Key results

- The profits are expected to boost +5.0% installment at +3.9% higher revenues.

- Technology expectations have stabilized in recent weeks in recent weeks.

- Next week we will hear from several S&P 500 companies, including MU, FDX and NKE.

Earnings in the second quarter are expected to boost by +5% compared to the same period last year at +3.9% of higher revenues. It will be a material release from the trend of growth of recent quarters.

In an unlikely case that the actual boost in profits in Q2 for the S&P 500 index turns out to be +5%, as expected, it will be the lowest rate of earnings for the index, because the growth rate +4.3% in 2023 III Q3.

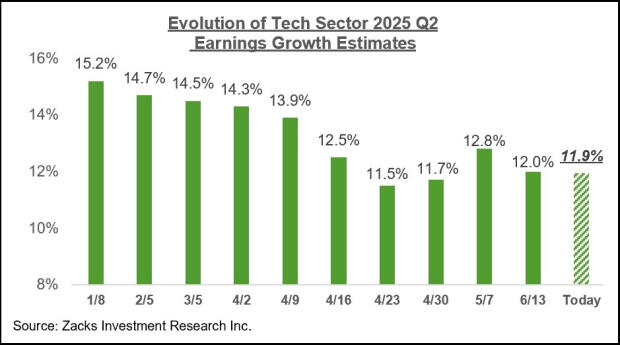

In recent weeks, we regularly mean that the estimates of earnings in 2025 are constantly falling, as can be seen in the chart below.

Image source: Zacks Investment Research

The size of the cuts to estimates 2025 Q2 from the beginning of the period is greater and more widespread than what we got used to in the period after the visit.

From the beginning of April, Q2 estimates have fallen for 14 out of 16 sectors of Zacks (airports and tools are the only sectors whose estimates increased), with the largest cuts of conglomerates, cars, transport, energy, basic materials and construction sectors.

Estimates for technological and financial sectors, the largest profits in the S&P 500 index, which is over 50% of all the earnings of the index, have also been reduced since the end of the quarter. But, as we have recently noticed, the tendency to revise the technology sector has stabilized significantly in recent weeks, as shown in the chart below.

Image source: Zacks Investment Research

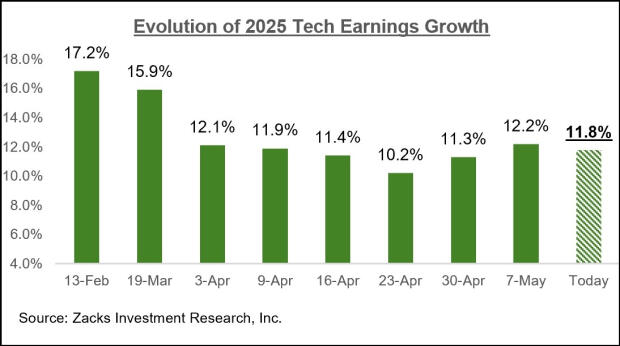

We also see the same trend in annual estimates. The chart below shows the evolving expectations of the technology sector all over 2025.

Image source: Zacks Investment Research

The probable explanation of this stabilization in the revision trend is to alleviate the tariff uncertainty after delaying the more criminal version of the tariff regime. Analysts began to view their estimates below in the direct consequence of tariff ads at the beginning of April, but since then they came to the conclusion that this Karf punishment is unlikely, which helps to stabilize the sequence of revision.

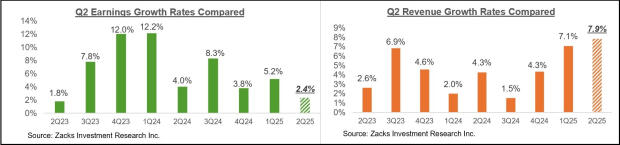

The chart below shows the current expectations of earnings and revenues in the context of the previous four fourth and upcoming three quarters.

Image source: Zacks Investment Research

The chart below shows a general picture of earnings based on the calendar year.

Image source: Zacks Investment Research

In terms of the S&P 500 “EPS” index, these growth feet are around USD 253.84 for $ 2025 and USD 286.87 for 2026.

The chart below shows how these calendar expectations for an boost in profits have evolved from the beginning of the quarter. As you can see below, the estimates fell sharply at the beginning of the quarter, which coincided with tariff ads, but in particular stabilized in the last four to six weeks.

