Image source: Getty Images

UK shares measured by FTSE All Share Indexare having a solid – if unspectacular – 2024. Year to date, the index – which covers 98% of UK market capitalization – is up 7.5%, beating its five-year annual average of 5.7%.

Admittedly, other markets performed better. For example S&P500 – boosted by Magnificent 7 – is up almost 27% this year. Ironically, I believe the lack of reliance on tech stocks is one of four reasons why the FTSE will do well in 2025.

1. Back to fashion

US stocks are currently valued at a staggering 2.08 times gross domestic product (UK: 1.08).

According to IG, the cyclically adjusted price-to-earnings ratio (CAPE) for US equities is currently 31.1 (UK: 18.6).

However, only 1% of the movement in the FTSE All-Share Index is in technology stocks. As valuations in this sector become increasingly tight, this could assist the “old-fashioned” energy, mining and banking stocks that dominate the market in particular. FTSE100.

One such action is Lloyds Banking Group (LSE: LLOY).

This is one of the highest scores in the index. For fiscal year 2024, the bank is likely to pay a dividend of 3.18 pa shares. This means the stock currently has a yield of 5.8%, well above the Footsie average of 3.8%.

Dividends are never guaranteed. However, based on the bank’s results for the first nine months of 2024, I believe the payout appears relatively protected for now. Revenues, after-tax profits and return on real equity were higher than analysts expected.

However, an ongoing investigation into possible mis-selling of auto loans is currently weighing on the bank’s stock.

In my opinion, even if the most negative predictions come true, the situation at Lloyds will remain largely unchanged. As at 30 September 2024, its balance sheet had assets worth over £900 billion, including £59 billion of cash and cash equivalents.

However, despite my optimism, investors are concerned, so I will wait until the picture becomes clearer before making an investment decision. I am also concerned that so-called ‘challenger banks’ may pose a threat.

2. Lots of dividends

However, Lloyds is just one of many dividend stocks.

The FTSE All-Share Index has gained 4% over the past 10 years, compared with 2% for the S&P 500. When share buybacks are taken into account, the cash yield on UK shares rises to 6%.

This should assist the domestic market recover in 2025 and may explain why cash is making a comeback.

3. Lots of money

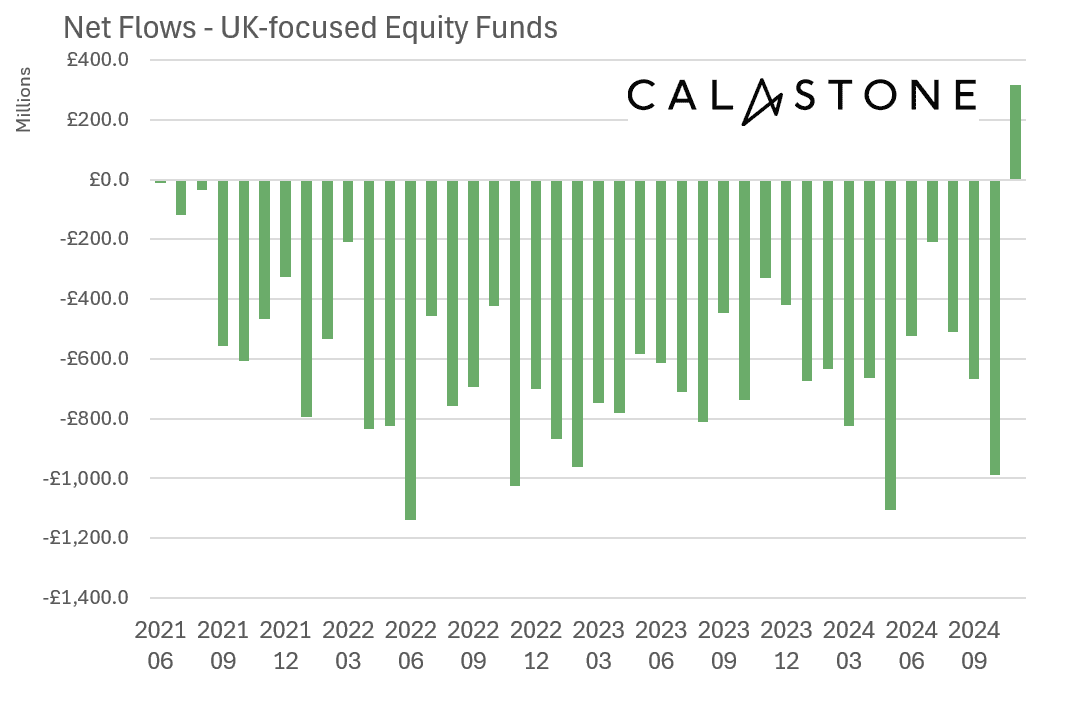

Data from Calastone shows the first net inflow into UK-focused equity funds since May 2021, when the global funds specialist began monitoring the situation.

In my opinion, this is forceful evidence that investors believe the UK stock market is currently trading at a discount to peers.

4. Back to growth

Finally, I am encouraged by the recent update of the OECD’s 2025 growth forecast for the UK (from 1.2% to 1.7%).

And with the Governor of the Bank of England suggesting four interest rate cuts next year, consumer (and investor) sentiment should improve. Higher disposable incomes should give people more cash to invest.

With the majority of my investment portfolio focused on UK shares, I hope others share my optimism for 2025!