Image source: Getty Images

For most people, five great per month in passive income was very nice. Indeed, it may even be enough to give up work, assuming that he does not plan regular luxury spa breaks in the Bahamas.

Probably the best way to direct dividend income is in ISA actions and actions. This account protects all tax refunds, enabling wealth of construction faster.

Over the past 10 years, ISA shares and shares are following performance FTSE 100 The index easily exceeded ISA cash. The average return is about 9% per year and slightly higher S&P 500 thrown into the mixture.

On the other hand, cash returned about 2% to 2.5%, even in this higher interest rates from 2022. This suggests that saving would lose their real purchasing power during this period due to inflation.

It should be remembered that tax treatment depends on the individual circumstances of each client and may change in the future. The content in this article is provided only for information purposes. It is not to be, nor does it constitute any form of tax advice. Readers are responsible for implementing their own diligence and obtaining professional advice before making investment decisions.

Striving for a portfolio worth 1 million pounds

The annual contribution limit for ISA is 20,000 pounds. This means that building the aforementioned header will take some time.

Let’s assume, for example, that the portfolio gives 6% in the future. To obtain a monthly income of 5000 GBP, ISA shares and shares will have to be worth 1 million GBP.

This is of course a enormous sum, and achieving it may sound like a dream of a pipe, especially when the annual ISA limit is “only” 20,000 pounds.

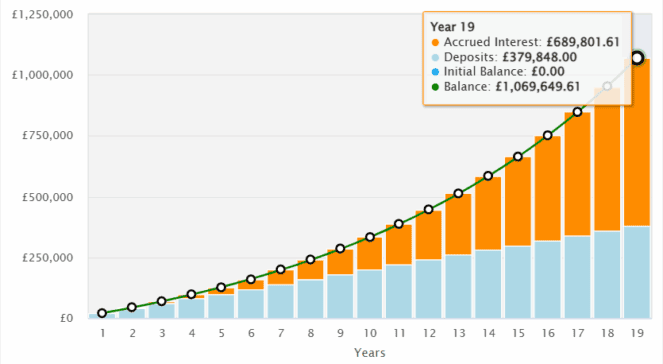

However, he was an investor who achieved an average of a 10% refund that the seven -digit sum would be achieved in less than 23 years. The great news is that it will be investing 12,000 pounds a year (or 1000 GBP per month), not 20,000 GBP.

But if the full ISA benefit were invested regularly, 1 million pounds would be achieved in 19 years! Both of these examples include someone who starts from scratch.

Now I should mention that a 10% return is not guaranteed, while dividends can be suspended if the company gets into trouble.

However, potential long -term prizes can be significant.

Ready growth portfolio

One of the approaches that can be used to strive for a 10% return is investing in investment funds. These are listed companies that buy a diverse portfolio of assets, usually shares.

. Baillie gifford us growth trust (LSE: USA) is one that I rate highly. Among the best trust resources is Meta platformswhose earnings simply exceeded the expectations of Wall Steet. AI is the efficiency of turbocharging ads on Facebook and Instagram, ensuring performance and greater returns.

Meanwhile, the game platform Roblox He did something similar. As I write today (July 31), Meta and Roblox shares increased by 12% and 17%, respectively.

It seems that trust managers have an eye for great choices (including Nvidia).

One of the risks, however, is that the portfolio is heavily tilted to American technological stocks. If they fell by grace, trust would probably not achieve worse results. There is also no geographical diversification (although most American technology companies are currently global).

Trust is currently with a 7.5% discount into net assets, which I consider attractive. I think that it is worth considering, especially as a way to get an exposure to a portfolio to a deepening AI revolution.

When ISA achieves magic 1 million pounds, it would be possible to focus completely on dividend actions. The portfolio by 6%would then throw the equivalent of 5000 GBP per month to tax -free passive income.