Image source: Getty Images

Personal pension (SIPP) is a tool for cultivating our pension funds. Personally, all my pensions have been consolidated in this vehicle and are self -sufficient.

However, like many people my age – 32 – I wonder if my pension will be huge enough to support me in later years. Of course I have a lot of time. However, my perspectives could be better if I started earlier.

In Great Britain we can start a pension of any age. And that’s why my daughter now has several thousand pounds in her retirement. Let’s take a closer look at why we do it.

Reducing the weight on it

I have to be straightforward, I’m not incredibly sure of the world in which I bring my child. At a very basic level, global resources are stretched, and the competition for these resources is becoming more and more intense. In combination with the creation of artificial intelligence (AI), like many parents in front of me, I wonder what the future will bring.

With this in mind, it is always good to have a socket egg or a little more. Starting a pension today, there may be fewer trucks to put more money when it starts to work. People often talk about how complex it is to postpone money today … What if it is more complex in the future?

Connection

Complex key. Then the money earns our investments that will start earning their own business. It’s like a snowball, which becomes larger and attracts more snow when it goes on. This is how elaborate works.

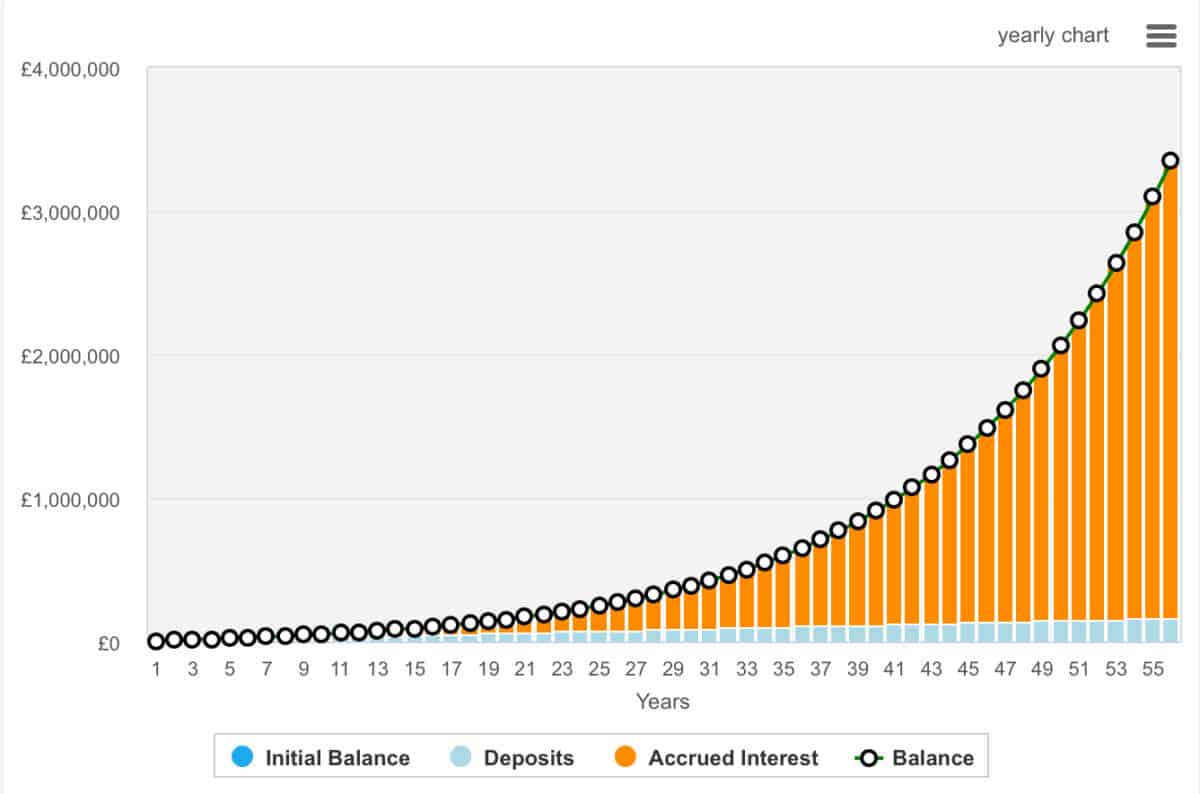

In this case, the current 3000 pounds in my daughter’s SIPP may enhance to 425,000 pounds before it is at my age. This assumes maintaining 240 pounds of monthly contributions and an 8% annual growth rate.

Of course, this is too adolescent to retire in Great Britain. But from 32 her SIPP will develop very quickly due to the aforementioned elaborate. Just look at this chart and growth rate in later years.

Where do I invest?

Because it is a relatively petite portfolio, the will of Trusty, Funds and Conglomerates. They provide diversification in a single investment.

One of the investments is Berkshire Hathaway (Nyse: brk.b). Warren Buffett reserves did not work too badly, taking into account the recent variability. It remains one of the most observed companies on global markets, mainly due to the diverse portfolio and long -term Buffetta investment philosophy.

The company owns a mixture of companies in full property-in this geico, BNSF Railway and Berkshire Hathaway Energy-Wraz with significant capital rates in public companies, such as AppleIN Coca-Cola, American Express, AND Occidental petroleum. From 2025, Apple remains the largest farm, although recent disclosures show an increased exposure to energy and financial services.

The huge collection of cash company also aroused eyebrows. Buffett has accumulated over USD 330 billion in cash, and now it has about 5% of all American treasures. This contributed to his recent immunity.

However, it remains very concentrated. At least in the near future this is a risk because President Trump’s commercial policy seems to sin some company owners. Still, I will buy one in the long run.