Image source: Zacks Investment Research

Key earnings this week: FDX, NKE, MU

The reporting cycle in June in the quarter will really start when enormous banks come out of the results of July 15th. But by this time we will officially count almost two dozen quarterly reports from S&P 500 members. All these reports will come from companies with fiscal quarters completed in May, which we and other research organizations are counted as part of the June quarter.

We saw such results in fiscal May from 9 S&P 500 members and we are on the right track to see how the next 8 index members will appear this week. Well -known companies reporting this week include Fedex, Nike, Micron and others. Fedex shares were enormous in response to March 20th Quarterly when he missed the estimates. But the actions have been fighting for the last few years, and the uncertainty related to international trade increases subdued demand trends in the industrial sector. FedEx is actively working on reducing the cost base and reducing the company’s capital intensity. The announcement of the management board about spending LTL activities (less than a truck) is part of this repositioning.

Fedex is to report after closing the market on Tuesday, June 24th. The company is expected that the company will earn USD 5.94 per share with the revenues of USD 21.7 billion, which is a change in the year of +9.8% and -1.9%, respectively. Estimates for this period have fallen constantly, and the current 5.94 USD for the action will estimate from USD 5.98 per month and USD 6.32 three months ago.

FedEx shares lost about one fifth of their value this year, more or less in accordance with the UPS efficiency, but indeed below the S&P 500 +1.2%index. Over the past three years, reserves have dropped by -2.1%, while the S&P 500 index has gained +60.3%.

Like Fedex, Nike is another bell that has recently fought, and the supply dropped by -21.1% this year, when the market as a whole increases +1.2%. Expectations regarding the quarterly Nike edition after closing the market on Thursday, June 26thremain low, from EPS and revenues, which will fall, respectively -89.1% and -15.4% compared to the same period last year

Incorrectly permanently in the face of Nike includes the perception of an dated product line, which burdens on demand and the resulting compilation of inventory, which must be entitled. The inventory onhang will be expected to persist for several consecutive quarters, but the market will be impatiently looking for incremental information on the reception of fresh products and updating the product pipeline. The squeeze of the margin is primarily the result of the settlement of dated stocks, but also reflects the renovated concentration of the fresh management team on wholesale activities, which has been neglected in recent years.

Micron Technology shares have recently been literally in general, up +46.2% in the year, with the survivor of the height of Zacks Tech Sector Sector Zacks +1.5% and the S & P 500 +1.2% boost. Conducting an impressive supply of stocks is a micron steering position in a high capacity memory space (HBM), a critical contribution to high -performance calculations (HPC) and artificial intelligence (AI).

It is expected that a combination of stable demand trends in older products, such as drama and continuous strength in HBMth. MICRON is expected to report $ 1.57 per share in profits at 8.81 billion USD revenues, which is changes during the year +153.2% and +29.3%, respectively. Estimates for the fiscal quarter have remained unchanged in the last three months, although they increased modestly in the August period and next year.

Profit season results card from Q2

As mentioned earlier, we have already seen the results of May-Quarter Fiscal from 9 S&P 500 members, which we count as part of our Q2. Total earnings for these 9 index members who reported the results increased by +2.4% compared to the same period of last year in terms of profits of revenues +7.9%, with 77.8% of companies overcome EPS estimates, and all beaten the estimates of revenues.

The comparative charts below place profits and revenues for these index members in a historical context.

Image source: Zacks Investment Research

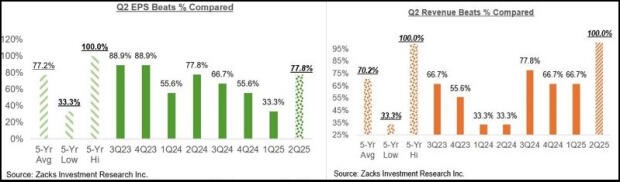

The comparative charts below place q2 EPS interest and revenues in a historical context.

Image source: Zacks Investment Research

We do not draw any conclusions from these results, taking into account the diminutive size of the sample at this stage. Nevertheless, we wanted to put these early results in a historical context.

Do you want the latest recommendations with Zacks Investment Research? Download 7 best stocks for the next 30 days. Click to get this free report