Key results

-

Net sales of grabs in Q1 increased by 8.3% year -on -year to USD 3.12 billion, led by strength in various customer segments.

-

Sales of hardgoods increased by 12.3% compared to better stocks, novel brands and faster market implementation.

-

The sale of autoshipps increased by 14.8% to USD 2.56 billion, reaching a record 82.2% of total net sales in this quarter.

Chewy, Inc. (Grip – Free report) reported solid results in the first quarter of the 2025 tax year, in which both the upper and lower lines overcome the estimation of Zacks consensus and increased year to year.

The company provided the highest growth, which exceeded high -class guidelines for net sales. His good results were caused by a solid busy growth of customers and high loyalty of customers.

The company continued to expand the Chewy Vet Care initiative, opening three novel clinics and transferring the sum to 11 locations in four states. Performance exceeded the expectations of customer acquisition and ecosystem involvement. The company remains on the right track to open from eight to 10 novel clinics in the 2025 tax year.

Chewing price, consensus and EPS surprise

Quarterly captivity of grips: key indicators and observations

Chewy published corrected earnings of 35 cents per share, which overcome the estimation of Zacks consensus at 34 cents. This drawing increased by 12.9% compared to the previous year. (Find the latest EPS estimates and surprises in the calendar of Zacks earnings.)

The company reported net $ 3,116 million, exceeding the estimation of Zacks in the amount of USD 3,076 million. This number increased by 8.3% from USD 2,877.7 million published in the previous period. Expensive results were supported by continuous momentum among novel and existing customers, a favorable mix of basic consumables, health category and well -being, and a particularly mighty escalate in hardgoods.

Sales of hardgoods increased by 12.3% year on year to $ 342.2 million, powered by a better range, better management of the life cycle, better ability to discover and faster strategy to the market, including adding over 150 novel brands in the last two quarters. Consumer sales increased by 6.4% year on year to $ 2.18 billion. Assessment of Zacks consensus was determined with a 6.1% escalate in net sales hardgoods and an escalate in net sales of consumables by 5.7% in the first fiscal quarter.

The Autoship subscription program remained the cornerstone of the Chewa model. The sale of customers from Autoshipp increased by 14.8% to USD 2.56 billion, exceeding the overall escalate in net sales. The record was 82.2% of total net sales, which is a record for the company. New customers and reactivation increased while gross crushing improved. The company finished the first fiscal quarter with 20.8 million busy customers, which is an escalate of 3.8% year -on -year.

Net sales of Chewy for an busy customer reached USD 583, reflecting the escalate of 3.7% year on year. Improvements were attributed to stronger customer retention, higher order rates and increased purchases between categories, especially from members of the Chewy+ loyalty program, which showed early promise after its launch.

Margin and grip costs

Chewe’s gross profit increased by 8.2% year on year to USD 923.8 million. The gross margin fell by 10 base points (BPS) to 29.6% compared to 29.7% in the first quarter of the 2024 tax year.

SG I A costs increased by 8.4% year on year to USD 653.1 million in the fiscal quarter. As a percentage of net sales, SG I A expenses increased by 10 BPS year on year to 21%. Advertising and marketing costs for the first fiscal quarter amounted to USD 193.8 million, which is an escalate of 3.7% year -on -year. Due to the date of some marketing campaigns, the cost category provided a slight benefit of the lever in this quarter.

The corrected EBITDA amounted to USD 192.7 million, which is an escalate in 18.3% of USD 162.9 million reported in the previous quarter. The corrected EBITDA margin increased by 50 BPS year on year to 6.2%.

Snapshot of financial health

The company finished a quarter of USD 616.4 million in cash and cash, remained free of debts and reported a total liquidity of about USD 1.4 billion. The shareholders’ own capital was USD 375.6 million.

In the first fiscal quarter, the company reported free cash flows of USD 48.7 million, from USD 86.4 million in net cash provided by operating activities and USD 37.7 million in the field of investment expenditure.

