ETFS of Technology Sector (XLK) and Energy Sector (XLE) trade in the last fifth wave of the wedge pattern, but there is still room for slightly higher purposes, preferably to the upper wedge line before we see the best formation this year.

Dziennik XLK

Xle daily table

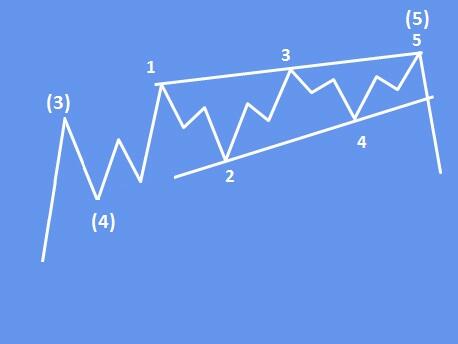

The end of the diagonal wedge pattern is a special type of reversal of the pattern marked with waves 1-2-3-4-5, where each leg is made with three underwires. This will usually occur in the fifth wave, but we can also find it in a W wave or sometimes in a wave of convoluted correction. This means that they occur in very tardy stages of higher trends, and normally the price action will be sluggish, agitated and covered with very miniature volume and rush. But after the market removes certain stops with miniature ups/falls in waves 3 and waves 5, the market will usually be a edged and explosive turn in the opposite direction. The confirmation point of the trend change is the rupture of the Wave 2-4 line, plus the closing price outside the Wave 4 end level. After the diagonal ends, you can expect that the price will return to the starting point of the pattern.

Basic pattern diagonal/wedge.

To get more such analyzes, you can watch below our latest video analysis recorded on January 25:

https://www.youtube.com/watch?v=MQK6YCM-EUU

“

Get full access to our Wave Premium Elliott analysis for 14 days. Click here.

“