Image source: Getty Images

The British cannot have enough isas cash. In the tax year in 2023/24, the latest HMRC data emphasize that the saving have lowered almost 70 billion pounds for such tax -free products. It is an enhance of 28 billion pounds compared to the previous year.

Cash Isa is a great way to save in a long term. But do the interest rate on such products fall over the past year, or is it really the best option for people who want to build a enormous nest egg?

It should be remembered that tax treatment depends on the individual circumstances of each client and may change in the future. The content in this article is provided only for information purposes. It is not to be, nor does it constitute any form of tax advice. Readers are responsible for implementing their own diligence and obtaining professional advice before making investment decisions.

HMRC statistics

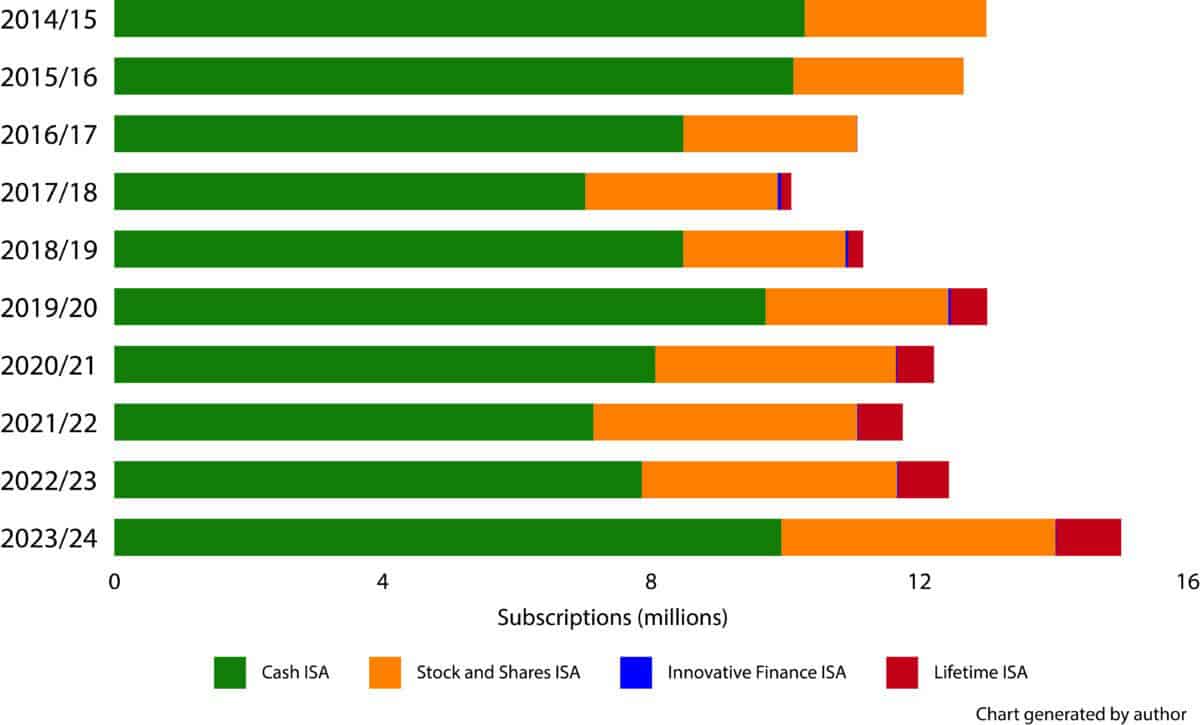

Last week, HMRC published its annual savings statistics and paint the image of crazy activities. The chart below emphasizes the scope of this shopping madness. The number of novel cash ISA increased by 2.1 m. This completely overshadowed novel shares and ISA (283,000) and ISAS (209,000).