The company bought around 665,000 shares for a total amount of USD 23.2 million under the existing program. At the end of the quarter $ 383.5 million, the redemption capacity remained available as part of the current permit.

Zapasy minister

Image source: Zacks Investment Research

What can you expect from a grip in the future?

In the second quarter of the 2025 tax year, Chewy expects net sales from $ 3.06 billion to USD 3.09 billion, which is an escalate of about 7% to 8%. A corrected profit per share in the range of 30 cents to 35 cents is employed. It is expected that the gross margin shows sequential improvement compared to the first fiscal quarter, powered by continuous strength in sponsored commercials, favorable mixing of products and autoshippu contribution. However, the corrected EBITDA margin is expected to fall slightly from the first fiscal quarter due to normal seasonal trends and the date of some investments.

In the case of fiscal 2025, Chewy expects that net sales from 12.3 billion to USD 12.5 billion, which is about 6% to 7% of the year’s year, when it is corrected to exclude the 53th week in the 2024 tax year. The company maintains corrected guidelines of the EBITDA margin between 5.4% and 5.7%. The middle point of this range is about 75 base expansion points from year to year. It is expected that about 60% of this expansion of the margin will come from the improvement of the gross margin.

Chew provides for the transformation of about 80% of the corrected EBITDA into free cash flow in the 2025 tax year, translating around $ 550 million. Investment expenditure is expected to appear at the low end of the previously defined range from 1.5% to 2% net sales. It is expected that advertising and marketing expenses will remain in accordance with the previous year, at the level of about 6.7% to 6.8% net sales, in accordance with the long -term target range from 6% to 7%.

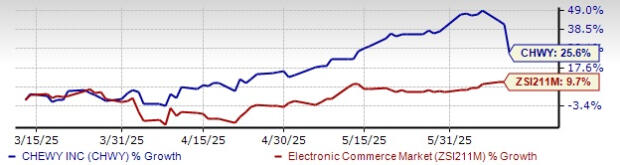

This shares of Zacks No. 3 (Hold) have gained 25.6% in the last three months compared to the escalate in the industry by 9.7%.

Stocks to be considered

Farmers of the sprout (SFM – free report), which deals with the sale of the sale of fresh, natural and ecological food products, currently wears the rank of Zacks No. 1 (mighty purchase). You can see the full list of today’s Zacks #1 stocks.

SFM provided four.5%on average during four surprises of earnings. Estimates of the Zacks consensus for ongoing sales and earnings of farmers in the year and earnings suggest an escalate by 13.7% and 35.5%, respectively, compared to the numbers reported year.

Urban Outfitters Inc. (Urbn – free report) is a specialized seller of a specialized lifestyle who offers fashion clothing and accessories, footwear, home decorations and gift products. Currently has the rank of Zacks No. 1.

Respect for Zacks for Urbna Fiscal tax profits and sales mean an escalate in 21.2% and 8.1%, respectively, compared to the year of the year. Urbn provided a surprise of an average four-four-month earnings of 29%.

Canada Goose (Gois – Free report) is a global brand of outerwear. Goos is a designer, producer, distributor and seller of premium outerwear for men, women and children. Currently, it has the rank of Zacks No. 2 (buy).

Estimates of the consensus Zacks for current earnings and sales in a tax year in Canada indicate an escalate of 10% and 2.9%, respectively, compared to the actual year of the year. The Canadian goose provided a treated surprise with an average profit of four -quarters of 57.2%.

Five inventory set to double

Everyone was carefully selected by the expert Zacks as a favorite supply No. 1 to gain +100%or more in 2024. While not all elections can be winners, previous recommendations increased +143.0%, +175.9%, +498.3%and +673.0%.

Most of the stocks in this report fly under Wall Street Radar, which is a great opportunity to enter the ground floor.

Do you want the latest recommendations with Zacks Investment Research? Download 7 best stocks for the next 30 days. Click to get this free report