This Elliott Covers wave update BHP Group Limited (ASX: OHS) on the Australian Stock Exchange.

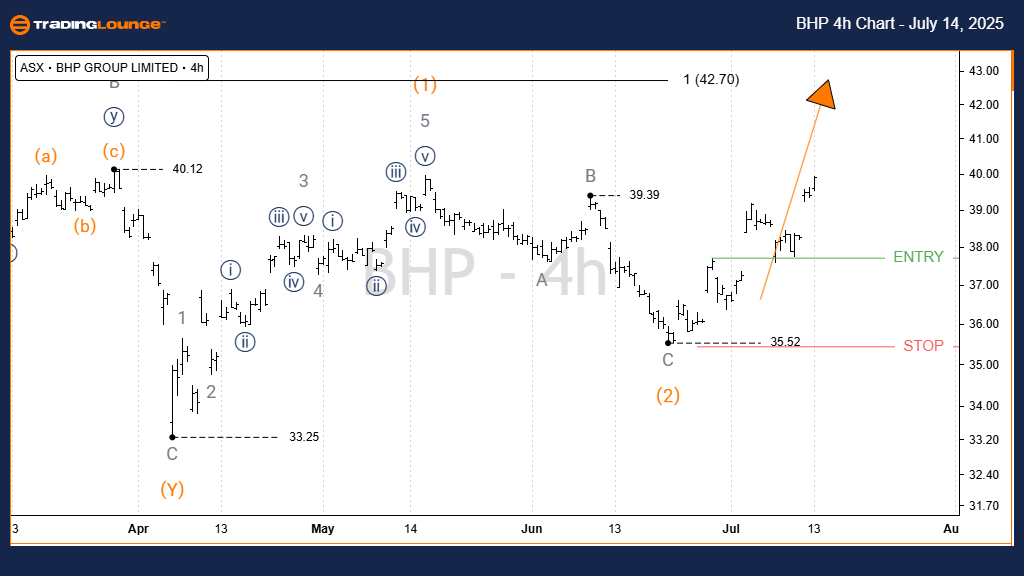

It is possible to grow on the chart wave 2) orange He recently graduated as a zigzag formation. Now the chart suggests the beginning wave 3) orangepotentially increasing the higher price. This analysis determines both the expected target price and a critical level that supports this stubborn scenario.

BHP Elliott Wave Technical analysis-Mutherto chart

-

Function: The main trend (indirect, orange).

-

Mode: Theme.

-

Structure: Impulse.

-

Position: Wave 3) orange.

Details:

From low 33.25wave 1) orange Completed as a model of five years. Then, wave 2) orange It seems that it ended as a three -wave zigzag ABC Gray. This pattern indicates this wave 3) orange It can now form and strive for 42.70 to 47.84. The stubborn scenario remains intact as long as the price remains above 35.52.

- Annulment point: 35.52.

BHP Elliott Wave Technical analysis-a four-hour chart

-

Function: The main trend (indirect, orange).

-

Mode: Theme.

-

Structure: Impulse.

-

Position: Wave 3) orange.

Details:

The 4-hour chart is compatible with a 1-day analysis. A long position can be considered when the price of the break above basic level. The level of annulment for the stubborn configuration remains 35.52.

Application

These are technical perspectives ASX: BHP Group Limited – OHS It aims to inform traders about current trends and useful strategies. By pointing to key points of checking correctness and annulment, wave analysis builds a more reliable market view. Our goal is to provide consistent, correct and professional insights for traders.