Cryptocurrency investors are closely watching Ripple (XRP) as technical indicators paint a troubling picture for the altcoin’s price. After closing below the 20-day exponential moving average (EMA) for four consecutive days, XRP has entered what many analysts interpret as a bear zone.

This technical indicator suggests a potential shift in market sentiment, with the average price of XRP over the last 20 days acting as a resistance level. With prices currently trading below this key benchmark, analysts fear a decline in demand may be imminent.

At the time of writing, the XRP rate was $0.52, down by 0.3% and 3.1% in the last 24 hours and seven days, respectively, according to Coingecko data.

Demand for XRP is losing strength

Adding fuel to the bear fire is XRP momentum indicators, which provide insight into the strength and direction of price movements. Both the Relative Strength Index (RSI) and the Cash Flow Index (MFI) are currently below their neutral points. This suggests that the buying pressure behind XRP is waning, with investors potentially looking to offload their holdings rather than accumulate more.

Further deterioration of sentiment is a significant drop in energetic addresses in the XRP chain. According to Santiment data, the number of daily energetic addresses on the XRP network has decreased by 30% over the past month. This decline is often seen as a harbinger of falling prices because it indicates a decline in overall web activity and user engagement.

Profit in the obscure?

However, there are some glimmers of hope for XRP bulls. Interesting data shows that everyday investors are still making profits. An analysis of XRP’s daily trading volume in profit versus loss shows that for every trade ending in a loss, 1.16 trades are profitable. This suggests that despite the overall bearish sentiment, there may be short-term trading opportunities for skilled investors who can take advantage of market volatility.

The MVRV indicator offers a different perspective

Another factor that may encourage some investors is the negative market-to-realized value (MVRV) ratio for XRP. This indicator essentially compares the current market price of XRP to the average price at which all XRP tokens were purchased.

A negative MVRV suggests that XRP is currently undervalued, potentially presenting a buying opportunity for investors looking for assets trading below their historical prices.

XRP price forecast

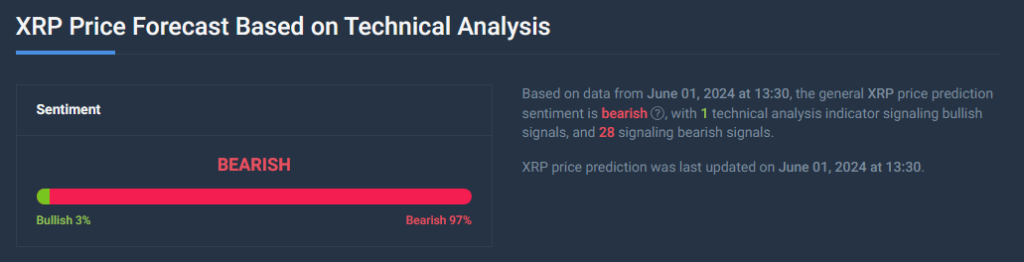

Meanwhile, the current XRP price forecast indicates a 20% enhance to $0.626627 by July 1, 2024, despite bearish market sentiment reflected in technical indicators. A Fear & Greed Index of 72 indicates high investor greed, suggesting mighty purchasing behavior, but also the risk of overbought conditions and potential price corrections if sentiment changes.