Image source: Getty Images

Dividend investors must be careful in banking operations. The prospect of decreasing interest rates is a real risk, but not everything FTSE 100 Banks are the same.

Barclays (LSE: BARC) is unique in combining a powerful retail presence with global investment banking. And the supplies are also captivating from the dividend perspective.

Dividends

At the moment, Barclays shares have 2.2% of dividend profits. Compared to Lloyds Banking Group (3.95%) or Natwest Group (4.42%), this is not particularly eye -catching.

When it comes to dividends, Barclays has a lot more than he meets with the eye. In February 2024, the company announced a characteristic approach to shareholders.

Instead of increasing the dividend, the bank decided to focus on the purchase of shares. As a result, the dividend for action increased, but only because of the number of shares.

This means more modest dividend performance, but it should – if everything goes well – result in stronger growth. And this is certainly expected by analysts.

Perspectives

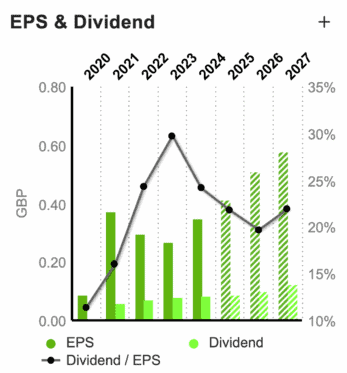

In 2025, Barclays is expected to return 0.902 pens to dividends. It is 7% higher than in the previous year, but the forecast is a significant extent in 2026 and later.

The latest numbers that I can find gains dividend increased to 10.06 pens per share in 2026, before rocket to 12.65 pens in 2027. This means a refund of 3.28% based on the current share price.

In terms of annual growth, this is an augment of 11.5%and then an augment of 27.5%. This is an augment that even some of the best growth actions would see more than respected.

However, dividend investors can question how it is realistic. If the total distribution remains the same, these assumptions regarding growth pay many expectations to the program to buy out.

Share purchase

In February last year, Barclays announced plans to return 10 billion pounds to shareholders by the end of 2026, and it is halfway through this program, and $ 3.75 billion was used to buy out shares.

In this way, the bank reduced its number of shares by over 11%. That is why the dividend to the action even increased that Barclays returned the same amount of cash.

Because the company now has a market value of about 55 billion pounds, it would take a lot to reduce the number of shares overdue by another 10%. And it’s worth noting.

The price of Barclays shares has been more than twice since the company first outlined its strategy. This reduces the impact of the exploit of cash on the purchase of shares to a enormous number of shares to a enormous extent.

Dividend augment

In the case of shares below the accounting value, the purchase of shares should augment the value of Barclays shares. But I think investors must be realistic in the face of the future.

The redemption would take a lot of redemption to generate a dividend augment by 11.5%and then 27.5%. There is also a risk that inflation can cause interest rates to fall slower than expected.

In such a situation, investment banking activities may not start in the way some analysts are waiting. This would make the bank a unique structure with weakness, not by force.

Different investors rightly have different priorities. But from a passive income perspective, I think there is a better choice than Barclays to consider.