HMRC data

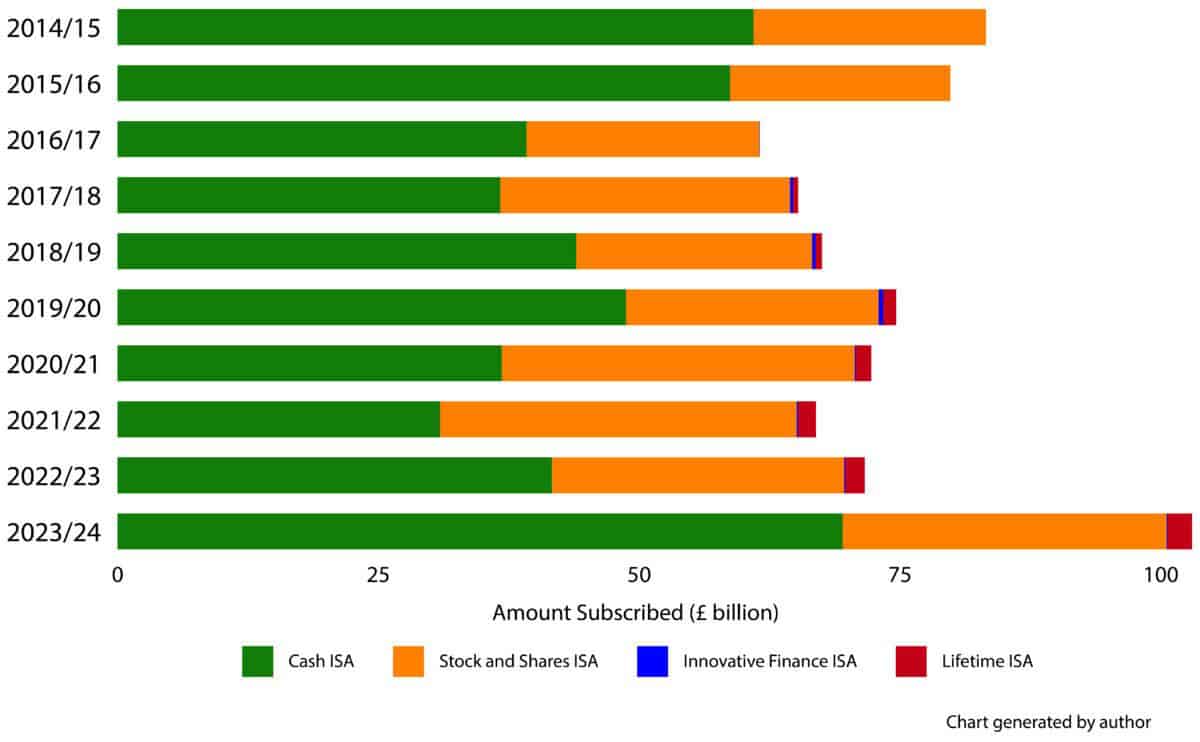

The scope of growth of cash deposits is lively by the chart below. Because the bank of the bank of Bank England reached its peak in the 2023/24 tax year, blocking returns about 5% completely tax and risk -free, was the main charm of saving.

HMRC data

Corresponding

Although interest rates fall, early observations of the main ISA suppliers such as Aviva AND Phoenix Group Emphasize the continuation of this growth trend this tax year.

Today, the basic rate of the Bank of England is 4%. However, so far a year FTSE 100 increased by 11%. In the long run, FTSE 100 generated average annual phrases of 6.5% and S&P 500 10.5%.

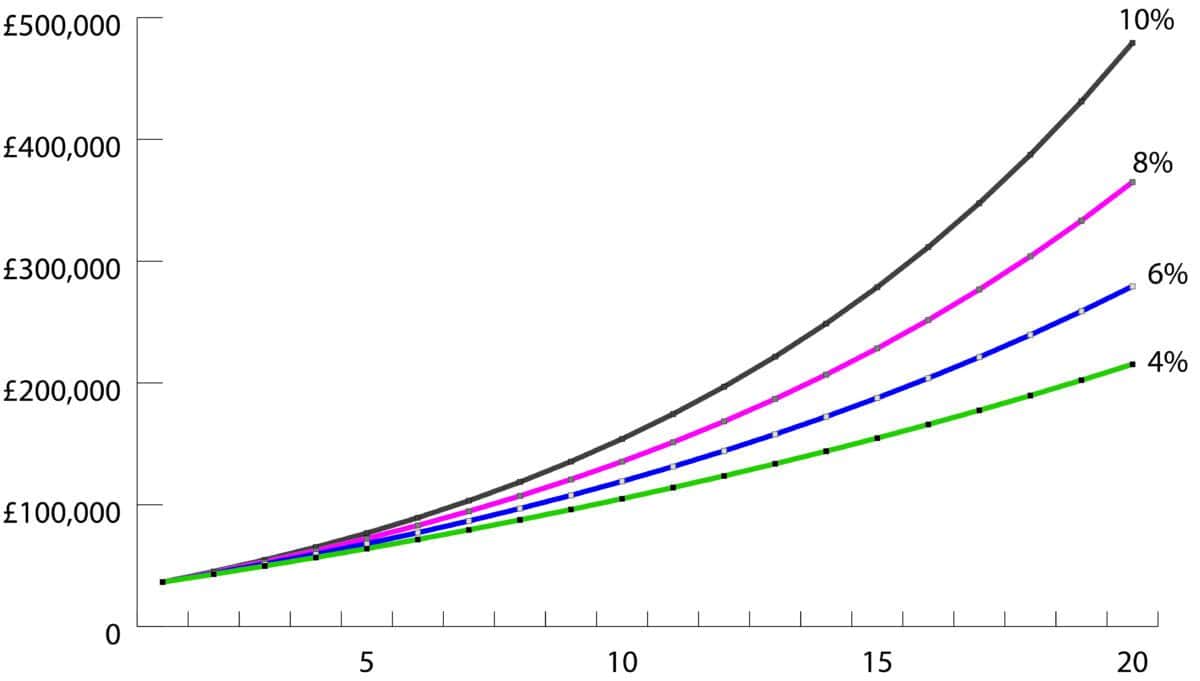

The average ISA value for people earning the average salary is £ 31,536. The following charts appear an initial investment with another contribution of 5000 GBP for the next 20 years. As you can see, petite changes in annual phrases lead to significantly different final pots. This is due to the magic of the connection.

The chart generated by the author

High performance plant

Personally, I prefer ISA shares and shares from ISA cash for this reason. I have a mixture of passive means that follow the performance of the main reference point, along with a varied portfolio of individual actions.

Collecting individual stocks can be discouraging for many, but the possibility of receiving a dividend is a great draw for me. Aberdeen (LSE: ABDN) is one of these stocks.

. FTSE 250 The Asset Manager currently offers a dividend performance of 7.7%. I believe that with over 500 billion pounds of assets or administration offers a fascinating growth history.

Interactive Investor, his direct-consumers’ offer, stormed the investment world. And as the above HMRC statistics show, the desire to take control of personal finances still accelerates.

In addition to ISA, the company recorded an extraordinary enhance in its SIPP portfolio. On average, balances on such accounts are higher than ISA.

However, shares are currently at many years due to outflows from various funds. This remains a constant problem and a clear risk for the company.

Despite the risk, I still like Aberdeen. His funds remain a selected investment tool for over 50% of independent financial advisers. A deep partnership with this cohort provides extraordinary growth potential. As long as its price is in Doldrums, I will continue to add more for my actions and ISA shares.