggests Serrabi shares will rise another 36% over the next 12 months:

Further increases in gold prices are, of course, not guaranteed. In fact, signs that recent growth has stalled could see gold mining stocks plummet again.

However, overall, things are looking good for the safe-haven metal given the ongoing macroeconomic challenges and huge geopolitical uncertainty. Morgan Stanley Analysts estimate that by mid-2026 the gold price will reach $4,500 per ounce.

Serabi is also making great strides in pedestrian production to take advantage of this fertile environment and ensure long-term profit growth. Production rose to a record high of 12,090 ounces in the first half, up 27% year-on-year. It remains on track to deliver 100,000 ounces of material per year by 2028.

Serabi shares are trading at a price-to-earnings (P/E) ratio of 5.3 times. This makes it one of the cheapest gold stocks and, in my opinion, leaves room for further price increases.

The best action for pennies

At 52.5p Financial capital of distribution (LSE:DFCH), the company’s share price has increased by an impressive 45% since the beginning of the year. If the forecasts prove true, the penny price may enhance significantly over the next 12 months.

City forecasts suggest the value of the specialist financial services provider will rise by almost two-thirds to 85p:

Please note that only one analyst currently has ratings on the company’s stock. This does not provide a broad spectrum of opinions. However, I believe there are good reasons to expect DF Capital to maintain its impressive momentum.

As with other financial services providers, profits are very sensitive to broader economic conditions. Investors should therefore take into account the bleak outlook for the UK economy. However, so far the company has managed to overcome the problems and report stunning results.

Thanks to the introduction of fresh products to the market and the enhance in market share, the company’s loan portfolio amounted to as much as GBP 759 million at the end of the third quarter. This is an enhance of 26% year on year.

DF Capital shares are currently trading at a forward P/E ratio of 9.1 times. In my opinion it looks really budget-friendly and provides room for additional price gains.