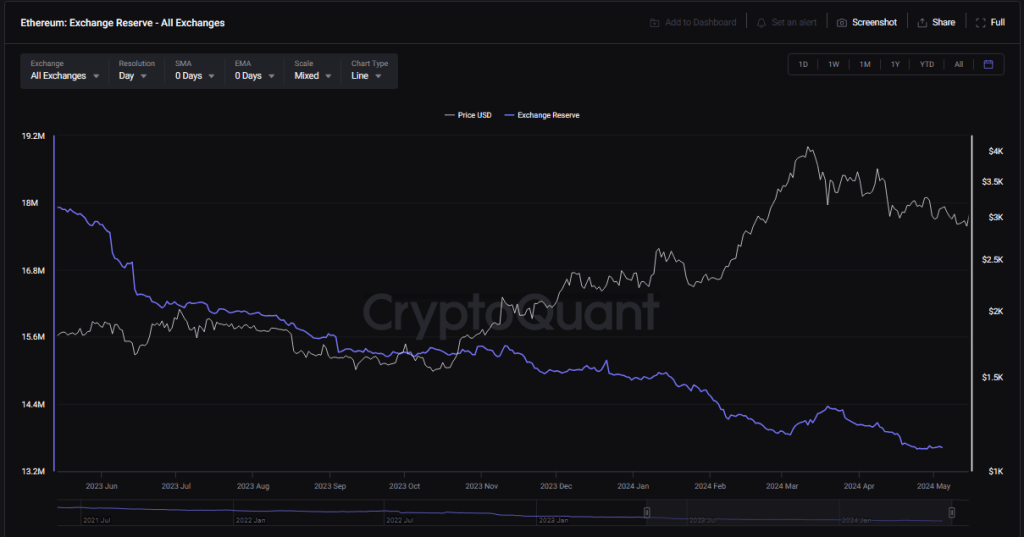

The winds of change are blowing through the Ethereum ecosystem. With the long-awaited approval of spot ETFs in the US on May 23, Ether’s noiseless exodus began. A huge amount of the world’s second-largest cryptocurrency, around $3 billion, has disappeared from centralized exchanges, marking the lowest level of Ether reserves in years. This flight of digital assets has analysts buzzing over the possibility of supply tightening, potentially taking Ether to recent heights.

Exodus to self-reliance: a bullish signal?

Crypto analyst Ali Martinez reported in a recent post on cryptocurrency exchange. Even if Ether ETF products have not yet formally started trading on exchanges, the continuation of this trend could have a significant impact on the behavior of ETH prices over time.

From @SECGov approved place #Ethereum ETFs, approximately 777,000 $ETH – worth approximately $3 billion – were withdrawn #crypto exchange! pic.twitter.com/EzQVC0cw27

— Ali (@ali_charts) June 2, 2024

Traditionally, high reserves on stock exchanges indicated a market rife with sell-offs, with investors eager to offload their holdings. However, the current situation paints a different picture. Analysts suggest this mass exodus signals a change in investor sentiment. Many people are moving their Ether into personal wallets, a move known as self-care and indicating a long-term bullish outlook.

Low foreign exchange reserves suggest that investors are treating Ether not just as a trading asset but as a potential store of value, says Michael Nadeau, a cryptocurrency analyst at DeFi Report. This shift in thinking, combined with the potential for increased demand from ETFs, could create a perfect storm for price increases.

The Ethereum network itself may also contribute to supply constraints. Unlike Bitcoin miners, who incur fixed operating costs, Ethereum validators, responsible for securing the network in a Proof-of-Stake model, do not have the same financial pressure to sell their assets. This lack of “structural selling pressure,” as Nadeau puts it, further limits the readily available supply of ether.

Ethereum ETF Launch: A Double-Edged Sword?

Upcoming premiere Ether ETFs in slow June adds another layer of intrigue. The success of spot Bitcoin ETFs in January, which saw a significant escalate in Bitcoin’s price, serves as a potential roadmap for Ether. Analysts are predicting a similar surge in demand, pushing the ether price towards or even above its all-time high of $4,871 in November 2021.

However, there is a potential obstacle in the form of Grayscale’s Ethereum Fund (ETHE), a massive investment vehicle that currently holds a staggering $11 billion in ether. If Grayscale decides to follow suit with its Bitcoin Trust (GBTC), which saw over $6 billion in outflows after launching spot Bitcoin ETFs, it could put a brake on price gains.

Buckle up for a bumpy ride?

While the future remains uncertain, current market conditions present a fascinating scenario for Ether. The combination of shrinking supply and a potential influx of demand from ETFs paints the picture: potential bull run. However, the ambiguous nature of Grayscale’s actions and broader market sentiment dictate caution.

Featured image from Current Affairs-Adda247, chart from TradingView