India Elliott Wave coal technical analysis – daily chart

Function: Counterattack.

Mode: Impulsive.

Structure: Gray Wave C.

Position: Orange wave 2.

Next direction lower level: Gray wave c (started).

Details: Gray Wave B seems complete; Gray Wave C is now ongoing.

The daily analysis of India coal charts, using the Elliott Wave method, shows the configuration of counterattacks. The price is now impulsive, which indicates that Gray Wave C has begun in a wider corrective pattern, located in Orange Wave 2.

Current analysis shows that the Gray B wave is probably over. Thanks to the operation of the gray wave C, the chart reflects a typical end wave in the corrective sequence. This movement usually ends the corrective phase before the main trend continues.

An impulsive wave pattern of a gray w wave indicates a sturdy rush down. Since the wave has just begun, further declines are possible. This configuration shows that India coal is in the repair stage, and Gray Wave C should end the overall correction.

Placed in an orange wave 2, this structure can be part of a larger correction. Gray Wave C is a key part of this configuration. Traders should watch out for the signs of the gray W Wave C approaching to the end, which could signal the end of the counter-trender and the return of the basic trend. Impulsive movement in the Gray C wave suggests that this decrease can continue strength before the end.

This analysis helps traders understand the current place of Coal India in a wider market cycle. The ongoing down movement can still take place to run. Because contract movements can be unpredictable, caution is recommended. The Wave Elliott theory offers a guide to identify key turning points, although such environments often require sturdy risk control strategies.

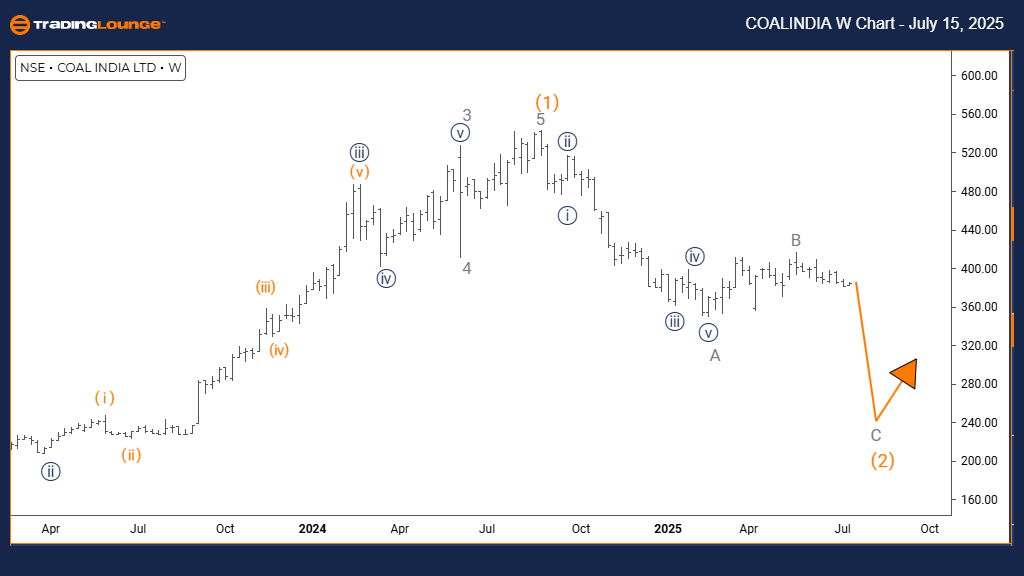

Coal wave analysis India Elliott – a weekly chart

Function: Counterattack.

Mode: Impulsive.

Structure: Gray Wave C.

Position: Orange wave 2.

Direction The next higher degree: Orange wave 3.

Details: Gray Wave B seems complete; Gray Wave C is growing now.

The Wave Elliott weekly analysis for India coal shows the phase of contracts as part of a wider correction. The price is formed by a gray W wave, which is part of the Wave 2 orange pattern. It suggests that the shares undergo a noticeable withdrawal as part of a larger trend.

The technical signals confirm the end of the wave of gray B. The chart now reflects the beginning of the Gray C wave, which is usually the last leg in a three -piece correction. The impulsive behavior of this wave is suggested by a sturdy price momentum.

Electricity pattern, part of the orange wave 2, signals indirect correction. Then, Orange Wave 3 is expected to resume the main trend to a higher extent. This configuration suggests that India coal is approaching the end of its correction, and Gray Wave C will probably end the final stage.

Traders should strictly monitor Gray Wave C in terms of any signs of weakness. After the end of this wave, it would indicate the end of the orange wave 2 and the possible beginning of the orange wave 3. The impulsive pattern of the gray wave wave can continue pushing prices before stabilization.

This weekly analysis helps to put wrestling as part of a wider trend. This means that the contract traffic may soon end. Wave Elliott theory helps to identify key reversal points. However, these configurations can be hard to trade, which is why traders should carefully manage the risk.