After a robust two -month reflection, S&P 500 entered the rising near the ups of all time. But can this rush continue or do we supplement the variability?

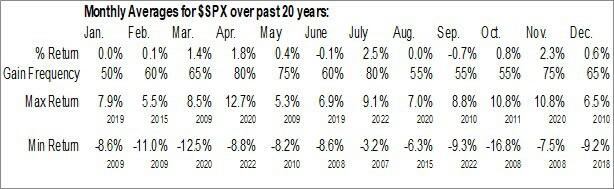

Historically, The first two weeks of July is the most stubborn episode of the year. In terms of seasonality, July is also average stubborn for SPX in the last 20 years. However, while seasonal trends look great, this time several catalysts can shake.

Source: EquityClock

Potential risk

The key fundamental risk to be observed in July is the following:

-

Freeze tariff ends on July 9 → Any re -escalation can be frightened by markets

-

Deadline fiscal tax account (July 4) → Policy delays can revive the concern of the deficit

-

Assumed conditions → RSI similar to 70+; The shoot is robust but extended

The earning season begins in mid -July

Watch out for the key results of Mag-7 (Microsoft, Apple, Google, Amazon, Meta, Nvidia, Tesla).

| Business | Expected date of the report |

| Tesla | July 17 (East) |

| Microsoft | July 23 (IS.) |

| Finish | July 24 (East) |

| Amazon | July 25 (IS.) |

| Google (alphabet) | July 25 (IS.) |

| Apple | July 30 (IS.) |

| Nvidia | August 14 (IS.) |

Current technical landscape SPX

-

The price is above 20, 50 and 200 EMA.

-

Ammed VWAP (April) still provides active support.

-

Breakout above 6100 shows a pure stubborn structure.

-

Next psychological goals: 6200 → 6300 → 6500.

This structure favors the continuation, if the mood occurs-but we are also approaching the resistance zones to the round and purchased territory.

Neutral trade scenarios

If stubborn:

-

Look for a continuation compared to 6300 and 6500 – especially if the volume is confirmed.

-

Buy possibilities nearby EMA-20 (6010) Or Earlier breakthrough zone (6120).

If Bearish:

-

Watch out for bears of discrepancies (RSI/MacD) or rejecting candles near 6300.

-

Key support zones: 6120 AND 5885 (EMA-50).

-

Detachment below anchored VWAP can start a lower turnover.

Final thought

July is known for good results – but this time the risk of macro, policy dates and variability of earnings are approaching. Although we are technically stubborn, it is a good idea to carefully observe fundamental changes.

In general, the mini rally seems to be one of them, even if we do not chilly down a bit here and test the EMA-20 zones, and even the EMA-200-how much we can remain above these prices (6000 and 5,700 USD, respectively).