Image source: Getty Images

Unlike our American counterparts, many investors in Great Britain prefer to focus on actions with high dividend profitability – instead of those promising exceptional price increases.

It seems that this is a particularly British trend, which probably results from the appeal of reliable and consistent income. Divide -paying shares can ensure a constant cash flow, which is attractive to pensioners focused on income, who prioritize regular returns due to the recognition of capital.

In addition, high -performance shares are often associated with fixed, financially stable companies that can offer greater resistance during periods of market variability. For many, this strategy is seen as a way to build passive income while reinvesting dividends to maximize long -term phrases.

Calculation of dividend phrases

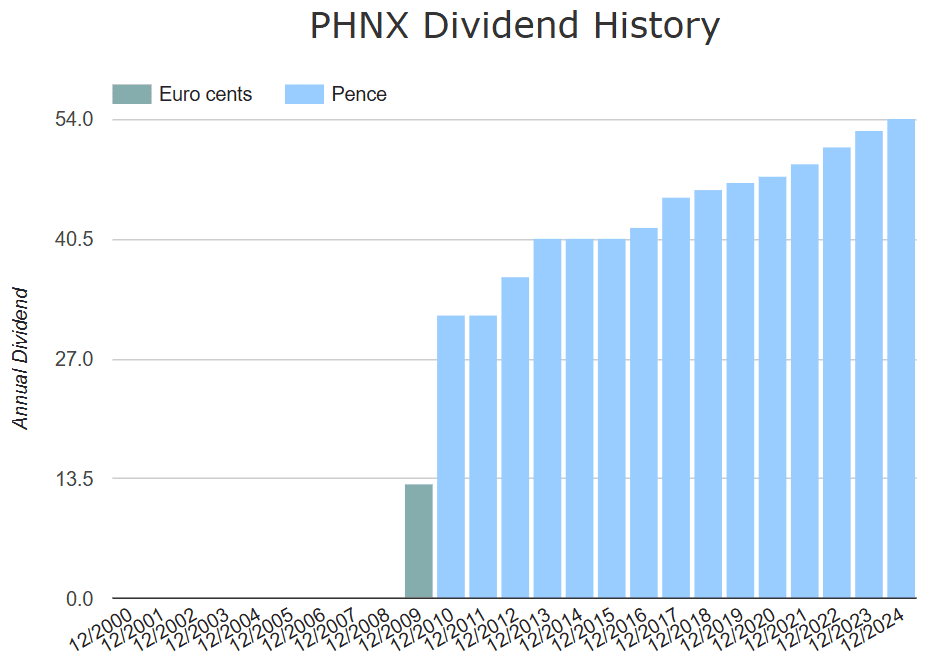

Calculation of returns from dividend shares can be more elaborate than just adding a percentage of price efficiency. Take the British insurance giant Phoenix group (LSE: PHNX), for example.

A year ago, the shares had 487 pence. From 10,000 pounds, the investor could buy about 2,053 shares.

If the investor bought shares until April 11, 2024, they would qualify for the dividend from the last year in 2023 in the amount of 26.65 pens per share, paid on May 22, 2024. This would pay 547.12 pounds depending on dividends. By reinvesting these dividends, this would augment shares by 108 shares to 2161 shares.

After maintaining the action in the second half of the financial year, the investor would also receive a transitional dividend of 2024 in the amount of 26.65 pens per share, paid on October 31, 2024. This would be equal to another 575.99 GBP – an additional 117 shares if it is invested again.

The investor would now have 2278 shares, while the total dividends received 1123 GBP during the year. Today, the price of the Phoenix group shares increased by 19% to 5.78 GBP, so the shares would now be worth 13,178 GBP.

In total, an investment 10,000 GBP a year ago would return around 3178 GBP-31.7% return on investment!

This example reveals the elaborate magic of reinvesting dividends obtained from high -performance campaigns.

Sustainable dividend performance?

Phoenix could do well over the past year, but as the proverb says: “Earlier results do not indicate future results“

Although it offers significant value in relation to dividends, there is a risk. Recent financial results were smaller than ideal, and the company published a loss of 1.12 billion GBP in 2024. This was largely due to operating expenses exceeding revenues by 661 million GBP.

But he still reached a 31% augment in the corrected operating profit and cash flows of 1.4 billion GBP.

For now, the financial situation is a bit sketchy and can potentially lead to dividend cut if things do not improve. This largely denies the company’s value, potentially causing a sale and further losses.

The analysis of the shares is gloomy, with the average target price of 12 months looking at an augment of only 8.6%. However, it is expected that dividends will grow constantly, reaching 55.7 pence this year and 57.3p next year.

Although there are grave concerns about the company’s finances, I think it is still a safe and sound position. Considering that this is a great chance of recovery and it is worth considering dividend income.